Discover how a quiet act of defiance planted a seed for a peaceful financial revolution rooted in lasting peace and equity.

The year was 2008, and the world was in the throes of a devastating financial crisis. The housing bubble had burst, leading to the collapse of major financial institutions, widespread foreclosures, and a crippling recession. Governments and central banks responded with unprecedented bailouts and monetary interventions, propping up failing banks at the expense of the public and the savers. Trust in the traditional financial system was eroding rapidly as people witnessed the fragility and corruption embedded within it.

It was against this backdrop of turmoil that, on January 3rd, 2009, a new beginning was quietly forged in the digital realm. An enigmatic figure, known by the pseudonym Satoshi Nakamoto, mined the first block — aka the “genesis block” — of the Bitcoin blockchain.

But Satoshi did more than just plant a seed for a radically different financial system with this effort; he embedded a message within this block: “The Times 03/Jan/2009: Chancellor on brink of second bailout for banks.”

It was a quiet act of defiance against the crumbling legacy of the financial system and governments that were once again bailing out banks.This was not merely a timestamp — it was a quiet act of defiance against the crumbling legacy of the financial system and governments that were once again bailing out banks — institutions that, instead of serving the people, had engaged in reckless and exploitative practices but were, yet again, not going to pay the price themselves.

When examining Satoshi’s white paper — which lays the foundation for the open-protocol design — more closely, the true brilliance of the invention becomes clear. The most striking aspect is how a collection of relatively simple design features come together to form what is as close to a perfect standard of money as imaginable — decentralised, incorruptible, immutable, and sound.

#1 The Genesis Block: A Statement of Intent

The creation of the Genesis Block was more than a technical necessity; it was a political and philosophical statement that set the stage for an alternative financial system. This block, which cannot be altered or spent, represents the birth of a new financial paradigm — one where trust is not placed in fallible institutions but in mathematics and decentralised consensus.

Encoded in the genesis block is a reference to the headline of this article.

Encoded in the genesis block is a reference to the headline of this article.#2 The Hard Cap of 21 Million

Arguably, the most central feature of Bitcoin is its hard cap of 21 million coins. This decision directly addresses the issue of ethical erosion, a phenomenon that has plagued every form of money throughout history. From the Roman denarius to the modern dollar, inflation and debasement have been the tools of those in power to extract value from citizens — whether through outright theft or, even when well-intended, by distorting incentive structures that fuel unsustainability and division. By capping the supply, Satoshi ensured that Bitcoin could not be devalued by arbitrary decisions, preserving its value over time and providing a stable store of wealth.

This hard cap can be seen as the defining feature of Bitcoin — the feature that makes it perfect sound money — with the rest of its aspects either safeguarding this limit from manipulation or incentivising adoption.

Why it’s vital: The hard cap ensures that Bitcoin remains scarce, giving its key deflationary properties that preserve its value over time, unlike fiat currencies that can be printed in unlimited quantities.

If it were absent: Without a hard cap, Bitcoin could be inflated at will, just like fiat currencies, leading to the same issues of devaluation and loss of trust that plague traditional money.

#3 Decentralisation: Trust Through the Many, Not the Few

At its core, Bitcoin’s decentralisation is about distributing trust across a network rather than placing it in the hands of a few. In traditional systems, we rely on central authorities — banks, governments, or corporations — to verify and process transactions. These entities have the power to manipulate, censor, or control the flow of value, often prioritising their own interests. This has led to issues like financial corruption, inefficiency, and unequal power structures.

Bitcoin changes the dynamic entirely by eliminating the need for a central authority. Instead, it uses a network of participants who collectively verify and validate transactions.

To understand this, let’s break down what a “block” and a “node” are. A block is a collection of transaction data that gets added to the blockchain (which is the public ledger that records every Bitcoin transaction). New blocks are created roughly every 10 minutes through a process called mining. A node is any computer that participates in the mining process.

Each block of transactions on the blockchain is linked to the block before and after.

Each block of transactions on the blockchain is linked to the block before and after.When Satoshi Nakamoto first designed the protocol, he set a 1 MB limit on the size of each block, effectively restricting the number of transactions per block. This decision wasn’t arbitrary; it was a safeguard against centralisation. At first glance, a larger block size might seem beneficial — allowing for more transactions per block and a faster network. However, Satoshi had the remarkable foresight to recognise that larger blocks would require more storage space and higher bandwidth, gradually raising the cost of running full nodes. By keeping block sizes small, Satoshi ensured that running a full node would remain affordable for many, from individuals to companies. In doing so, the risk of centralisation and monopolistic control of the mining effort is mitigated.

