Crypto AI agents are in a tough spot right now, with market caps declining around 60-70% in the past two months. Yet, there is strong potential for sustainable growth. The volatility inherent in crypto can weed out unsuccessful projects while fostering a sense of determination and innovation.

DeFAI remains an intriguing area of investment, and many members of the Ethereum community still foresee strong potential from combining AI and crypto.

Do AI Agents Have a Place in Crypto?

AI agents were touted as the next big thing in Web3 just a few months ago. However, volatility and speculative trading has severely impacted the sector.

Last month, the sector’s market cap fell 65%, and new launches have seen mixed success. Now, some community members are speculating that the whole concept was a fad and that meme coins will subsume all demand.

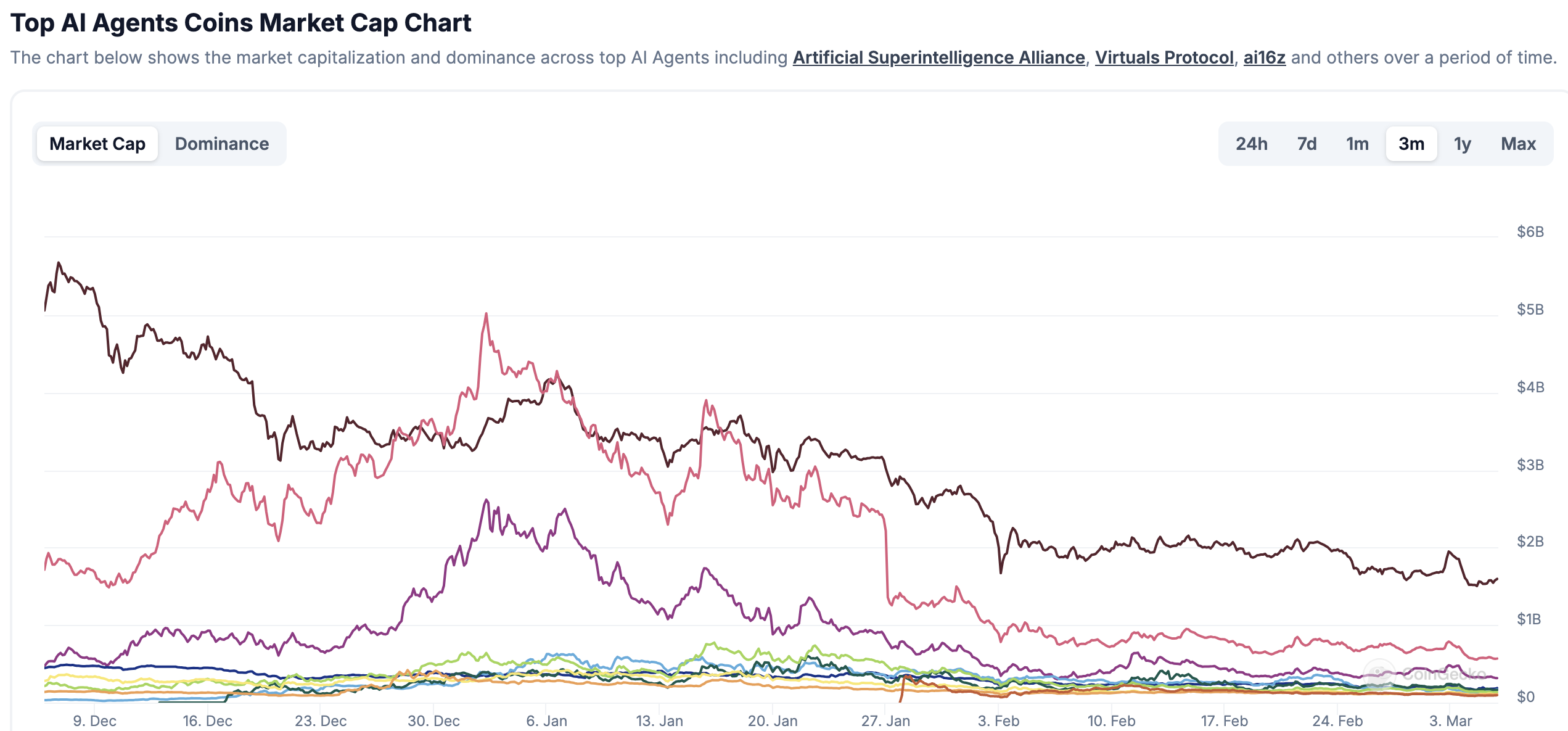

Case in point, AI agents’ market cap is down 60-70% from the start of 2025.

Crypto AI Agents Market Cap. Source: CoinGecko

Crypto AI Agents Market Cap. Source: CoinGeckoDespite these bearish figures, not everyone in crypto shares this dismal vision. This industry has always been defined by its volatility and boom and bust cycles.

However, from shock incidents like market collapses to scheduled events like Bitcoin halvings, bear cycles always present an opportunity to weed out nonviable projects. Successful fundamentals win out.

“AI agents are not over. They’re on the path of adoption like the majority of other technological breakthroughs.Initially, people believed every AI project would be worth billions. Now, after months of development and the natural elimination of unsustainable projects, people are more bearish than ever. This is the exact time to lock in for solid projects,” developer DeFi Warhol claimed.

He claimed that AI agents hit a “peak of inflated expectations” in late 2024, which led to widespread disillusionment at the first sign of trouble. However, ambitious developers are still trying to innovate and are determined work will bring new projects to the markets.

Popular AI investor 0xJeff posited that one area looks particularly fruitful for future investment: DeFAI, which merges DeFi with AI.

“The best way to build a highly differentiated AI agent is to tap into existing high-value verticals. One of the best sectors is DeFi—many highly matured sub-sectors offer tons of value with ~$100 billion TVL combined. The easiest way to start isn’t by adding AI—it’s by bringing DeFi to AI agent tokens,” he claimed.

Before the AI agent space hit this bear market, DeFAI was already heralded as a potential growth area. 0xJeff identified a few extant projects that already have high potential, claiming that AI could make complicated DeFi instruments more intelligible to the average user.

This simple integration could be a massive value-add to projects like Pendle or GammaSwap.

DeFi projects in categories like liquid Staking, restaking, yield markets, and stablecoins can benefit from AI agents. Additionally, community members are reporting that the hype isn’t dead yet.

At ETHDenver, the Ethereum community’s biggest conference, AI integration was a key agenda. So, the crypto AI agents bubble might have popped, but real tangible growth is likely just starting.

The post The AI Agent Bubble Has Popped As Speculative Trading Fades appeared first on BeInCrypto.

9 hours ago

23

9 hours ago

23

English (US) ·

English (US) ·