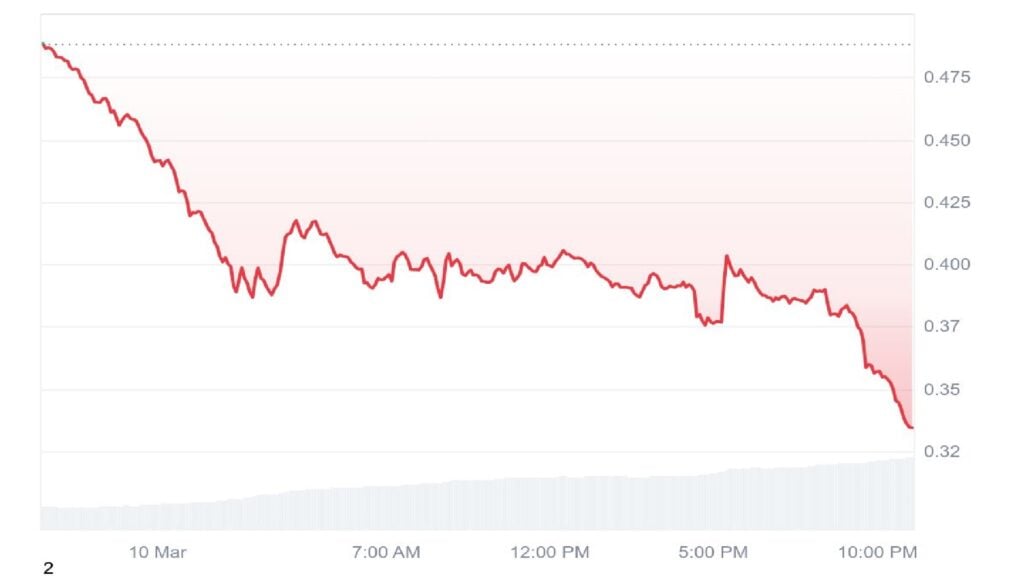

The cryptocurrency market is experiencing a significant downturn, with SPX6900 taking a major hit. The token has plunged from $0.50 cents to $0.38, marking a steep decline. Historically, many cryptocurrencies tend to correct by 95-98% from their all-time highs in a prolonged bear market.

While there is uncertainty about whether SPX6900 will see a short-term bounce before further declines, the overall market sentiment remains bearish. Broader economic conditions and political influences, including the impact of Trump’s involvement with crypto, have contributed to the market’s struggles.

This downward trend is not exclusive to crypto, as traditional financial markets like the S&P 500 are also facing significant declines. The S&P has dropped from 6,100 to 5,700, indicating a broader market weakness that is affecting multiple asset classes.

Source – Jacob Crypto Bury on YouTube

$SPX Crypto Price Prediction

Looking at price predictions for $SPX, the coin has already fallen through key support levels, recently breaking below $0.42 and now trading at $0.38. Further downside could bring the price down to $0.34, where a potential support zone exists.

Technical indicators suggest that the token may be forming a macro falling wedge pattern, which historically signals a possible reversal after bottoming out. If SPX6900 manages to recover, a potential bounce of around 56% could be seen.

However, the uncertainty surrounding the project’s Twitter suspension adds to the bearish outlook, as a lack of social media presence can negatively impact investor confidence. Until the overall crypto market shows signs of recovery, SPX6900 may continue to struggle.

Conclusion

The current market conditions highlight the importance of cautious trading strategies. With the total crypto market cap down to $2.73 trillion and fear levels at extreme lows, it is crucial for investors to avoid impulsive decisions.

Market cycles often follow patterns, with euphoria leading to overbought conditions and inevitable corrections. Learning from past trends, taking profits during bullish phases, and recognizing warning signals—such as heightened social media activity—can help traders navigate volatility.

While trading opportunities still exist, the risks remain high, making careful risk management essential. Investors can optimize their strategies by leveraging low-fee exchanges and community insights to maximize potential gains while mitigating losses.

Given the current downtrend, SPX6900 faces significant resistance in its path to recovery. A move toward $1 in the coming weeks appears unlikely without a major catalyst or broader market reversal.

While a partial rebound is possible if sentiment improves, the ongoing lack of bullish momentum suggests that traders should remain cautious. Monitoring key support levels and staying informed about macroeconomic trends will be essential in assessing $SPX’s future trajectory.

7 months ago

43

7 months ago

43

English (US) ·

English (US) ·