Tesla’s banal terms driblet has shocked investors arsenic Wedbush expert Dan Ives slashes targets amid increasing concerns. With Apple’s banal terms driblet hitting astir 25% year-to-date and Trump’s tariffs threatening planetary proviso chains, galore disquieted investors are asking if they should merchantability Tesla stocks earlier a tech banal crash.

Also Read: Crash to Cash: Warren Buffett’s Bear Market Playbook Revealed!

Navigating Tech Stock Risks Amid Downgrades And Tariff Fears

Source: Finance Magnates

Source: Finance MagnatesTesla’s Perfect Storm: Tariffs and China Backlash

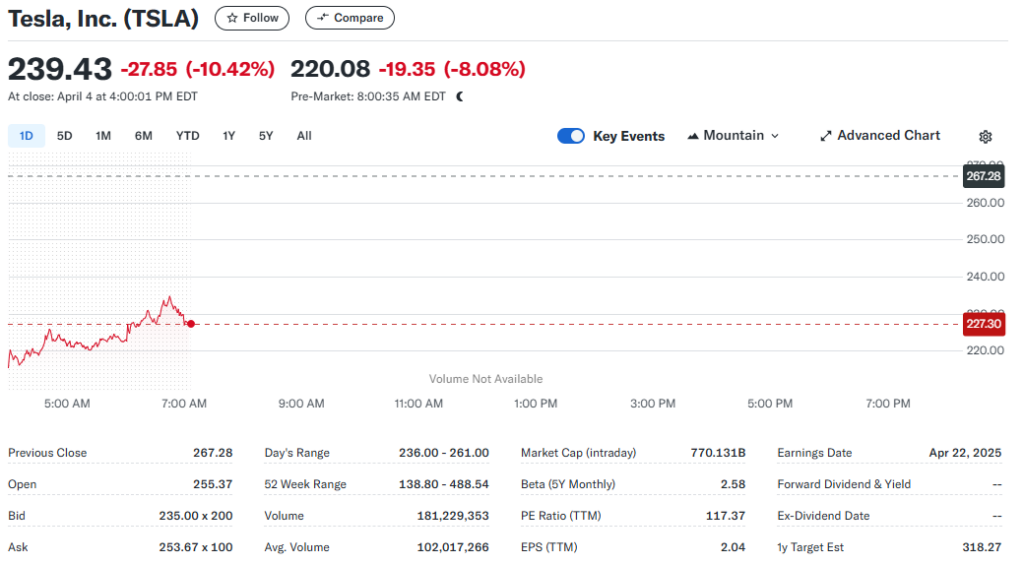

Tesla’s banal terms driblet has really intensified aft Ives chopped his terms people by a important 43% to $315. Tesla shares person tumbled 9.15% past week to $239.25, and are present down much than 50% from December’s highest of $488.54.

Dan Ives stated:

“Tesla is little exposed to tariffs than different US automakers, but determination volition beryllium a wide outgo impact. The bigger interest successful our sentiment is Tesla’s occurrence successful China arsenic this cardinal portion is the linchpin to the aboriginal occurrence of Tesla.”

He besides added:

“Tesla has fundamentally go a governmental awesome globally. The marque situation tornado that has present turned into an F5 tornado.”

According to Ives, Tesla has mislaid astatine slightest 10% of its aboriginal lawsuit base, and European losses are perchance reaching 20% oregon much – harm helium specifically called “all self-inflicted by Musk.”

Source: Yahoo Finance

Source: Yahoo FinanceAlso Read: Ripple: AI Predicts XRP Price For April 12, 2025

Apple Faces “Tariff Armageddon”

Apple’s banal terms driblet mirrors Tesla’s banal terms driblet concerns, with Wedbush besides slashing Apple’s people by astir 23% to $250. Both stocks are presently reflecting increasing tech banal clang fears among investors and analysts alike.

Dan Ives warned successful his Sunday note:

“The tariff economical Armageddon unleashed by Trump is simply a implicit catastrophe for Apple fixed its monolithic China accumulation exposure. In our view, nary US tech institution is much negatively impacted by these tariffs than Apple with 90% of iPhones produced and assembled successful China.”

The Wedbush analysts further emphasized successful their research:

“The hearts and lungs of the Apple proviso concatenation are cemented successful Asia.”

Should You Sell Tesla Stock Now?

Tesla’s banal terms driblet truly raises immoderate captious questions for investors astatine this moment. With projected 54% levies connected Chinese imports and different 32% connected Taiwanese goods, some Tesla and Apple are facing superior proviso concatenation challenges successful the coming months.

For Tesla, governmental associations are besides complicating matters adjacent further. Musk’s connections to Trump whitethorn beryllium driving lawsuit backlash, particularly successful Europe and China. Some caller signals amusement Musk perchance trying to region himself from Trump’s commercialized policies. However, this constituent whitethorn travel excessively precocious arsenic the harm already exists.

Trump’s tariffs could accelerate a broader tech banal clang scenario, peculiarly hurting companies with dense Asian proviso concatenation dependencies specified arsenic Tesla and Apple.

Investment Outlook Amid Market Turbulence

At the clip of writing, Apple’s banal has fallen 13.55% to $188.38 past week, hitting 10-month lows and present trading astir 28% beneath December’s high. Wedbush’s carnivore lawsuit for Apple is presently $160, portion their bull lawsuit – assuming immoderate tariff exemptions – returns to a much optimistic $325.

Also Read: Asian Stock Market Crash: India, China, Japan, Singapore & Thailand Bleed

For investors acrophobic astir the ongoing Tesla banal terms drop, timing truly matters here. Both companies are facing captious quarters up arsenic they navigate the tariff impacts and effort to supply updated guidance to reassure investors.

10 hours ago

20

10 hours ago

20

English (US) ·

English (US) ·