Despite more than 85% of the network’s computing power supporting a protocol change to increase the block size, the attempt failed.During the “block size wars” in 2017, despite more than 85% of the network’s computing power supporting a protocol change to increase the block size, the attempt failed — proving Bitcoin’s resilience to changes.

Why it’s vital: Decentralisation prevents a single point of failure and ensures that no entity can control or censor the network. The block size limit keeps the barrier low to participate in securing the network. The outcome of the “block size wars” provides a proven record of Bitcoin’s incorruptibility.

If it were absent: Without decentralisation, Bitcoin would become vulnerable to control by governments, corporations, or other powerful entities. A larger block size could have led to centralisation.

#4 Proof of Work: The Key to Incorruptibility

Proof of Work is the cornerstone of the protocol’s security, connecting its digital existence to the physical world through computational effort. In this system, miners — those responsible for processing and validating transactions — must expend significant energy to solve complex mathematical puzzles. This energy-intensive process makes the network highly secure, as any attack would require an immense amount of resources, rendering such efforts both impractical and economically unfeasible.

Think of it like this: if it costs more than $1 to counterfeit $1, no sane person would attempt counterfeiting. Similarly, the energy required to mine Bitcoin serves as a natural deterrent to dishonest actors, ensuring that the cost of disrupting the network is far higher than any potential reward.

(If you’d like to get a sense of the difficulty of “guessing” someone’s private key, this article provides a mind-blowing analogy.)

The proof-of-work mechanism solves a dilemma known as the Byzantine Generals Problem in game theory.

The proof-of-work mechanism solves a dilemma known as the Byzantine Generals Problem in game theory.Why it’s vital: Proof of Work ensures that the security of the network is tied to the expenditure of energy, making attacks practically impossible and irrational.

If it were absent: Without proof of work, the network could be easily attacked or manipulated.

#5 The Difficulty Adjustment: Timeless Security

Bitcoin’s difficulty adjustment is a self-regulating mechanism that ensures block creation remains consistent, roughly every 10 minutes, regardless of changes in mining activity or technological advancements. As more computational power is devoted to mining, the protocol automatically increases the difficulty of solving the cryptographic puzzles required to mine new blocks.

Why it’s vital: The difficulty adjustment ensures the issuance of new coins remains consistent, regardless of external factors.

If it were absent: Without difficulty adjustment, advances in mining technology could lead to blocks being mined too quickly, potentially defeating the entire purpose of the network.

