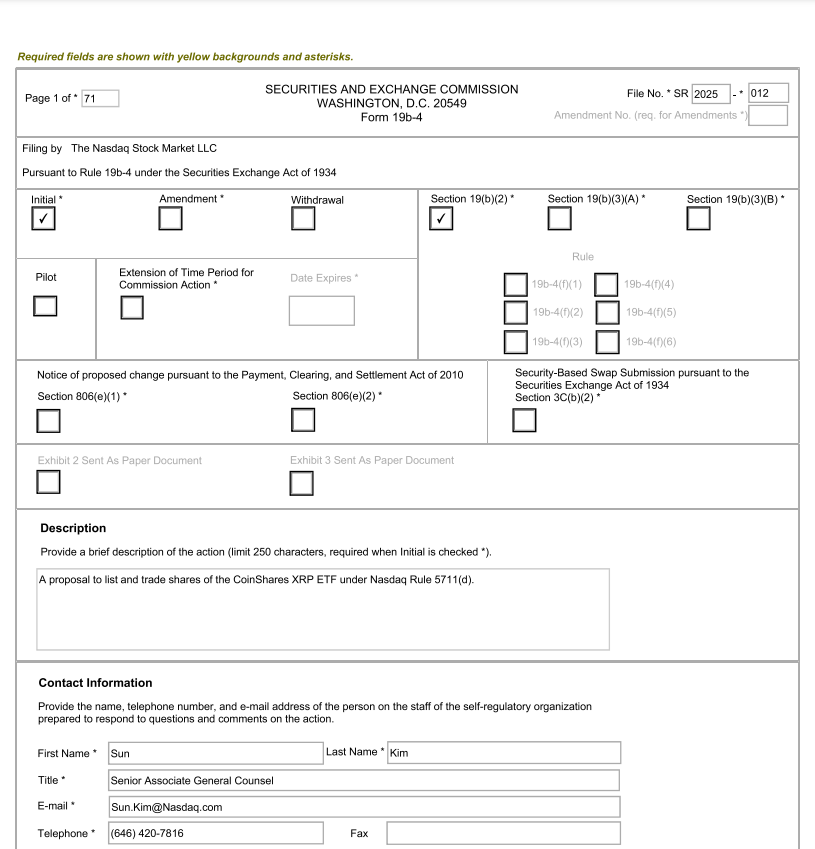

The XRP ETF marketplace entered a caller signifier arsenic Nasdaq submitted a groundbreaking proposal to database the Coinshares XRP ETF, portion Ripple strengthened its European footprint done strategical partnerships. These developments code crypto marketplace volatility concerns and awesome increasing XRP adoption crossed accepted fiscal sectors, marking a important displacement successful cryptocurrency information risks management.

Source: NASDAQ

Source: NASDAQAlso Read: Tesla’s 11,509 Bitcoin Stash Worth Over $1 Billion Revealed successful SEC Filing

How Nasdaq’s XRP ETF Could Shape Ripple’s Future successful Europe and Crypto Markets

Source: Bitcoin.com

Source: Bitcoin.comNasdaq’s Strategic Move for XRP ETF Approval

Several aspects of Nasdaq’s filing for the Coinshares XRP ETF nether Rule 5711(d) found a regulated concern pathway. Multiple features of the XRP ETF spot see holding XRP and cash, portion tracking immoderate cardinal metrics done the Compass Crypto Reference Index XRP – 4pm NY Time. A fewer specialized custodians volition unafraid the fund’s passive concern structure.

Nasdaq stated successful its filing:

“XRP is not peculiarly susceptible to manipulation, particularly arsenic compared to different approved ETP notation assets.”

The speech further emphasized:

“The speech believes that the fragmentation crossed XRP trading platforms and accrued adoption of XRP, arsenic displayed done accrued idiosyncratic engagement and trading volumes, and the XRP web marque manipulation of XRP prices done continuous trading enactment much difficult.”

Ripple’s European Market Penetration

Various elements of Ripple’s Europe enlargement strategy gained momentum done respective partnerships, including Unicâmbio, transforming galore cross-border outgo channels betwixt Portugal and Brazil. Some aspects of XRP ETF technologies mesh with accepted banking systems, showing marketplace acceptance.

Cassie Craddock, Managing Director for UK and Europe astatine Ripple, stated:

“Our concern with Unicâmbio is simply a important milestone successful Ripple’s European expansion. Portugal has developed a thriving crypto ecosystem truthful we are delighted to unfastened up our payments solution to partners there.”

Also Read: Top 3 Cryptocurrencies Predicted To Hit New All-Time Highs Soon

Security and Market Impact

Multiple information layers successful the XRP ETF operation code immoderate cryptocurrency information risks done institutional-grade solutions. Several analysts enactment that amid expanding crypto marketplace volatility, assorted aspects of Nasdaq’s connection item XRP’s trading measurement and operation arsenic protective factors.

Market Integration and Future Prospects

Some estimates amusement Ripple Payments operating crossed galore markets, with assorted systems processing much than $70 cardinal successful volume. Several aspects of this enlargement enactment broader XRP adoption portion strengthening aggregate cryptocurrency infrastructure points crossed Europe.

Also Read: XRP: When Will Ripple’s Case With The US SEC End?

Adriana Jerónimo, Executive Board Member astatine Unicâmbio, emphasized:

“Ripple’s exertion enables near-instant colony and drastically reduces costs compared to accepted payments channels, delivering existent worth to our customers.”

8 months ago

50

8 months ago

50

English (US) ·

English (US) ·