- Senator Lummis’ BITCOIN Act proposes the U.S. acquire 1 million BTC over five years, funded by Fed earnings and gold certificates.

- The bill differs from Trump’s Bitcoin reserve plan by allowing limited future sales of BTC, while Trump’s approach is strictly long-term holding.

- If passed, the bill could solidify Bitcoin’s role in U.S. financial policy, influencing global central banks and institutional investors.

Senator Cynthia Lummis (R-WY) has introduced the BITCOIN Act, a bill that would authorize the U.S. government to acquire an additional 1 million Bitcoin—a massive expansion of President Donald Trump’s Strategic Bitcoin Reserve.

What’s in the Bill?

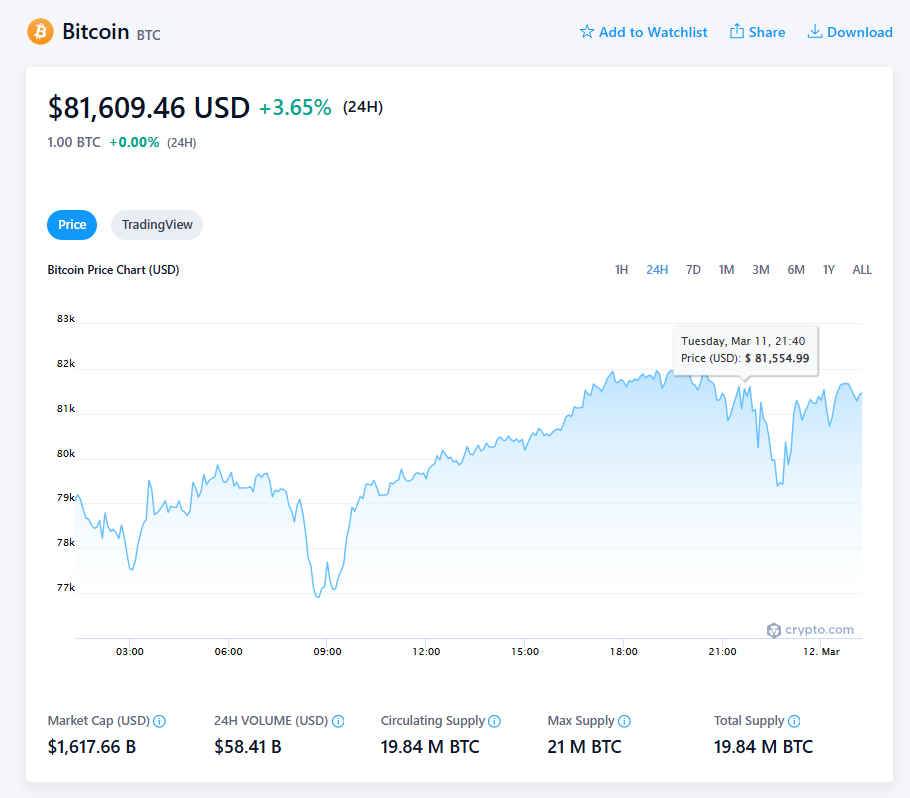

Lummis’ proposal would obligate the U.S. government to accumulate 1 million BTC over five years, worth roughly $80 billion at current prices. The acquisition would be funded by:

- Net earnings from the Federal Reserve

- Issuing new gold certificates based on current market prices, with the Fed paying the difference

Additionally, the bill requires the Treasury Secretary to create a “decentralized network” of secure Bitcoin storage facilities across the U.S., where the BTC would be held in cold wallets for at least 20 years before any portion could be sold.

Bitcoin as a National Asset?

The legislation already has five Republican co-sponsors, including Jim Justice (R-WV), Tommy Tuberville (R-AL), Roger Marshall (R-KS), Marsha Blackburn (R-TN), and Bernie Moreno (R-OH)—all known for their pro-crypto stances. Rep. Nick Begich (R-AK) is expected to introduce a companion bill in the House of Representatives.

Lummis believes this is a once-in-a-lifetime move to position the U.S. as the global leader in digital assets:

“By transforming the president’s visionary executive action into enduring law, we can ensure our nation harnesses the full potential of digital innovation,” she said.

How Does This Differ from Trump’s Plan?

While Trump’s Bitcoin reserve aims for long-term holding with no plans to sell, Lummis’ bill allows for some future sales, but limits Treasury Secretaries to selling no more than 10% of the reserve in any two-year period.

Last week, White House officials emphasized that their plan for Bitcoin acquisition must remain budget neutral, meaning no additional taxpayer funds would be allocated. Lummis’ approach appears far more aggressive, securing funding through financial instruments rather than relying on government budget cycles.

What’s Next?

With the U.S. Senate shifting toward a more crypto-friendly stance, this bill could set the stage for an unprecedented federal Bitcoin accumulation strategy. If passed, it would cement Bitcoin’s role in U.S. financial policy, potentially influencing global central banks and institutional investors.

For now, all eyes are on Congress to see if this ambitious Bitcoin play becomes law.

7 months ago

54

7 months ago

54

English (US) ·

English (US) ·