- SHIB exchange reserves have climbed to roughly 82 trillion tokens, increasing sell-off risk

- Net flows and derivatives data point to short-term pressure, despite traders staying mostly bullish

- Whale transactions and active addresses are rising, hinting at continued long-term interest

On-chain data suggest a growing chunk of Shiba Inu is sitting on exchanges, and that’s not exactly comforting for price watchers. When coins move onto exchanges, it usually means one thing: holders are preparing to sell, or at least keeping that option open. Recent net flow data backs this up, showing more SHIB flowing into exchanges than leaving them, which quietly raises the risk of short-term sell-offs.

82 Trillion SHIB on Exchanges Raises Red Flags

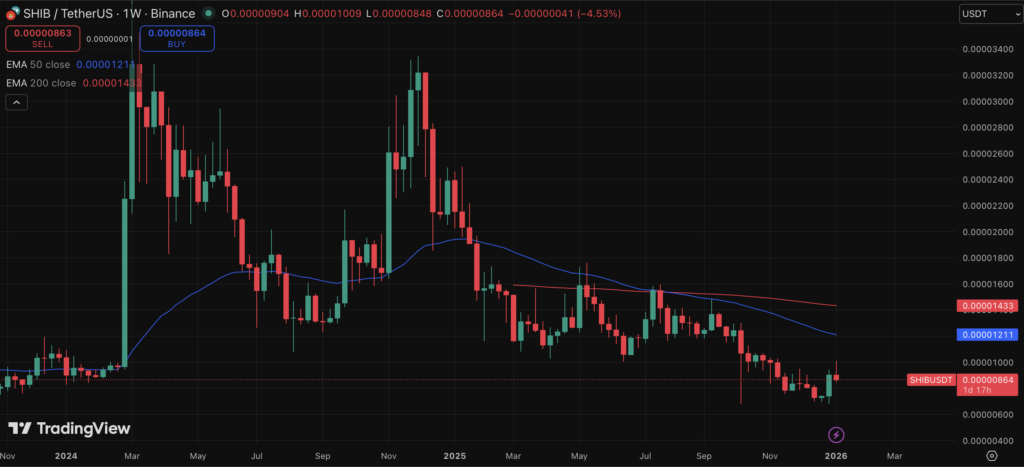

According to CryptoQuant, Shiba Inu’s exchange reserve now sits around 82 trillion tokens. That number has inched up from roughly 81 trillion at the start of the year, a small change on paper but a meaningful one in context. Around the same time these reserves increased, SHIB gave up part of its year-to-date gains, sliding back after briefly pushing above the $0.000009 level. The timing isn’t great, and it hints that some holders used the rally as an exit.

Net Flows and Market Mood Add Pressure

Another bearish signal comes from exchange net flows, which have recently flipped positive. In plain terms, more SHIB is being deposited than withdrawn, suggesting selling pressure is outweighing demand right now. This shift lined up closely with SHIB’s yearly high, and the broader market hasn’t helped either. Bitcoin pulling back toward $90,000 after flirting with $94,000 seems to have cooled risk appetite across the board, SHIB included.

Derivatives Data Shows Cooling Momentum

Activity in SHIB’s derivatives market is also losing steam. CoinGlass data shows trading volume is down a little over 5%, now sitting near $203 million, while open interest has dropped more than 7% to around $108 million. That said, it’s not all doom and gloom. The long-to-short ratio remains above 1, meaning a majority of traders are still leaning bullish, even if conviction feels a bit shaky right now.

Whale Activity Tells a Different Story

Interestingly, whales don’t appear to be backing away. Santiment recently highlighted a 111% spike in large SHIB transactions, those above $100,000 in value. That puts Shiba Inu among a small group of tokens with market caps over $500 million seeing notable whale activity. It’s not a guarantee of upside, but it does suggest bigger players are still paying attention, maybe even positioning quietly.

Network Activity Is Slowly Picking Up

There’s also some encouragement coming from on-chain usage. CryptoQuant data shows daily active SHIB addresses have risen since the start of the year and are holding above the 3,000 mark. It’s not explosive growth, but it does signal renewed interest in the ecosystem. If the broader crypto market finds its footing again, this uptick in activity could give SHIB a bit more breathing room.

At the time of writing, Shiba Inu is trading around $0.000008752, down slightly over the past 24 hours, based on CoinMarketCap data. The setup feels mixed, honestly. There’s pressure from exchange inflows, but also signs of underlying interest that haven’t disappeared.

Disclaimer: BlockNews provides independent reporting on crypto, blockchain, and digital finance. All content is for informational purposes only and does not constitute financial advice. Readers should do their own research before making investment decisions. Some articles may use AI tools to assist in drafting, but every piece is reviewed and edited by our editorial team of experienced crypto writers and analysts before publication.

3 weeks ago

18

3 weeks ago

18

English (US) ·

English (US) ·