Immediately after the inauguration ceremony of Trump as the new President of the USA, World Liberty Financial spent over 110 million dollars in stablecoin to purchase various crypto.

At the same time, however, Donald Trump did not publicly mention “Bitcoin” or “crypto” during the inaugural speech, causing the asset prices in the market to plummet.

The memecoin TRUMP also faced strong selling pressure, while the president’s entourage made large profits.

Let’s see all the details below.

World Liberty Financial exchanges stablecoin for various crypto for over $110 million after Trump’s inauguration

Yesterday, World Liberty Financial, the DeFi platform linked to Donald Trump and his family, carried out a large number of stablecoin swaps by purchasing various crypto.

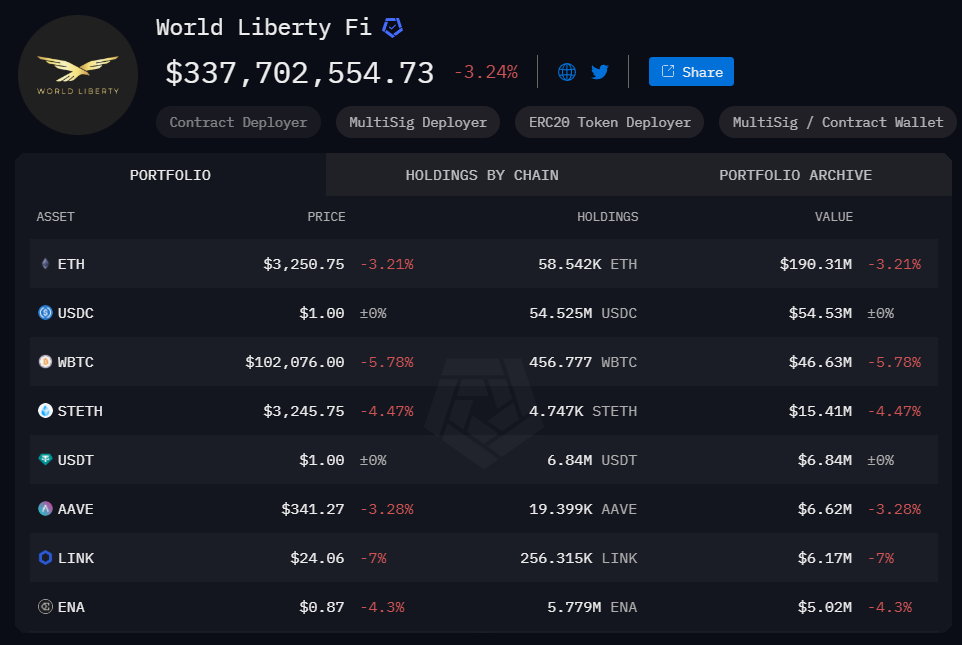

In total, the address connected to the president’s crypto project has spent approximately 112.8 million dollars in altcoins such as WBTC, ETH, AAVE, TRX, LINK, and ENA.

In particular, there have been exchanges for 47 million dollars in WBTC, 47 million dollars in ETH, and 4.7 million dollars for each of the remaining tokens.

The operations were carried out through the decentralized protocol CoW Swap immediately after the celebratory inauguration speech.

Overall, the value of the portfolio of World Liberty Financial amounts to 337 million dollars, of which 60 million are in stablecoins like USDC and USDT.

The largest holding is ETH with a value of 190 million dollars, increasing after the latest purchases over the weekend and yesterday.

Source: https://intel.arkm.com/explorer/entity/worldlibertyfi

Source: https://intel.arkm.com/explorer/entity/worldlibertyfiThe recurring purchases in stablecoin of the project strengthen Trump’s brand in the crypto world, bringing confidence among the community.

It seems that the plan is to enable a lending protocol with the assets that have been accumulated, potentially also launching its own stablecoin.

The recent transactions occurred while the sales of the governance token WLFI have increased in recent days reaching the threshold of 1 billion dollars.

