Telegram bot tokens have had an equally rough day, as the crypto market’s decline has affected their prices.

This bearish sentiment is furthered by skeptical investors who opted to sell their assets expecting profits but ended up facing losses.

Banana Gun Holders’ Losses

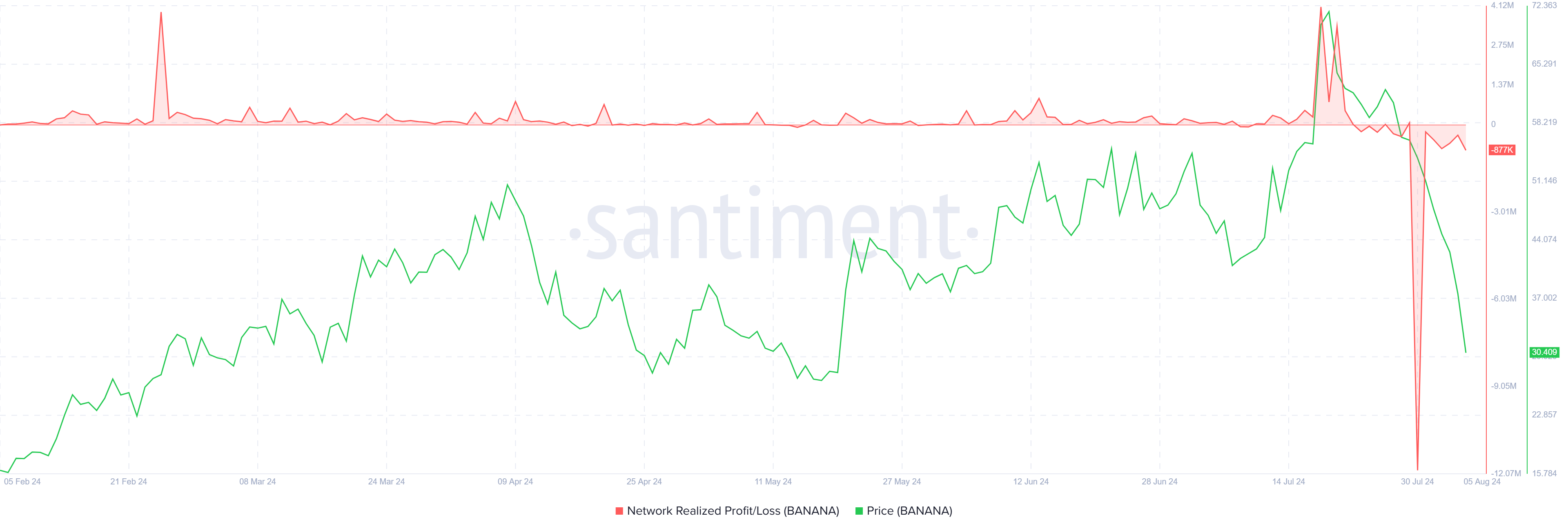

BANANA’s price is presently at a multi-month low and continues to drop due to the lack of bullishness among the Telegram Bot token’s investors. Towards the end of July, panicked investors tried to offload their holdings, leading to significant market turbulence.

This rush to sell resulted in unprecedented losses for the Banana Gun token, marking a historic downturn for the asset. The mass sell-off caused the Telegram Bot token to experience the largest losses it has ever seen. The intense market reaction reflects the depth of investor panic during this period.

Read More: What Are Telegram Bot Coins?

