- Standard Chartered predicts Bitcoin could reach $500,000 by 2028, driven by improved investor access and reduced volatility.

- Institutional inflows into spot Bitcoin ETFs are expected to grow under the pro-crypto Trump administration.

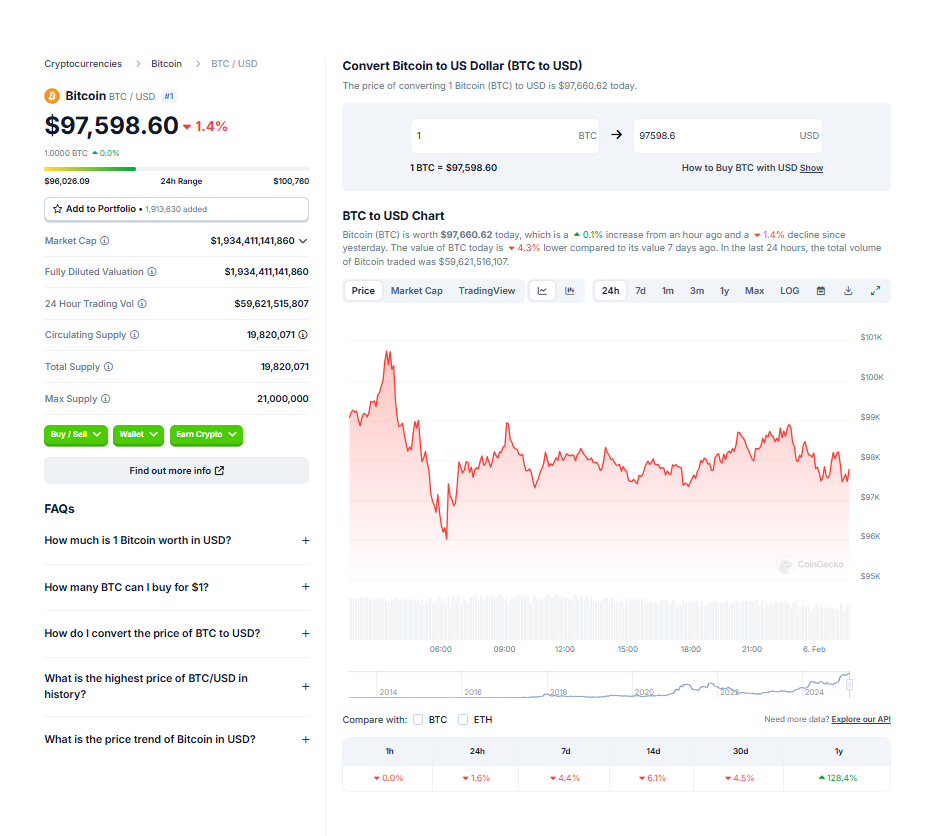

- Bitcoin is currently trading around $98,000, while the BTC-to-gold ratio has dropped amid increased demand for gold.

Bitcoin’s price could soar to $500,000 by 2028, driven by greater investor access and reduced volatility, according to a forecast by Standard Chartered. Geoffrey Kendrick, the bank’s global head of digital assets research, noted in a report that as the U.S. spot Bitcoin ETF market matures, price stability will improve, bolstering Bitcoin’s appeal as a hedge against traditional finance issues.

The Path to $500,000

Kendrick predicts that institutional inflows into Bitcoin ETFs will continue to rise, particularly under the pro-crypto Trump administration. This growing access and adoption are expected to increase Bitcoin’s role in diversified portfolios, especially alongside gold. “This dynamic could push Bitcoin’s price to $500,000 before Trump leaves office,” Kendrick wrote.

The bank also set shorter-term targets of $200,000 by the end of this year and $300,000 by 2026.

Bitcoin’s Current Market Position

Bitcoin is trading near $98,000 as of now. Meanwhile, the BTC-to-gold ratio has hit its lowest point since mid-November, driven by a surge in gold prices amid heightened concerns over a U.S.-China trade war and rising demand from China.

Institutional Confidence Builds

As investor confidence strengthens, Bitcoin’s dual role as a hedge and growth asset becomes more pronounced. Kendrick expects that this maturing market environment will attract more capital, solidifying Bitcoin’s long-term growth trajectory and positioning it as a core digital asset in institutional portfolios.

8 months ago

46

8 months ago

46

English (US) ·

English (US) ·