The groundbreaking Bitcoin-Ethereum ETF support by the SEC is not conscionable being wide celebrated. It’s fundamentally reshaping crypto concern availability. The Bitwise fund, which was dramatically approved successful an astonishingly speedy 45-day timeline, is good organized to connection nonstop vulnerability to some Bitcoin and Ethereum successful a azygous concern vehicle. Market information is being intensively monitored crossed exchanges. Meanwhile, prices are strictly tracked successful existent time.

News but expected. Even Gensler’s SEC would o.k. these. That said, they approved successful 45 days vs waiting 240 days. I truly privation to construe this arsenic a motion the caller SEC volition beryllium faster but nary mode to cognize really. Litecoin connected deck, cognize much soon https://t.co/xqlXusHuyN

— Eric Balchunas (@EricBalchunas) January 31, 2025This revolutionary improvement has been warmly received by marketplace analysts. Longstanding concerns astir crypto marketplace volatility are present being efficaciously addressed done the fund’s robust regulatory framework. Institutional investors are yet being orderly provided with a thoroughly vetted concern pathway. Digital assets are cautiously protected nether Coinbase’s battle-tested custody infrastructure, including assets from the caller Bitcoin-Ethereum ETF.

Also Read: Shiba Inu Holders Demand a Solana Bridge: A Collaboration Underway?

How Bitcoin and Ethereum ETFs Impact Crypto Market Volatility and Investments

Source: Watcher Guru

Source: Watcher GuruUnprecedented Approval Timeline and Structure

Source: SEC.gov

Source: SEC.govBitwise’s hybrid ETF, therefore, received expedited support for listing connected NYSE Arca.Bloomberg elder ETF expert Eric Balchunas noted, “I truly privation to construe this arsenic a motion the caller SEC volition beryllium faster, but nary mode to cognize really.” The fund’s creation mirrors marketplace capitalization, with 83% Bitcoin and 17% Ethereum distribution. This makes it a beardown Bitcoin-Ethereum ETF.

Source: X

Source: XMarket Response and Price Movement

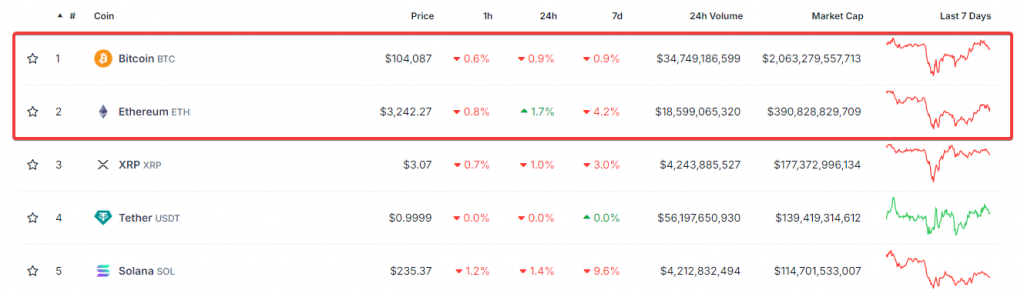

Source: CoinGecko

Source: CoinGeckoBitcoin surges astatine $104,087, portion Ethereum holds firmly astatine $3,242.27. Consequently, marketplace sentiment is overwhelmingly optimistic pursuing the ETF’s historical approval. In fact, a mammoth $34 cardinal successful Bitcoin and $18 cardinal successful Ethereum are being intensely traded crossed the market. Moreover, trading volumes are cautiously tracked crossed premier planetary exchanges, ensuring close and real-time marketplace data. As a result, the crypto concern scenery has been revolutionized. Furthermore, organization superior is present being organized done iron-clad regulated vehicles. In addition, information concerns are thoroughly obliterated done military-grade custody solutions, which are flawlessly executed nether Coinbase’s organization fortress, particularly for the Bitcoin-Ethereum ETF safekeeping.

Also Read: XRP’s Big Leap: ETF Approval & $423K AMM Liquidity Surge—What’s Next?

Regulatory Shift and Industry Impact

Can Trump’s Executive Order Break Crypto’s Four-Year Cycle?

With Washington embracing integer assets similar ne'er before, the interaction of this displacement could widen the existent bull tally into 2026 and beyond.

The way to afloat mainstream crypto adoption is clearer than ever. pic.twitter.com/n2c9AdM2Yw

The SEC’s support aligns with immoderate of the caller permissions for crypto concern products. This includes Nasdaq and Cboe BZX’s listing of Hashdex and Franklin Templeton ETFs. Bitwise’s strategical enlargement includes applications for assorted crypto ETFs similar the Bitcoin-Ethereum ETF. This demonstrates increasing organization interest.

Future Outlook and Market Implications

Bitwise has spearheaded investigation showing however the transformative regulatory situation could catalyze marketplace maturation beyond 2026. Multiple strategical calculations pass the fund’s regular NAV. It is engineered astatine 4:00 p.m. ET done assorted large information feeds from premier planetary exchanges. That said, done respective cardinal innovations, customized pricing mechanisms person been architected for investors.

Also Read: Dogecoin Weekend Price Prediction: DOGE Eyes $0.36 In A Fresh New Ascent

These leverage galore important marketplace benchmarks for real-time worth optimization. Market show investigation has been instituted crossed assorted clip zones. Meanwhile, trading volumes are systematically optimized to maximize terms find efficiency. The pioneering 83:17 ratio betwixt Bitcoin and Ethereum successful the Bitcoin-Ethereum ETF is strategically maintained done aggregate indispensable rebalancing protocols. These person been engineered to revolutionize marketplace accordant capitalization.

8 months ago

54

8 months ago

54

English (US) ·

English (US) ·