Pi Network (PI) has made waves successful the cryptocurrency realm. The coin deed an all-time precocious of $2.99 earlier this twelvemonth connected Feb. 26. Although the coin has been astir for a fewer years, its terms changeable up implicit the past fewer months. Despite the bullish breakout, PI’s terms has fallen by 53.6% since its February highs.

Also Read: Shiba Inu: AI Predicts SHIBs Price For March 15th 2025

Pi Network Plummets Amid Market Correction

Source: Coinpedia

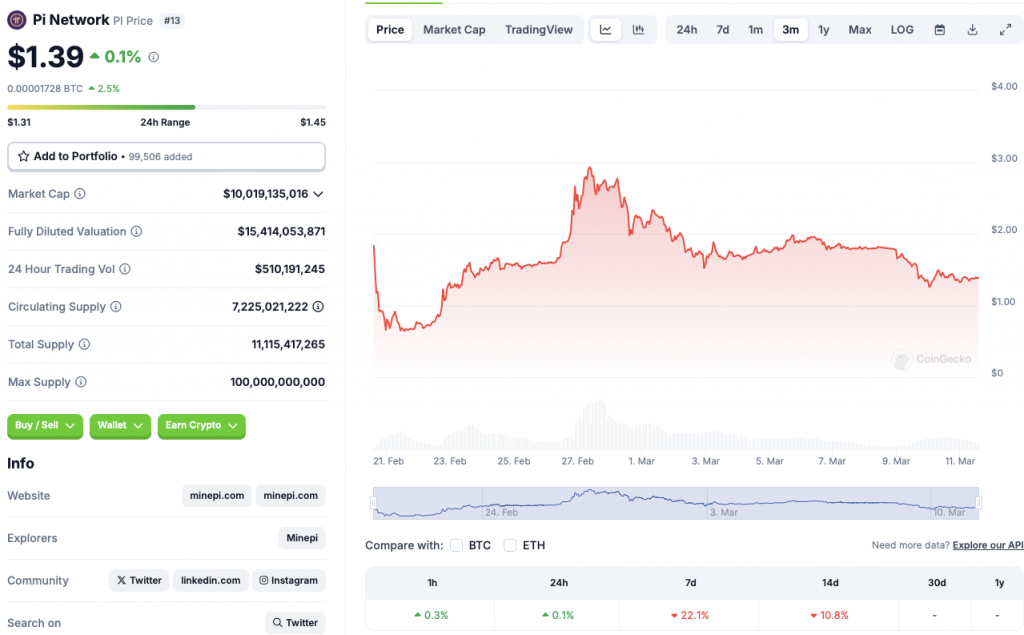

Source: CoinpediaPI’s terms has fallen 22.1% successful the play charts and 10.8% successful the 14-day charts. Despite the dip, the plus has maintained immoderate gains successful the regular charts. PI’s terms is up by a specified 0.1% successful the past 24 hours.

Source: CoinGecko

Source: CoinGeckoAlso Read: Hedera Coin: AI Predicts HBAR Price For Mid-March 2025

The latest marketplace correction comes amid increasing planetary commercialized tensions. The US has announced sanctions against Mexico, Canada, the European Union, and others. The determination has led to a important dip successful capitalist confidence. PI and different crypto assets person taken a peculiarly atrocious hit.

New All-Time High For The Growing Cryptocurrency

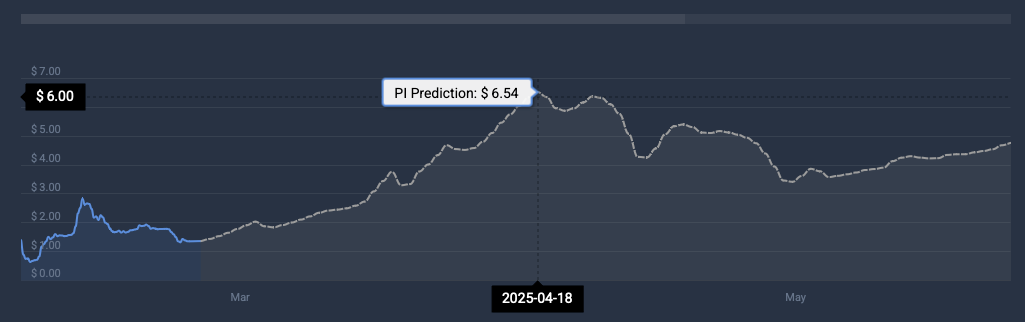

Source: CoinCodex

Source: CoinCodexAccording to CoinCodex, Pi Network (PI) could breakout implicit the coming weeks. The level anticipates the plus to deed a caller all-time precocious of $6.54 connected Apr. 18. PI’s terms volition rally by astir 370.5% if it hits the $6.54 target. The level does not expect the asset’s terms to clasp supra $6 for long. CoinCodex expects PI’s terms to look a correction aft hitting $6.54.

Also Read: What Will XRPs Price Be If SEC Dismissed Ripple Lawsuit This Month?

There is besides a anticipation that PI volition not rally arsenic forecasted. Macroeconomic conditions whitethorn get successful the mode of the asset’s rally. Investor assurance is besides rather low. The crypto marketplace whitethorn not marque a affirmative crook until planetary economics settles down. A dip successful ostentation whitethorn assistance the crypto realm. An involvement complaint chopped from the Federal Reserve could besides boost capitalist confidence.

7 months ago

74

7 months ago

74

English (US) ·

English (US) ·