- XRP rebounded to $3.11 after a 12.20% surge, recovering from a dip below $3.

- Ripple’s regulatory wins, including securing MTLs in Texas and New York, boosted market confidence.

- CoinCodex predicts XRP could hit $4.70 by April, driven by increasing utility and regulatory support.

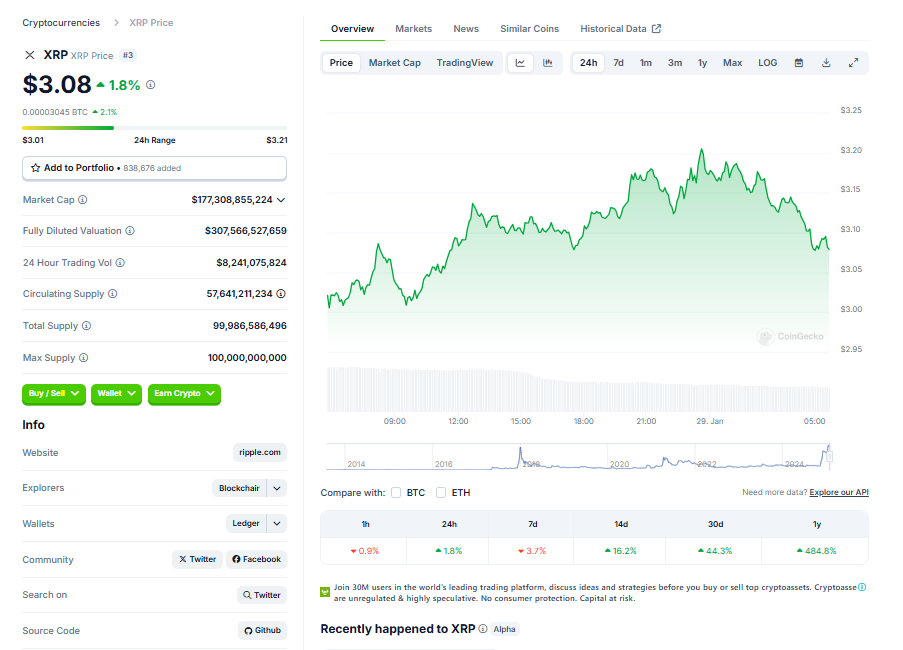

Ripple’s XRP has spent seven long years trying to reclaim its all-time high, and while it’s edged closer this year, the journey has been anything but smooth. Just yesterday, the third-largest altcoin tumbled below the $3 mark, dashing the hopes of many in the community. However, XRP quickly bounced back, thanks to Ripple’s recent regulatory wins in the U.S.

XRP Rises as a Top Performer

At the time of writing, XRP was trading at $3.11, marking a 12.20% increase over the past 24 hours. Earlier in the day, the altcoin dropped to a low of $2.71, but its swift recovery made it one of the top gainers during a broader market rebound.

Ripple’s success in securing Money Transmitter Licenses (MTLs) in key states like Texas and New York has played a significant role in fueling this rally. These licenses allow Ripple Payments to offer a fully licensed version of its cross-border payment services, streamlining transactions for U.S. customers.

Ripple’s Joanie Xie, Managing Director of North America, highlighted the growing demand for blockchain-based solutions, stating:

“We’re continuing to see more interest from financial institutions to crypto businesses that want to unlock the benefits of crypto and blockchain for faster, cost-efficient, and 24/7 cross-border payments.”

Could $5 Be on the Horizon?

According to CoinCodex, XRP might be nearing a significant milestone. The platform predicts that by April, XRP could trade as high as $4.70, a 50% increase from its current levels. While this forecast falls just shy of the $5 mark, increasing utility and regulatory acceptance could help the altcoin reach that psychological threshold even sooner.

As the community keeps a close eye on Ripple’s progress, the question remains: will this be the year XRP finally reclaims its former glory? With regulatory wins stacking up and market momentum on its side, the possibility seems more realistic than ever.

8 months ago

64

8 months ago

64

English (US) ·

English (US) ·