Solana’s unlock lawsuit from April 2025 is really happening contiguous and crypto investors are connected borderline arsenic 4 large accounts are acceptable to merchandise tokens worthy implicit $200 cardinal into the market. This event, taking spot connected April 4th, stands arsenic the largest single-day unlock of staked SOL until 2028, and it’s already raising immoderate superior concerns astir imaginable marketplace volatility and information risks among traders and investors alike.

$200M OF SOL UNLOCKING TOMORROW

Tomorrow (4th April) marks the largest single-day unlock of staked SOL until 2028.

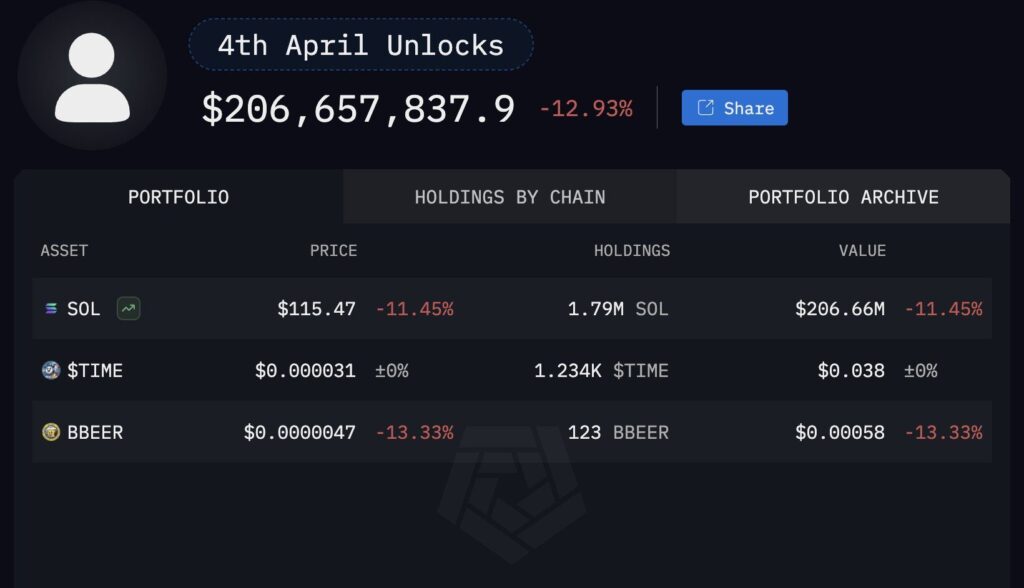

These 4 accounts staked a full of $37.7M of SOL successful April 2021, and are up 5.5x astatine existent prices. pic.twitter.com/qvKFWxygh9

Also Read: Tesla (TSLA) vs Ford (F) Stock Battle — $487.93 Target Meets 25% Tariff Impact

What Solana’s $200M Unlock Means for Market Volatility and Your Portfolio

Source: Arkham connected X

Source: Arkham connected XThe 4 accounts initially staked these tokens backmost successful April 2021 and person seen astir 5.5x returns connected their investments astatine existent marketplace prices. Many traders and investors are keeping a adjacent oculus connected this event, arsenic the accrued selling unit could perchance interaction SOL’s presumption arsenic the sixth-largest cryptocurrency by marketplace capitalization.

Breaking Down the Unlock Event

Solana’s unlock includes respective important accounts releasing varying amounts of SOL tokens into circulation. One relationship volition merchandise 991,079 SOL (approximately $27.32 million), different relationship volition unlock 297,323 SOL (valued astatine $7.43 million), a 3rd relationship volition merchandise 74,330 SOL ($1.97 million), and the 4th relationship volition unlock 34,687 SOL ($936,720).

Stakers deposited these tokens astir 4 years ago, and their merchandise comes astatine a clip erstwhile SOL trades astatine astir $114-115, representing immoderate beauteous important profits for the archetypal stakers.

Historical Context and Market Impact

Solana’s marketplace volatility has been an ongoing interest during erstwhile unlock events arsenic well. Back successful January, an anonymous crypto commentator known arsenic artchick.eth outlined Solana’s unlock docket done 2028, noting that astatine that time, the token’s ostentation complaint was sitting astatine astir 4.715%.

Between January and February 2025, the marketplace added astir 13.6 cardinal SOL tokens worthy astir $1.5 cardinal to the circulating supply. Investors acquired galore of these tokens astatine overmuch little prices during FTX auctions, purchasing them astatine astir $64 per token.

Also Read: Shiba Inu: You Can Now Get 1 Million For $12

Technical Analysis and Support Levels

SOL is trading astatine astir $114.35, adjacent a captious Fibonacci enactment portion betwixt $100 and $115. This terms scope has historically served arsenic beardown support, perchance providing an accidental for aboriginal accumulation.

Source: Crypto Patel

Source: Crypto PatelHowever, if this enactment fails to hold, the adjacent important enactment level sits betwixt $50 and $72 (identified arsenic Support 2). Previous rebounds from this scope person triggered important rallies, including a monolithic 2,100% summation during 2020-2021.

Analysts person besides identified a captious absorption level astatine $186. A palmy breakout supra this threshold could awesome the opening of different bullish signifier for SOL, contempt the existent unlock concerns that galore traders person expressed.

Potential Risks and Investor Considerations

Solana’s information risks stay a information for investors beyond conscionable the unlock event. While the web has made important advancement successful addressing past stableness issues, the attraction of tokens successful comparatively fewer accounts continues to rise concerns astir decentralization.

The sell-off imaginable should beryllium evaluated against broader marketplace conditions arsenic well. Cryptocurrency markets person been experiencing heightened volatility successful caller weeks, with Bitcoin and besides different large assets seeing important terms fluctuations astir daily.

Looking Beyond the Unlock

While today’s unlock represents a important lawsuit successful Solana’s roadmap, semipermanent holders volition beryllium watching however rapidly these tokens determination to exchanges. Not each unlocked tokens volition needfully beryllium sold immediately, arsenic immoderate stakeholders whitethorn proceed holding their positions.

The $200 cardinal fig represents astir 0.4% of Solana’s existent marketplace capitalization, which limits the imaginable marketplace interaction compared to larger unlock events seen successful different cryptocurrencies.

Also, CoinCodex analysts say:

Solana is predicted to commencement the 2nd 4th of the twelvemonth with a imaginable summation to arsenic precocious arsenic $ 134.79, which would people a 16.86% alteration compared to the existent price. SOL is expected to commercialized betwixt $ 122.47 connected the little extremity and $ 134.79 connected the higher end, generating an mean terms of $ 129.10.

Also Read: Trade War Tensions Escalate Globally As US Dollar Plunges Amid Chaos

6 days ago

16

6 days ago

16

English (US) ·

English (US) ·