World Liberty Financial is led by Zachary Folkman and Chase Herro, two pioneers of the DeFi sector who previously worked for Dough Finance.

Several members of the Trump family have publicly supported the crypto platform, including the two sons Eric, Donald Jr, and Barron, involved with the titles of “Web3 Ambassadors” and “DeFi Visionary”. The president has instead been appointed “Chief Crypto Advocate“.

Great news! An additional 5% of our token supply is now available to purchase on our website. We appreciate the overwhelming support and look forward to welcoming so many new people to our community!

Please only purchase using the link in our bio to avoid scams.

Trump never mentioned “crypto” or “Bitcoin” during the inauguration ceremony speech

Very curious to observe how yesterday Donald Trump never mentioned terms like “crypto” or “Bitcoin” during the inauguration speech.

Despite the DeFi project renewing its commitment in the sector with significant stablecoin swaps, the new USA president has not publicly spoken about digital assets, creating mixed feelings among his supporters.

In the middle of the inaugural oath, Trump spoke about “America First Priorities,” referring to the theme of immigration. He also explained that the country will shine again under his administration, but without ever connecting to the theme of a cryptographic reserve of the treasury, the dollar’s inflation, or its memecoin.

At the same time, even his first batch of 42 executive orders did not focus in any way on the crypto sector.

Various sources close to Donald Trump state that the first changes could arrive soon, such as the introduction of a council on cryptocurrencies and the blocking of a central bank digital currency (CBDC).

On January 13, the Washington Post reported that Trump was expected to immediately sign some executive orders, such as the repeal of a banking accounting policy that views crypto as liabilities on the banks’ balance sheets.

Other supporters of the industry hope that Trump will keep his promises and proceed to offer pardon to Ross Ulbricht, founder of the black market Silk Road,

In any case, up to now there has been no public reference to the crypto sector, such as to trigger a vortex of uncertainty in the middle of the market.

BTC, after reaching new all-time highs yesterday, fell below 102,000 dollars accompanying a general dump.

Overall, the market lost 240 billion dollars in capitalization after the initial morning rise, highlighting how the inauguration event was perceived by investors as a “sell the news”.

The memecoin TRUMP crashes after the inaugural speech but the President’s crypto team records billion-dollar profits

The absence of mentions of the crypto world by Trump during the inauguration ceremony also affected the memecoin of the new USA president.

The token TRUMP, which in the first two days of its debut attracted a high inflow of trades in stablecoin, was then abandoned causing a 50% dump from yesterday’s local top.

In particular, the meme coin had reached its ATH at 74 dollars on Sunday, only to dump heavily in the midst of the launch of MELANIA.

The sales then continued on the day of the inauguration, reaching 30 dollars before a slight recovery during the night.

TRUMP currently has a market cap of 8.3 billion dollars with liquidity in DeFi pools of 443 million dollars in USDC stablecoin.

Despite yesterday’s decline, Donald Trump’s crypto entourage has already made substantial profits thanks to insider activity.

The launch of the memecoin TRUMP and MELANIA was indeed accompanied by large initial purchases, which are now strongly in the bull.

A large part of the supply of the two coins is held by insider wallets that recorded trades in the very first minutes after the debut on the markets,

It is estimated that all wallets connected with the presidential memecoins currently hold 2.3 trillion dollars, obviously not all liquidatable at market price given the high impact that such sales would cause.

It is not easy to calculate how much the Trump family is in profit and how much they can actually manage to sell for stablecoin, but we are talking about a figure slightly below a billion dollars.

Did the $TRUMP coin have insiders in it?

Of course, yes.

Was I able to track them?

Yep.

These wallets have made GENERATIONAL WEALTH in the past 24 hours.

Over $400 million in profits.

Here's a list of these insider wallets

pic.twitter.com/hNyTsd79dm

pic.twitter.com/hNyTsd79dm

(@ardizor) January 19, 2025

(@ardizor) January 19, 2025

9 months ago

66

9 months ago

66

English (US) ·

English (US) ·