Mar 23, 2025 at 12:32 // Price

The price of Shiba Inu (SHIB) is fluctuating within a range after falling to a low of $0.00001067 on Febreuary 3.

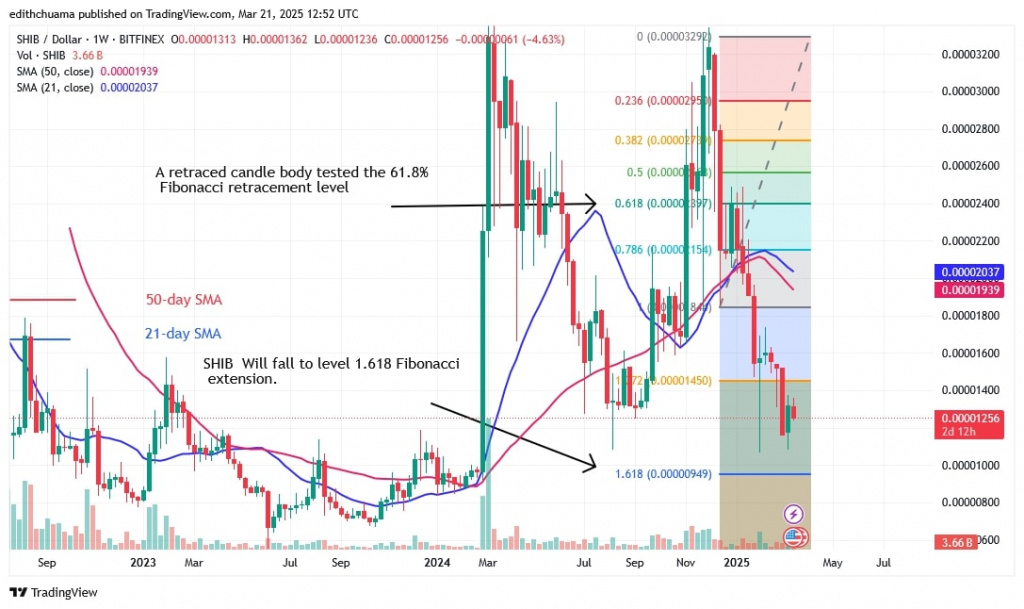

SHIB price long term prediction: bearish

On the daily chart, the altcoin is trading below the 21-day SMA barrier or resistance at $0.00001300 but above the support at $0.00001100. The 21-day SMA barrier repelled SHIB today as it started its rangebound trend. The altcoin was rejected twice at the 21-day SMA barrier in the previous price action. The altcoin is retracing to its previous low above the $0.00001100 support.

However, if the negative trend breaks the support at $0.00001100, the altcoin will fall and reach the expected price level of 1.618 Fibonacci extension or $0.00000949.

Analysis of the SHIB indicator

The moving average lines have dropped significantly at the bottom of the chart. The resistance line of the price bars is the 21-day SMA. The underside of the chart is indicated by the elongated candle tails. They indicate that there is considerable buying pressure at lower prices.

Technical indicators

Key Resistance levels: $0.00002800, $0.00002900, $0.00003000

Key Support levels: $0.00002200, $0.00002000, $0.00001900

What is the next move for Shiba Inu?

Since February 3, the altcoin has maintained its position above the $0.00001100 support, reducing selling pressure. The upside is limited below the high of $0.00001300.

According to the price analysis by Coinidol.com, SHIB is trading in a range above the current support. The market has moved sideways since March 11 as the altcoin reaches bearish exhaustion.

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

2 days ago

25

2 days ago

25

English (US) ·

English (US) ·