TLDR:

- Stablecoin supply on ERC20 has reached record levels in 2025, reinforcing its role as a key liquidity signal.

- Rising supply continues to precede major Bitcoin moves, according to data tracked by CryptoQuant.

- Global liquidity expansion supports the trend, but stablecoins offer faster and more precise market insight.

- Stablecoins now act as the primary liquidity engine for trading, lending, and ETF-driven market flows.

Global liquidity is climbing again as major economies push new stimulus and easing expectations grow. Investors are watching how this trend feeds into crypto, where stablecoin supply has reached historic levels.

Data shared by CryptoQuant shows consistent expansion across ERC20 stablecoins. Market participants now view this metric as a leading gauge of buying power within the digital asset ecosystem.

Stablecoin Supply Emerges as a Leading Crypto Liquidity Indicator

CryptoQuant and XWIN Research pointed to a stable rise in ERC20 stablecoin supply, which has crossed $160 billion in 2025. This level marks an all-time high and reflects direct inflows into trading venues, lending markets, and decentralized exchanges.

The data also aligns with comments on X noting that stablecoin supply behaves more consistently than Bitcoin’s price. It captures investor flows faster than global money supply reports, which often arrive with long delays.

Rising supply has also matched earlier shifts in the market. The pattern appeared during the 2021 cycle, where expansion in stablecoin balances preceded Bitcoin’s rally. It reappeared through the 2024 and 2025 recovery phases noted by CryptoQuant.

Analysts tracking the metric say that rising supply often supports stronger market conditions.

XWIN Research highlighted the broader macro backdrop as well. The group noted rising liquidity in the United States, China, Japan, and Europe. These moves continue a trend that began in 2020 when global M2 surged and Bitcoin followed with a major bull run.

Correlation decreased in later years, though, showing that M2 alone cannot signal the direction of Bitcoin’s price.

The divergence became clearer during the tightening cycle of 2022 and 2023. Bitcoin often moved independently of M2 levels.

That shift drove more attention to stablecoins, which remain closely tied to real-time crypto market activity. Their supply growth now represents what some describe as the heartbeat of crypto liquidity.

Record Supply Suggests Rising Buying Power in the Crypto Market

Stablecoins remain central to market flow because they serve as the primary funding asset for trading pairs. Their usage on DEXs and lending platforms has also expanded sharply.

According to CryptoQuant, this supply continues to rise even during periods of price uncertainty. That suggests underlying capital is still entering the ecosystem.

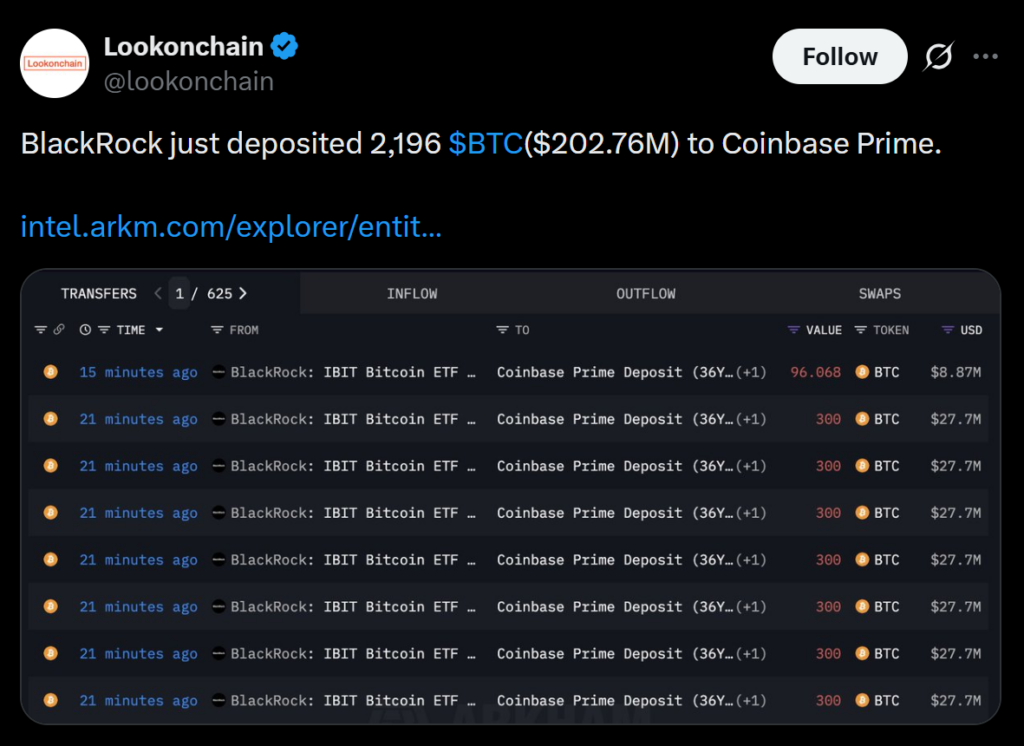

The data also captures institutional flows tied to ETFs and structured products. Activity from these channels feeds directly into stablecoin balances, which then power market transactions. When supply accelerates, traders often interpret it as increased liquidity. When it slows, the market can experience reduced momentum.

Market watchers following posts from CryptoQuant and XWIN Research noted that stablecoin supply has become one of Bitcoin’s most important indicators.

With supply at record highs in 2025, the data points to growing buying power. Investors now track this metric closely to understand short-term and medium-term market strength.

The post Stablecoin Supply Hits New Highs as Liquidity Rises Across Global Markets appeared first on Blockonomi.

1 week ago

11

1 week ago

11

English (US) ·

English (US) ·