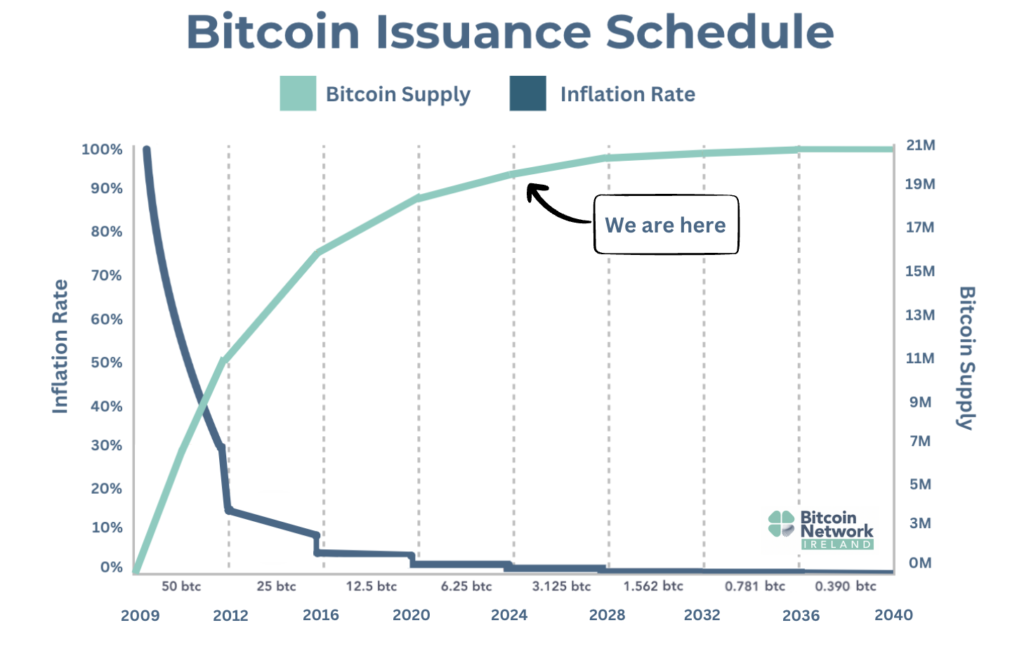

#6 The Halving: Ensuring Adoption

The halving event — where the reward for mining new blocks is halved every four years (every 210,000 blocks) — acts as the initial spark for Bitcoin’s adoption. Satoshi Nakamoto designed this mechanism to reward early adopters, creating momentum and ensuring the network gains the critical mass needed to become self-sustaining. The gradual reduction in new coins is intended to phase in adoption over approximately 130 years, with the last coin expected to be mined around the year 2140. This structured scarcity incentivizes early participation while steering the network toward a fee-based model as block rewards diminish, ultimately solidifying Bitcoin’s position in the global economy.

Why it’s vital: The halving process is essential because it drives adoption, which is crucial for the success of the network.

If it were absent: Without the incentives for early adoption, the network would likely never have gained momentum.

#7 Mining: A Catalyst for Geographical Decentralisation of Power

Bitcoin mining, which completely relies on cheap energy for financial viability, provides regions with excess or under-utilised power the ability to monetise it. In areas where local energy demand is low but the supply is abundant, mining creates a financial incentive to harness this surplus. This helps energy producers capitalise on otherwise wasted resources.

By opening up new markets for cheap energy, mining drives economic activity in remote locations, encouraging investment in infrastructure and reducing the concentration of energy production in a few centralised hubs. This shift encourages populations and industries to disperse geographically, fostering a decentralised energy and economic landscape. In essence, mining encourages people to relocate to where the resources are, rather than depending on resources being transported to centralised hubs, often at high environmental costs.

Mining functions as a natural incentive for investing in sustainable energy.

Mining functions as a natural incentive for investing in sustainable energy.Why it’s vital: Bitcoin mining incentives the geographical decentralisation of power by monetising energy surpluses in areas where natural supply is high.

If it were absent: Bitcoin mining provides remote areas with abundant energy resources the unprecedented opportunity to monetise them, which incentivises geographical decentralisation.

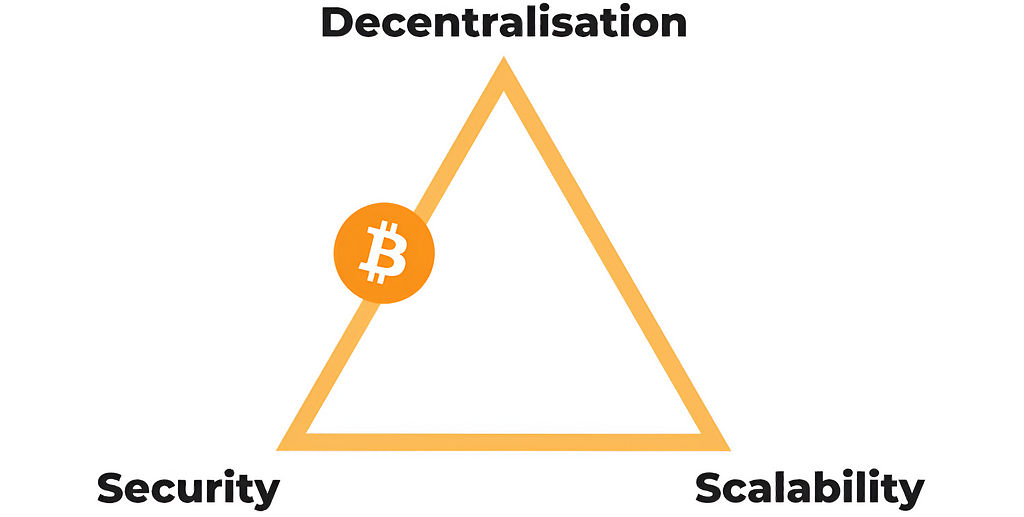

#8 The Layered Expansion

Satoshi Nakamoto focused on decentralisation and security in the white paper, deliberately choosing not to prioritise scalability in the protocol’s base layer. This was intentional, not a flaw. The foundational layer, the blockchain, was never meant to have the capacity to handle all the world’s transactions directly.

