- Software valuations are repricing fast, and private credit is tied to the same borrowers

- Private credit expanded in easy conditions and hasn’t faced a real stress test

- When equities reprice this hard, credit problems often surface with a lag

The last major financial crisis didn’t begin with banks collapsing overnight. It began with confidence slipping, slowly at first, then all at once. Credit had been extended to borrowers that looked fine as long as prices stayed supportive. When that support vanished, the story changed quickly. Today, the risk isn’t housing. It’s corporate borrowers, many of them backed by private credit, across software, services, and growth-focused firms.

Private credit ballooned during the long stretch of low rates and predictable growth. Defaults were limited, valuations moved slowly, and losses felt rare. But that calm was mostly a reflection of the environment. It wasn’t proof that the asset class is built to handle real disruption.

Why Software Is the Pressure Point

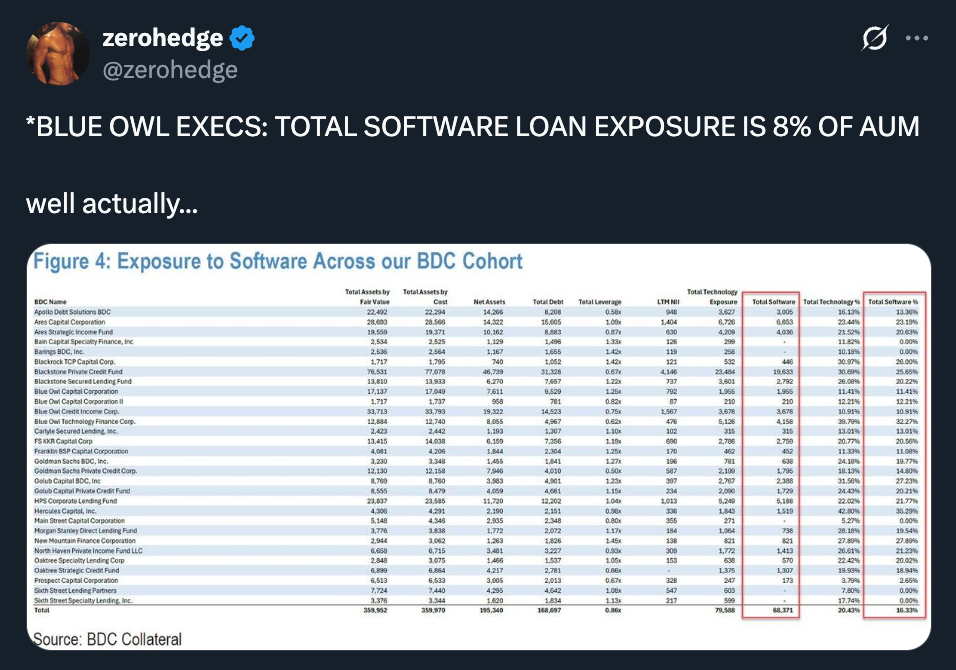

The recent repricing in software stocks isn’t random noise. It reflects a deep reassessment of business models as AI pushes into areas that were once treated as defensible. Public markets have erased hundreds of billions in value in days, and that matters because software isn’t just an equity story. It’s also a major borrower base.

A meaningful share of private credit loans are tied to software and services companies. When public markets start questioning revenue durability, credit markets eventually start questioning repayment durability. Equity reacts first because it’s liquid and forward-looking. Credit reacts later because it moves slower and prefers to pretend nothing changed until it has to admit it did.

Private Credit’s “Stability” Can Be a Delay Mechanism

One of the structural issues with private credit is that it doesn’t trade openly. Pricing is updated infrequently, often based on internal models, manager assumptions, and smooth mark-to-model valuations. That can create the illusion of stability, even when the underlying borrowers are under stress.

The problem is that delayed stress doesn’t disappear. It piles up. When pressure finally shows up in private credit, it tends to arrive suddenly, with fewer exit paths and more surprise. That’s why the recent declines in private credit managers shouldn’t be dismissed as sentiment alone. Markets are starting to question what’s inside those loan books.

When Public Markets Move Fast, Private Assets Don’t Get a Choice

Private credit isn’t collapsing, at least not yet. But the belief that it’s insulated from disruption is wearing thin. When fast-moving public markets and slow-moving private assets collide, history suggests the adjustment comes from one direction only.

Software stocks repricing this aggressively is a warning, not a headline. If the equity layer is cracking, the credit layer usually follows, just on a delay. The next phase won’t be about narratives. It’ll be about whether borrowers can still pay when the market stops giving them the benefit of the doubt.

Disclaimer: BlockNews provides independent reporting on crypto, blockchain, and digital finance. All content is for informational purposes only and does not constitute financial advice. Readers should do their own research before making investment decisions. Some articles may use AI tools to assist in drafting, but every piece is reviewed and edited by our editorial team of experienced crypto writers and analysts before publication.

2 hours ago

9

2 hours ago

9

English (US) ·

English (US) ·