MicroStrategy (MSTR) isn’t your average tech stock. It has a unique identity as a publicly traded proxy for Bitcoin. For professionals exploring finance or cryptocurrency for the first time, the allure of binary options trading on MSTR is an exciting blend of math, strategy, and creativity.

Let’s unpack how to navigate this dynamic opportunity with European binary options, balancing the art of speculation with the science of quantitative finance.

What’s a Binary Option?

Think of a binary option as a “yes or no” question in finance. At a specific moment in time (expiration), if a condition is true, you get a fixed payout. If not, you walk away with nothing. It’s straightforward — like flipping a coin, but with more math.

For example:

- You bet $10 on MSTR crossing $400 by next Friday.

- If MSTR is above $400, you get $100.

- If not, well, you don’t.

Binary options are the financial world’s version of high-stakes trivia.

Spot vs. Forward Bets: The Basics

Before diving into strategies, let’s clarify two types of bets in the binary options world:

Spot Bets:

- You pay upfront.

- The payout happens only if the condition is met at expiration.

- Example: You pay $10 today to potentially win $100 if MSTR closes above $400.

Forward Bets:

- Payments are made at expiration.

- No upfront cost, but the stakes are settled later.

- Example: You agree to pay $50 if MSTR closes below $400, and you get $100 if it closes above $400.

The key difference is timing — spot bets require payment now, while forward bets settle later.

Why MSTR and Binary Options?

MSTR’s price dances in sync with Bitcoin. When Bitcoin surges, so does MSTR, often with amplified swings. This makes MSTR a dream playground for binary options traders. Here’s why:

- Volatility: Sharp price movements create opportunities.

- Bitcoin Correlation: MSTR mirrors Bitcoin, letting you speculate indirectly.

- Defined Risk: With binary options, you know your maximum loss and potential gain upfront.

Building the Strategy: Binary Options with Vanilla Call Spreads

Binary options are clean and elegant in theory, but replicating them in real life isn’t as simple. Enter the vanilla call spread — a practical way to mimic binary payoffs using regular options.

How to Replicate a Binary Option

Say you want to bet $100 that MSTR will close above $400 at expiration. Here’s how you can use a call spread:

Buy a Call Option:

- Strike price just below $400 (e.g., $399.99).

- This gives you the right to profit as MSTR rises.

Sell a Call Option:

- Strike price just above $400 (e.g., $400.01).

- This caps your upside, mimicking the fixed payout of a binary option.

The result? A payoff structure that approximates a binary option while using instruments already available in the market.

Math Behind the Magic

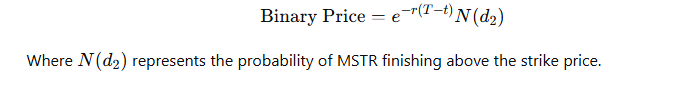

Binary options’ pricing relies on the Black-Scholes-Merton model, but here’s the simplified version:

- The higher the volatility, the more valuable the option.

- As expiration approaches, the option’s delta (sensitivity to price changes) spikes, creating “pin risk” — a sharp payoff sensitivity at the strike price.

If you like formulas, here’s one:

Skew: The Hidden Force in Option Pricing

Skew is the asymmetry in implied volatility across different strike prices. Think of it like a bias in the market — traders expect larger moves in one direction (usually up for Bitcoin-correlated assets like MSTR).

How Skew Affects MSTR:

- Higher volatility for out-of-the-money (OTM) calls reflects Bitcoin’s upside bias.

- Binary options are sensitive to skew, making their pricing more complex.

Practical Implications:

- Narrow spreads minimize skew effects but increase transaction costs.

- Wider spreads simplify execution but may dilute the payoff precision.

Risk Management: The Art of Staying Balanced

Trading binary options isn’t just about making bets — it’s about managing the risks.

Delta Hedging

Delta measures how much an option’s price moves relative to the underlying asset. For binary options, delta explodes as MSTR nears the strike price.

- Challenge: Rapid price changes can wipe out profits.

- Solution: Use dynamically adjusted vanilla options to neutralize delta exposure.

Gamma Management

Gamma measures how fast delta changes. It’s the second derivative of the option price, and it spikes near expiration.

- Challenge: High gamma increases volatility in your portfolio.

- Solution: Add ATM (at-the-money) options or widen the call spread to smooth out spikes.

Bitcoin Correlation

MSTR’s strong link to Bitcoin means you’re not just trading a stock — you’re trading Bitcoin’s volatility.

- Hedge: Use Bitcoin futures or options to manage the broader correlation risk.

Advanced Techniques: Adding Risk Reversals

A risk reversal enhances your binary strategy by combining:

- A long OTM call (e.g., $420) to capture upside potential.

- A short OTM put (e.g., $380) to offset costs.

For MSTR, this aligns with Bitcoin’s inherent bullish skew, giving you asymmetric exposure.

Step-by-Step Guide: Binary Options on MSTR

Define Your Bet:

- Bet: MSTR > $400.

- Payout: $100.

Construct the Hedge:

- Use 10,000 units of $399.99/$400.01 call spreads to replicate the binary payoff.

Adjust for Skew:

- Monitor volatility differences across strikes to optimize pricing.

Dynamic Adjustments:

- Add ATM options to dampen gamma spikes near expiration.

- Watch Bitcoin for correlated price moves.

Minimize Execution Risks:

- Account for bid-ask spreads and liquidity constraints in both MSTR and Bitcoin derivatives.

Why This Matters

Trading binary options on MSTR isn’t just about profits — it’s about leveraging cutting-edge financial tools to harness volatility. For professionals dipping their toes into this space, it’s an intellectual exercise with real-world stakes. You’re not just trading a stock; you’re navigating the interplay of math, markets, and human psychology.

Final Thoughts: MSTR as a Gateway to Bitcoin Exposure

MicroStrategy has redefined what it means to be a public company by intertwining its fate with Bitcoin’s. By using binary options and the strategies outlined here, you can turn MSTR’s volatility into a calculated advantage. Whether you’re speculating or hedging, this approach provides a sophisticated way to engage with one of the most dynamic assets in the market.

In the end, binary options on MSTR aren’t just trades — they’re a window into the future of finance, where traditional tools meet the bold frontier of cryptocurrency.

Spot vs. Forward Bets: The Art of Playing Financial Poker with MSTR was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

32

2 months ago

32

English (US) ·

English (US) ·