Instead, Satoshi foresaw that scalability would be addressed through layers built on top of the base layer, allowing Bitcoin to remain decentralised and secure while enabling the handling of large transaction volumes in additional layers built on top of the base layer. Had they attempted to address scalability at the base layer, such as by increasing block sizes, the network would have been forced to compromise decentralisation.

Why it’s vital: Scaling through layers ensures that the core principles of decentralisation and security remain intact while handling mass adoption in a flexible, layered approach.

If it were absent: Compromising on decentralisation or security at the base layer would have opened the gate to corruption.

#9 Permissionless Access: A System for Everyone

Anyone with an internet connection can access and use the Bitcoin network, without needing approval from banks, governments, or any centralised authority. Unlike traditional financial systems, which often discriminate based on identity, nationality, or financial status, Bitcoin is maintained by the people, for the people.

It doesn’t matter who you are — whether you’re unbanked, a refugee, lack traditional identification, live under oppressive regimes or relationships, or are marginalised in any way by existing systems. Bitcoin operates without discrimination, offering equal access for all.

Satoshi’s open-protocol is non-discriminatory.

Satoshi’s open-protocol is non-discriminatory.Not the least, it offers citizens in hyper-inflationary countries with the option to opt out of the destructive economic policies that corrupt governments use to enrich themselves at the expense of their citizens.

Why it’s vital: Permissionless access guarantees that Bitcoin doesn’t discriminate, ensuring financial inclusion and freedom for anyone, anywhere in the world.

If it were absent: Without this permissionless structure, the network would fall into the same patterns of exclusion as traditional financial systems, undermining its core mission.

#10 The Disappearance of Satoshi: It Was Never About One Person

Perhaps the most mysterious and profound aspect of Bitcoin’s story is the disappearance of its creator, Satoshi Nakamoto. After ensuring that the network was stable and functional, Satoshi gradually reduced their involvement, eventually vanishing entirely from public view in 2011. In one of the last known messages, Satoshi stated, “I’ve moved on to other things,” adding that Bitcoin was now in capable hands and marking the severing of the umbilical cord.

This may be the most underestimated and yet critical aspect in the entire saga. This withdrawal not only secured Bitcoin’s decentralisation but gave rise to one of its most powerful qualities — what some have called its “immaculate conception.” This refers to Bitcoin’s birth and existence being free from bias, corruption, or any form of manipulation — essentially “free from sin.” Unlike a publicly traded company or other so-called ‘crypto-coins,’ Bitcoin did not have an initial offering (IPO/ICO), where early insiders could amass a large portion before the public. Instead, it was released to everyone simultaneously, ensuring that the same rules have applied to everyone since its inception. Bitcoin has never had a central authority or board of directors; it operates and will continue to operate autonomously, governed solely by its open protocol.

One of the most compelling pieces of evidence supporting Satoshi’s selfless integrity is the fact that the large amount of coins Satoshi mined in the early days remains untouched to this day. By refraining from cashing in on this substantial wealth, Satoshi showcased an unprecedented level of foresight.

Why it’s vital: Satoshi’s disappearance ensured that Bitcoin’s value was tied to the larger idea that it represents and not to its creator.

If it were absent: Had Satoshi stayed involved, Bitcoin might have become centralised around their decisions, with the community potentially deferring to them as the ultimate authority. This would have made the network vulnerable to the same problems that affect centralised systems.

