- Solana trades near $137 with compressed price action, and the $133 zone is emerging as a major demand area.

- A staked Solana ETF filing was withdrawn by CoinShares, adding a new twist to an already sensitive market.

- Despite regulatory noise, ecosystem partnerships and liquidity expansion keep Solana’s broader outlook constructive.

Solana is still trading in a pretty cautious environment as the market attempts to steady itself after the rough November drop. Price action feels compressed, almost like the market’s holding its breath, and traders are glued to the same key support levels waiting for that early flicker of strength.

At the moment, SOL is hovering near $137, up around 8% on the week. Short-term momentum remains soft, maybe even a bit tired, but the latest structure looks less like a continuation of the decline and more like a market searching for direction.

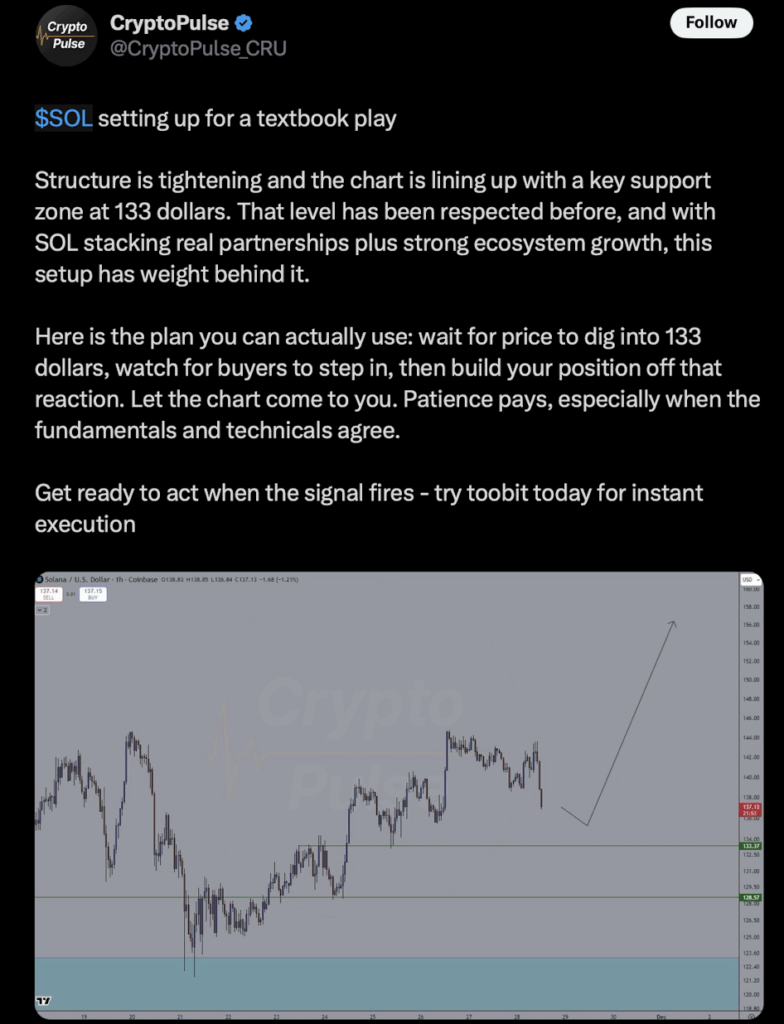

A “continuation play” may be forming at $133

According to CryptoPulse, Solana is creeping into what they call a “textbook continuation play” around the $133 support zone. They noted that price has respected this level repeatedly — buyers tend to come in quickly every time SOL taps it, almost like muscle memory.

CryptoPulse suggested traders wait for SOL to approach $133 and then watch how buyers behave before taking a position. Instead of treating $133 as a perfect line, they frame it as a flexible demand zone — a controlled pullback rather than obvious weakness.

On the daily chart, SOL is still below the 20-day EMA, which keeps the short-term trend pointed downward. But the candles between $135–$140 show much softer selling pressure than before, matching the idea that the market is compressing rather than dumping. RSI near 40 reinforces that view — bearish, yes, but flattening, hinting that stabilization could be forming underneath the surface.

Solana ETF withdrawal adds a twist to the narrative

A new wrinkle entered the picture when CoinShares officially withdrew its filing for a staked Solana ETF, according to the latest SEC note. The firm said the transaction necessary to launch the product never took place, so no shares were issued — or will be.

This comes at a time when U.S. attention on staked Solana offerings has been heating up. Other issuers have already launched similar products:

- REX-Osprey released the first staked SOL ETF in June

- Bitwise followed in October

Bitwise’s ETF opened to impressive demand, pulling in roughly $223 million on its first trading day. The contrast between providers shows how fragmented and experimental the regulatory landscape still is — different issuers are taking very different approaches as they try to figure out what passes compliance and what doesn’t.

Despite the noise, Solana’s ecosystem continues expanding

Even with the ETF withdrawal, analysts remain focused on the bigger picture: Solana’s network fundamentals. CryptoPulse highlighted ongoing partnerships, deepening liquidity, and overall ecosystem expansion — all of which form the backdrop for evaluating SOL’s current structure and how it might behave around the $133 support.

Final thoughts

Solana is still walking a tightrope between stabilization and hesitation. If buyers show up at $133 like they have before, SOL could carve out a stronger base for its next attempt upward. If not, the compression may drag on. Either way, the next move likely begins at this same support zone — the one everyone’s watching closely.

The post Solana Hesitates but Holds Ground — Here Is Why Traders Are Watching the $133 Zone Closely first appeared on BlockNews.

2 months ago

20

2 months ago

20

English (US) ·

English (US) ·