Shiba Inu (SHIB), the second most valuable meme coin, was not exempted from the market bloodbath that occurred on August 5. A few days later, the token bounced after initially hitting a five-month low.

This rebound sparked speculation of a notable price increase. However, SHIB has not lived up to that expectation despite flashing a sign that the current value could be a rare discount.

Shiba Inu At a Discount, Wants to Break Free

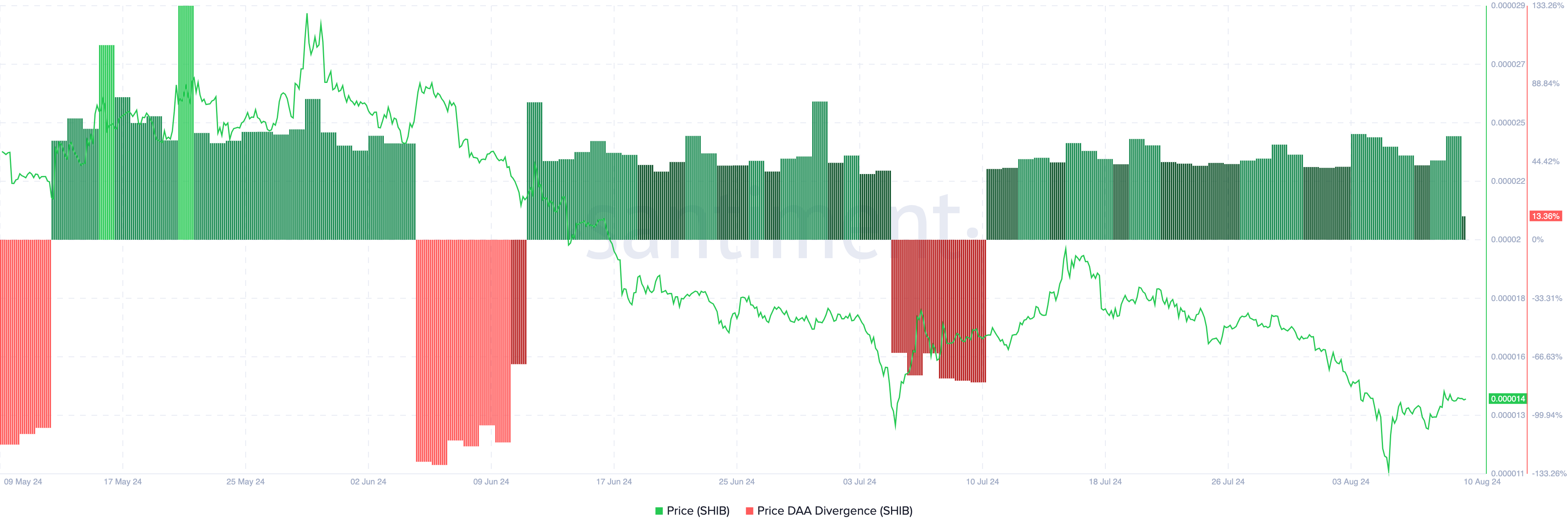

On-chain data from Santiment looked at Shiba Inu’s price DAA divergence. The DAA in this metric stands for Daily Active Addresses, and it measures the rate of user participation on a blockchain. A rise in this metric increases the chance of price growth, while a decrease suggests otherwise.

When combined with the token’s value, the price DAA divergence offers insights into entry and exit signals. Typically, if the reading is negative, the price is growing faster than active addresses, which usually indicates a sell signal.

However, if the reading is positive, it means user participation is outpacing price growth, serving as a buy signal. At press time, SHIB’s price DAA is 12.17%, suggesting the latter and flashing a buying opportunity.

Read more: 12 Best Shiba Inu (SHIB) Wallets in 2024

Shiba Inu Price DAA Divergence. Source: Santiment

Shiba Inu Price DAA Divergence. Source: SantimentLikewise, the Market Value to Realized Value (MVRV) ratio also corroborates this bias. This ratio uses the level of market profitability to determine whether a cryptocurrency is undervalued or overvalued relative to its fair value.

It also helps to spot tops and bottoms. Specifically, if the MVRV ratio is extremely high, holders have many unrealized profits, suggesting that they could be willing to sell. If this happens, it puts downward pressure on the price.

On the other hand, a low ratio suggests a low level of unrealized gains—sometimes, increased losses. If this is the case, market participants will rather hold than sell, which could offer stability to the cryptocurrency price.

Shiba Inu Market Value to Realized Value Ratio. Source: IntoTheBlock

Shiba Inu Market Value to Realized Value Ratio. Source: IntoTheBlock As shown above, the ratio in SHIB’s case is 0.69. This indicates higher unrealized losses than profits. As such, as supported by historical data, this could be a spot for increased accumulation before a notable bounce appears.

SHIB Price Prediction: Turnaround Not Imminent

Despite the bullish signals identified on-chain, the technical perspective is contrasting. At press time, SHIB’s price is $0.000014.

According to the daily chart, SHIB formed a descending channel between mid-July and August 7 before a slight bounce one day later. For context, a descending channel appears when two downward trendlines hit lower highs (resistance) and lower lows (support), indicating a bearish continuation.

Meanwhile, the token has yet to fully exit this pattern, suggesting that a notable upswing could be off the cards. Furthermore, Bull-Bear Power (BBP), which shows the relationship between bulls’ and bears’ strength, is negative.

Typically, a positive reading of the BBP indicates that bulls are in control. But since it is the other way around for the Shiba Inu token, it means that bears have more power.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

Shiba Inu Daily Analysis. Source: TradingView

Shiba Inu Daily Analysis. Source: TradingView If this remains the case, the price of SHIB could consolidate between $0.000012 and $0.000014. If selling pressure intensifies, the token could attempt retesting the swing low at $0.000010.

However, a rise in buying pressure may invalidate this thesis. If this happens, SHIB’s price could jump to $0.000017.

The post Shiba Inu (SHIB) Presents Buying Opportunity, Yet Rally Could Be Delayed appeared first on BeInCrypto.

2 months ago

28

2 months ago

28

English (US) ·

English (US) ·