The Genius in Simplicity

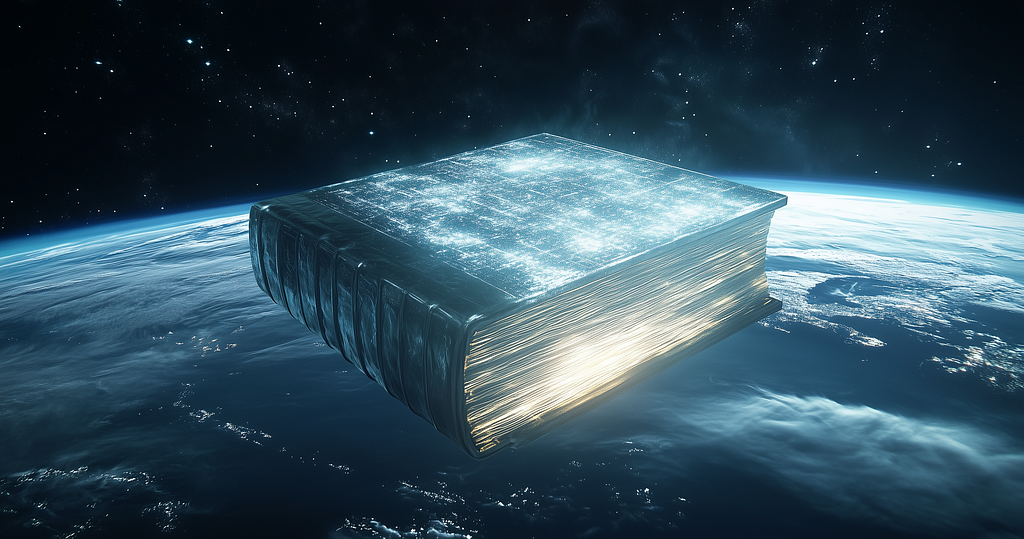

At its core, Satoshi’s open-protocol is really just one thing: an honest ledger of transactions.

At its core, Satoshi’s open-protocol is really just one thing: an honest ledger of transactions.If you boil it down to its essence, the brilliance of Satoshi’s open protocol lies in its simplicity. At its core, it’s really just one thing: an honest ledger of transactions — a technology to facilitate the exchange of value between humans that is incorruptible by any third party. This idea is so simple, so fundamentally right, yet history shows how difficult it has been to achieve and maintain.

Satoshi’s gift to the world was planting a seed of truth. Against all odds — or perhaps just because the world had become so ignorant — it managed to take root.Satoshi’s gift to the world was planting a seed of truth. Against all odds — or perhaps just because the world had become so ignorant — it managed to take root. Now, it has grown so tall that it can neither be ignored nor uprooted.

A Trojan Horse for Peace

At first glance, Bitcoin may seem like just another financial asset — one that attracts speculators, early adopters, and perhaps even institutional investors looking for the next big opportunity. But beneath the surface, Bitcoin’s design carries something far more profound. Once you grasp the idea it represents and the ingenious mechanisms that underpin its protocol, its deeper impact becomes clear: Bitcoin is a Trojan horse for peace.

For the very institutions that uphold the current financial system — banks, monopolistic corporations, and speculators — Bitcoin is too attractive an asset to resist. Yet, with every step they take to embrace it, they undermine themselves.For the very institutions that uphold and benefit the most from the current financial system — banks, monopolistic corporations, and speculators — Bitcoin is too attractive an asset to resist. Yet, with every step they take to embrace it, they fortify the new and better idea while gradually undermining their own power and influence.

What makes it so brilliant is that Bitcoin doesn’t challenge these institutions with force or deceit. Instead, it draws the old system in by appealing to its deepest flaw — greed. The more it’s adopted, however, the more those same incentives work against the old guard.

In All Along the Watchtower, written by Bob Dylan, the joker and the thief ride against the establishment. This time, they’re not alone.

In All Along the Watchtower, written by Bob Dylan, the joker and the thief ride against the establishment. This time, they’re not alone.Contrary to what many might assume at first glance, traditional beneficiaries of the FIAT system don’t gain power by embracing Bitcoin — they lose it. As adoption spreads, their services gradually become less valuable, until they are barely needed at all. Even if they still hold wealth, any investment outside of the protocol will only devalue that wealth over time.

They’ll face a choice: either keep their wealth within the protocol, increasing purchasing power for everyone else, or attempt to find higher returns elsewhere. However, in a world governed by this new sound money standard, the familiar tools of financial manipulation will have been lost. The only path forward under this new paradigm will be through genuine investments in ventures that create real value for society.

It’s absolutely genius.

Satoshi’s Gift to the World: A Trojan Horse for Peace was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

3 months ago

35

3 months ago

35

English (US) ·

English (US) ·