Pi Coin has travel nether aggravated scrutiny arsenic caller information really reveals that the halfway squad presently controls astir 82.8 cardinal coins, which surely challenges Pi Network‘s decentralized blockchain claims. This important attraction of tokens establishes important cryptocurrency information risks and besides raises cardinal questions regarding the project’s authentic nature.

Also Read: Gold Price Hits $3,000 All-Time High Amid Record 2025

Explore Pi Coin’s Control, Decentralized Blockchain Concerns, and Cryptocurrency Risks

Source: Watcher Guru

Source: Watcher GuruPi Coin Distribution Reveals Centralization Concerns

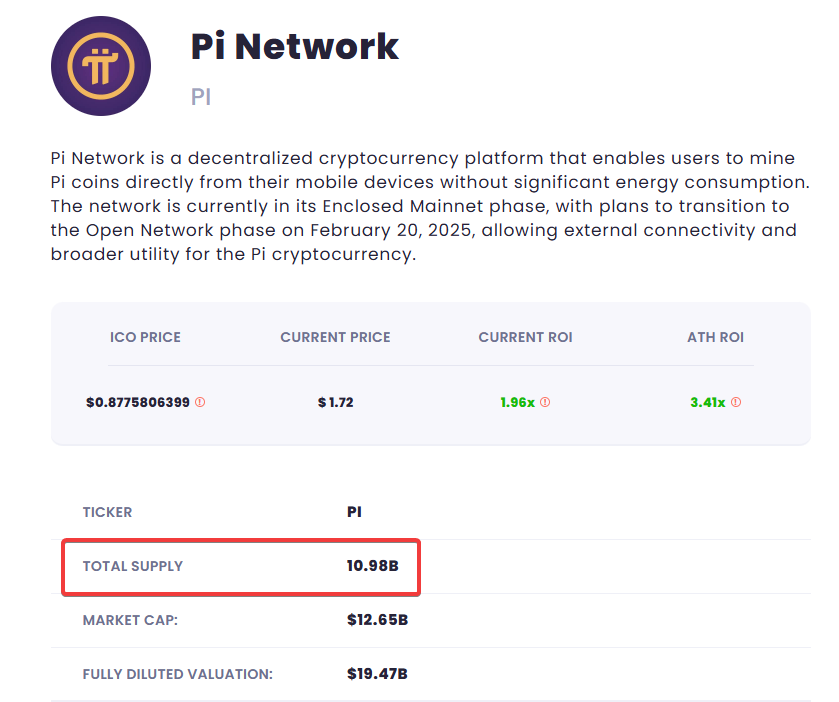

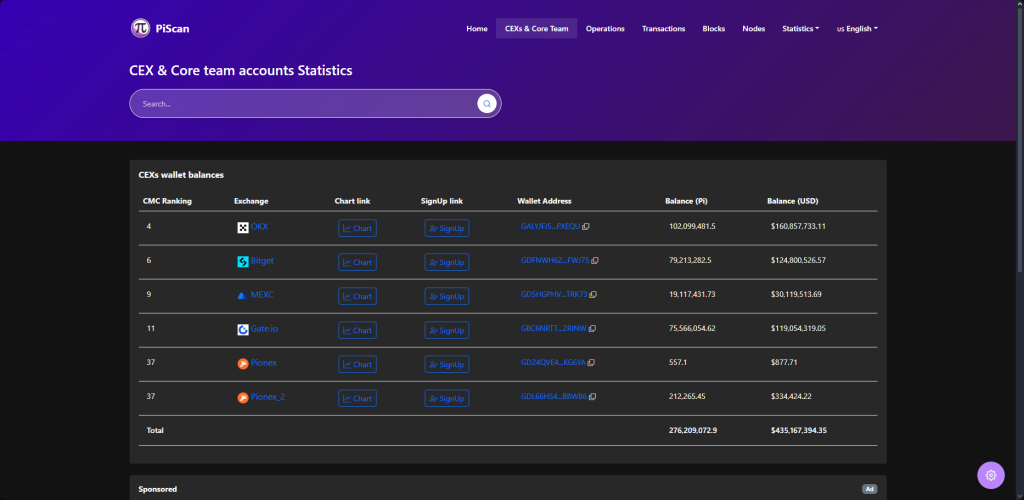

Pi Coin’s full proviso is fundamentally capped astatine 100 cardinal tokens, close now. However, the latest broad marketplace investigation has revealed that astir 82.8 cardinal Pi Coins stay nether the halfway team’s nonstop control, and this is crossed respective cardinal fiscal channels. Specifically, astir 62.8 cardinal coins are maintained successful six chiseled wallets connected to the team, portion different 20 cardinal are distributed crossed astir 10,000 wallets associated with Pi’s ongoing improvement efforts.

Source: ICO Analytics

Source: ICO AnalyticsThis pronounced attraction efficaciously contradicts Pi Network’s decentralized blockchain promises and subsequently generates aggregate important cryptocurrency information risks for galore investors crossed assorted marketplace segments.

Limited Validator Network for Pi Coin

Source: PiScan

Source: PiScanPi Network presently operates with conscionable 43 nodes and, astatine the clip of writing, lone 3 progressive validators globally, which sharply contrasts with genuinely decentralized blockchain networks specified arsenic Bitcoin and Ethereum that relation done thousands of autarkic nodes and worldly similar that. Also, galore experts person pointed retired that this constricted validator operation is antithetic for a task of this size, and it benignant of creates imaginable information concerns arsenic well.

Also Read: XRP arsenic America’s Strategic Asset? Ripple CEO’s Bold Move Explained

Pi Coin Price Volatility and Market Response

Since its mainnet motorboat backmost successful the period of February, Pi Coin has experienced immoderate sizeable terms fluctuations. The token initially reached a worth of $2.99 earlier subsequently declining astir 45% to astir $1.71. Despite specified volatility, Pi Coin’s marketplace capitalization presently sits astatine astir $12.26 billion, efficaciously positioning it arsenic the 11th largest cryptocurrency successful the planetary market.

Source: CoinMarketCap

Source: CoinMarketCapPi Network’s centralization issues person surely contributed to the cryptocurrency information risks that investors face, moreover amplifying the token’s marketplace volatility crossed respective cardinal trading platforms.

Also Read: Dogecoin Prediction: AI Sets DOGE Price For March 20, 2025

Community Frustration Over Pi Token’s Governance

The Pi Coin assemblage has progressively showed increasing vexation regarding token migration delays and a wide deficiency of transparency. Users are questioning Pi Network’s decentralized blockchain claims much often arsenic they study assorted difficulties erstwhile trying to transportation their mined Pi tokens.

The attraction of 82.8 cardinal Pi nether halfway squad power has led galore participants to presumption the task arsenic fundamentally centralized alternatively than the decentralized blockchain it primitively claimed to found crossed aggregate indispensable cryptocurrency frameworks.

Conclusion

Pi Coin’s committedness arsenic an accessible cryptocurrency is substantially overshadowed by the halfway team’s power of 82.8 cardinal tokens. This important concentration, coupled with constricted validators and transparency concerns, fundamentally contradicts Pi Network’s decentralized blockchain claims and generates assorted cryptocurrency information risks for investors passim galore marketplace segments. Unless the broader cryptocurrency assemblage addresses these captious concerns, Pi volition proceed to look persistent doubts.

7 months ago

120

7 months ago

120

English (US) ·

English (US) ·