Solana’s price has faced significant struggles in recent weeks, particularly in its attempt to breach the key resistance of $183. The altcoin’s inability to break through this level has caused a pullback, leaving it trading at around $150.

The recent market conditions, marked by a Death Cross, suggest more downward pressure could be ahead.

Solana Faces A Death Cross

Solana recently experienced its first Death Cross since October 2023, ending a 17-month streak of Golden Cross formations. The Death Cross occurs when the 200-day exponential moving average (EMA) crosses over the 50-day EMA. Historically, this is a bearish signal for the asset, as it suggests weakening momentum and potential further declines.

This technical indicator raises concerns about Solana’s ability to recover and may trigger additional selling, contributing to a downward spiral. The appearance of the Death Cross often indicates that sellers are in control of the market, and the price may continue to slide.

Solana Death Cross. Source: TradingView

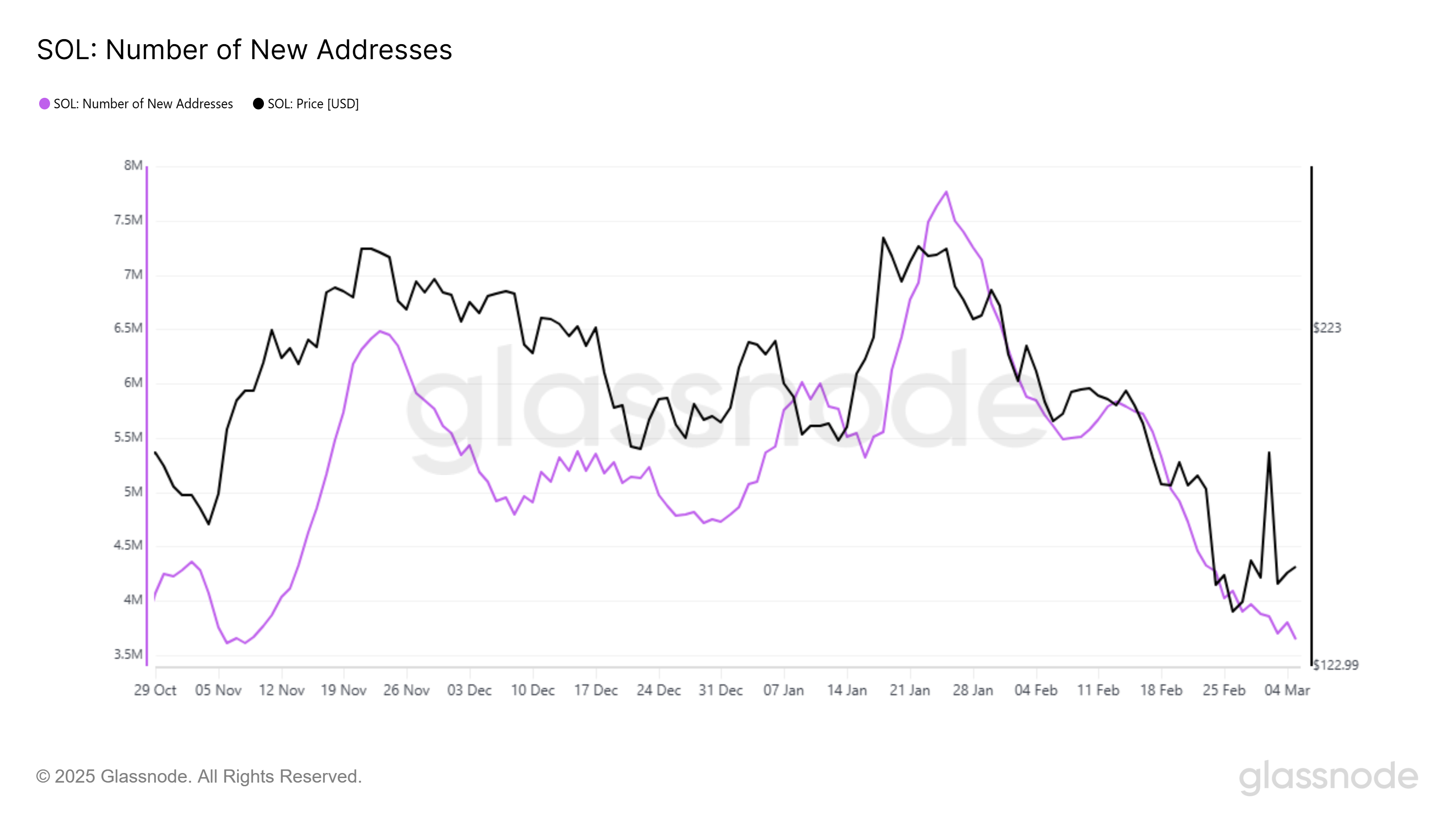

Solana Death Cross. Source: TradingViewThe overall macro momentum of Solana has also shown signs of weakening. A significant indicator of this shift is the decrease in new addresses interacting with the Solana network. The number of new addresses has dropped to a 4-month low, signaling a lack of new investor interest.

This decline suggests that Solana is losing traction in the market, as investors do not see an immediate incentive to pour capital into the altcoin. As the number of new participants decreases, Solana faces a risk of further stagnation.

Solana New Addresses. Source: Glassnode

Solana New Addresses. Source: GlassnodeSOL Price Needs A Boost

At the time of writing, Solana’s price stands at $149, about 23% away from the critical resistance of $183. While the altcoin remains above $137, it will struggle to regain upward momentum unless it can breach this resistance level. Without a reversal at this level, Solana could remain trapped within its current downtrend.

Given the bearish technical factors, Solana may struggle to maintain its current price level. The next key support for Solana lies at $131. If the downtrend continues, a drop to this level could be imminent. Losing support at $131 could lead to further declines, with a potential drop to $120 in the short term.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingViewThe only way to invalidate this bearish outlook is if Solana can capitalize on the broader market recovery. If the altcoin can breach $161, it would be a strong sign that it is gaining strength again. A successful flip of this resistance into support could set the stage for a move past $183 and a reversal of the current downtrend.

The post Solana Price At $150 Faces Death Cross After 17 Months; New Investors Pullback appeared first on BeInCrypto.

5 months ago

25

5 months ago

25

English (US) ·

English (US) ·