The post POPCAT Breaks Out! Meme Coin Eyes 25% Surge to $1.10 appeared first on Coinpedia Fintech News

The popular Solana-based meme coin, Popcat (POPCAT), is poised for significant upside momentum due to the formation of a bullish price action pattern on the daily time frame. Since the beginning of the new year, the overall cryptocurrency market appears to be recovering, including Bitcoin (BTC), Ethereum (ETH), and XRP.

Amid this potential market rebound, POPCAT has soared by more than 10% in the past 24 hours and is currently trading near $0.84. This notable price surge has contributed to a bullish setup for the meme coin.

POPCAT Technical Analysis and Upcoming Levels

According to expert technical analysis, POPCAT has recently broken out of a prolonged consolidation zone and closed a daily candle above that level, confirming the successful breakout.

Source: Trading View

Source: Trading ViewBased on the recent price action, following this breakout, there is a strong possibility that the meme coin could soar by 25% to reach the $1.10 mark in the near future.

Bullish On-Chain Metrics

This breakout has attracted significant attention from traders and investors over the past 24 hours, resulting in a 25% increase in trading volume and an 18% rise in POPCAT’s open interest. This highlights the growing interest from traders and investors as they seek to capitalize on the consolidation breakout, according to on-chain analytics firm Coinglass.

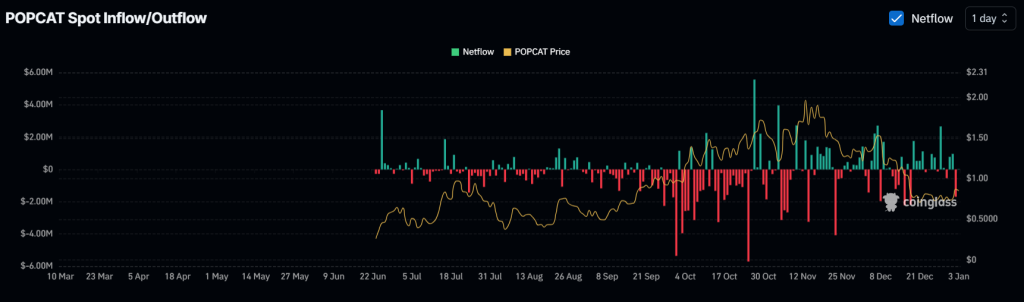

Data from POPCAT’s spot inflow/outflow reveals that exchanges have experienced an outflow of a significant $1.7 million worth of POPCAT. This indicates that long-term holders have withdrawn these notable meme coins following the breakout, suggesting potential upside momentum and increased buying pressure.

Source: Coinglass

Source: CoinglassAt press time, the major liquidation levels are at $0.826 on the lower side and $0.908 on the upper side, with traders over-leveraged at these levels, according to Coinglass data.

If the market sentiment remains unchanged and the price rises to the $0.908 level, nearly $5.52 million worth of short positions will be liquidated. Conversely, if the sentiment shifts and price drops to the $0.826 level, nearly $4.42 million worth of long positions will be liquidated.

2 days ago

16

2 days ago

16

English (US) ·

English (US) ·