BANANA Realized Losses. Source: Santiment

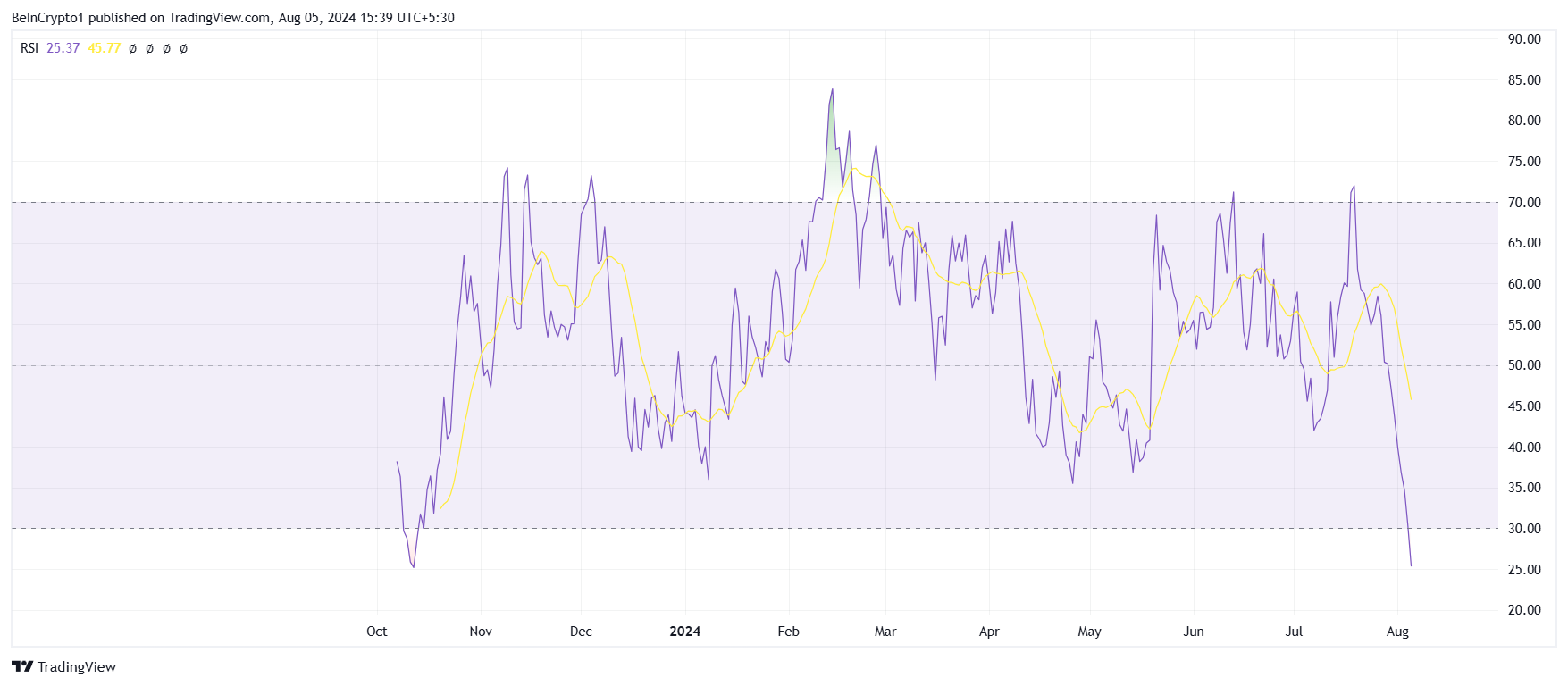

BANANA Realized Losses. Source: SantimentAs a consequence, BANANA is now significantly oversold. This oversold condition is highlighted by the Relative Strength Index (RSI), which indicates an extreme undervaluation of the token.

This oversold status of BANANA has occurred for only the second time since the token’s inception. This rare event highlights the severity of the current market conditions for Banana Gun.

BANANA RSI. Source: TradingView

BANANA RSI. Source: TradingViewBANANA Price Prediction: Small Chance to Bounce Back

BANANA’s price at $30 surprisingly holds above the critical support floor of $26. This level has been tested multiple times and has prevented a drawdown below $25 for over five months.

This gives BANANA a chance to bounce back from this support. However, considering the aforementioned factors and the Telegram Bot token’s 58% decline in the last two weeks, recovery could take a while.

Read More: Crypto Telegram Groups To Join in 2024

BANANA Price Analysis. Source: TradingView

BANANA Price Analysis. Source: TradingViewIf demand surpasses pessimism, the BANANA price could attempt a breach of the resistance at $36. Successfully breaching it would invalidate the bearish thesis.

The post Telegram Bot Token Banana’s Price Crashes 31% in 24 Hours appeared first on BeInCrypto.

3 months ago

28

3 months ago

28

English (US) ·

English (US) ·