Driven by a mix of positive elements, Solana (SOL) is seeing a spike in trading activity. This covers big buy orders, institutional investors’ savvy purchasing approach, and the expected release of SOL-based exchange-traded funds (ETFs).

Whales Consolidate SOL discretely

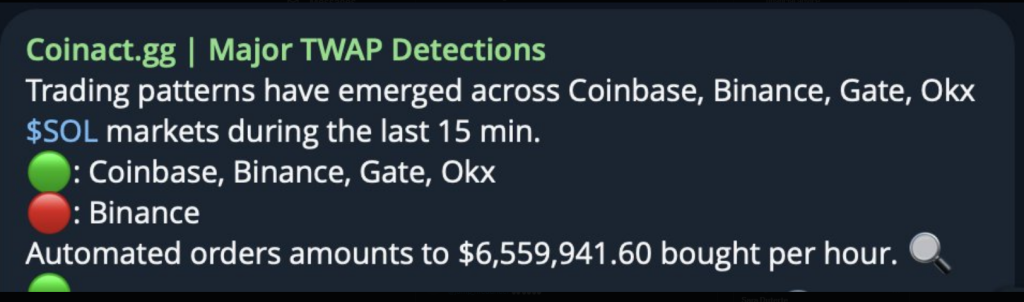

Trading data shows a notable increase in trading volume among key exchanges including Binance, Coinbase, Gate.io, and OKX. However, a more in-depth analysis by Coinact.gg, which is a real-time trading research programme, indicates a pattern that is very intriguing: a “Major TWAP” signal for SOL.

Major TWAP Detection alert on $SOL. Larger buyers are accumulating $SOL #Solana.

Trading patterns have emerged across @coinbase , @binance , @gate_io , @okx $SOL markets during the last 15 min.

: Coinbase, Binance, Gate, Okx

: Coinbase, Binance, Gate, Okx

: Binance

Automated orders amounts to… pic.twitter.com/TXpnfprQPn

: Binance

Automated orders amounts to… pic.twitter.com/TXpnfprQPn

— MartyParty (@martypartymusic) July 10, 2024

Big investors, notably financial institutions, typically employ a strategy known as Time-Weighted Average Price, or TWAP for short. It is common practice to spread out a large buy order over a certain time period in order to lessen the impact it has on the market price.

The implication of this is that institutional players are purposefully accumulating SOL without causing big price movements, which is a classic indicative of a long-term positive outlook.

ETF Hype Ignites Investor Interest

In addition, the announcement that probable SOL-oriented exchange-traded funds (ETFs) might hit the market by the middle of March 2025 is generating curiosity among investors. As a result of the Chicago Board Options Exchange (CBOE)’s recent submission of proposals to list exchange-traded funds (ETFs) offered by VanEck and 21Shares, the bitcoin community has been filled with excitement and speculation.

A number of analysts are projecting a continuous rise in SOL price; others estimate a 17% gain by August 10th under underlying cautious optimism. Additionally showing a positive trend are technical indicators.

Measuring general market mood, the Fear & Greed Index comes out as “Fear” (29). This implies that although investors are largely hopeful about SOL’s possibilities, certain fundamental issues remain present in the larger crypto industry.

The disparity seen in Binance’s trade statistics relative to other exchanges raises some questions. More research is required to find the cause of this varying behaviour as it could points to a distinct market dynamic acting especially on Binance.

ETFs’ promise of easily available, regulated SOL investing choices is drawing a fresh generation of investors, especially those previously reluctant to negotiate the complexity of cryptocurrency exchanges. The sustain 8% price rise for SOL in the weekly timeframe reflects this higher demand enabling network to pedal its way back to the $142 field.

Fueled by a convergence of favourable circumstances, Solana’s future seems bright. Positive outlook is presented by institutional investor interest, the possibility of regulated ETFs and recent price rise.

Featured image from Pexels, chart from TradingView

3 months ago

40

3 months ago

40

English (US) ·

English (US) ·