Welcome to our exciting journey into understanding AMPL, SPOT, and their innovative ecosystem!

This is the first article in our series where we’ll break down these fascinating protocols into bite-sized, easily digestible pieces. Whether you’re a crypto newbie or a DeFi veteran, there’s something here for everyone!

What the Heck is AMPL?

AMPL (or Ampleforth) is like that friend who adapts to any situation. Unlike Bitcoin or other cryptocurrencies that have a fixed number of tokens, AMPL does something unique — it adjusts the number of tokens in everyone’s wallets based on demand.

Wild, right?

Think of it this way:

- If you have a pizza and more people want it (demand increases), instead of the price just going up, the pizza magically gets bigger

- If fewer people want the pizza (demand decreases), the pizza gets smaller

- But here’s the key — everyone still owns the same percentage of the total pizza!

How Does This Magic Work?

Every day at 2 AM UTC, AMPL performs what we call a “rebase” — think of it as a daily check-up where AMPL looks at its price and makes adjustments:

- If people are buying lots of AMPL (price > $1 + 5%), everyone’s wallet balance increases

- If people are selling lots of AMPL (price < $1–5%), everyone’s wallet balance decreases

- If the price is steady (around $1 ± 5%), nothing changes

Let’s make this super real: Imagine you have 100 AMPL tokens.

During a positive rebase (when demand is high), your wallet might adjust to 110 tokens.

During a negative rebase, it might become 90 tokens. But — and this is important — you still own the same percentage of all AMPL tokens that exist!

The “Aha!” Moment

Remember when you first learned that the Earth orbits the Sun, and suddenly everything made more sense? AMPL has that kind of “aha!” moment too.

Instead of just letting prices go crazy up and down, AMPL adjusts the supply to help find a balance.

This is what makes AMPL truly special in the cryptocurrency world. It’s not just another token — it’s an entirely new way of thinking about digital money.

Why Was AMPL Created?

The story begins with a simple but crucial problem: most cryptocurrencies are too volatile for everyday use. Bitcoin might be worth $50,000 today and $45,000 tomorrow.

That’s not great if you’re trying to use it for things like loans or contracts!

AMPL was created to solve this problem by:

- Being completely decentralized — no central authority controls it

- Adjusting automatically based on supply and demand

- Maintaining long-term purchasing power

- Creating a new type of financial building block for the DeFi world

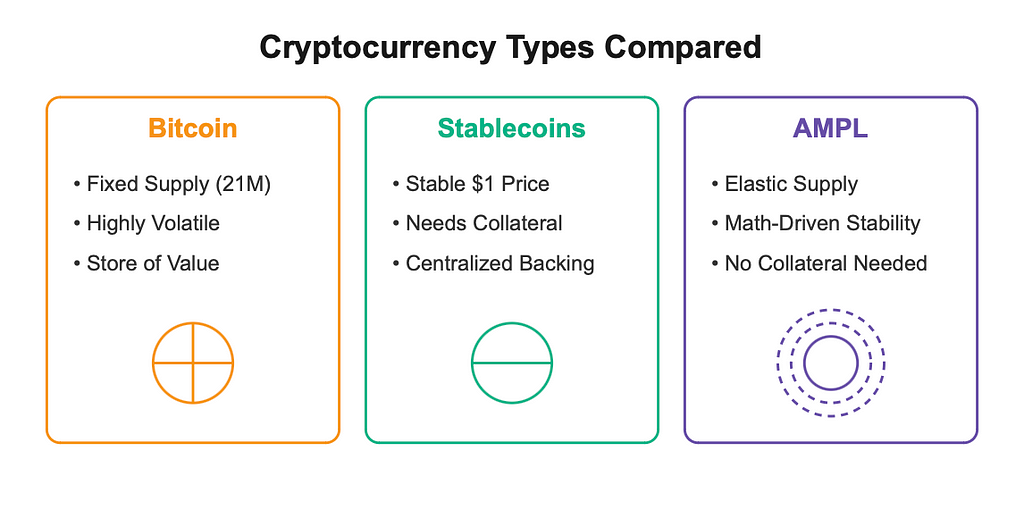

What Makes AMPL Different from Other Cryptocurrencies?

Let’s break down the key differences:

- Bitcoin: Fixed supply (21 million), highly volatile price

- Stablecoins: Stable price, but usually need real dollars or collateral

- AMPL: Adjustable supply, aims for price stability through pure mathematics and economics (no collateral required!)

Getting Started with AMPL

Ready to dive into the AMPL world? Here’s what you need to know:

- You can buy AMPL on various exchanges

- Your token balance will change daily (remember: your percentage ownership stays the same!)

- The best time to check your balance is after 2 AM UTC (after the daily rebase)

- Join the AMPL community — we’re a friendly bunch that is always ready to help!

Common Questions You Might Have

“Wait, my balance changes every day?” Yes! But don’t worry — these changes reflect market demand and your ownership percentage remains constant.

“Is this just another stablecoin?” Not quite! While AMPL aims for stability, it’s actually creating a whole new category of digital asset — an elastic supply cryptocurrency.

“Do I need to do anything during a rebase?” Nope! The protocol handles everything automatically. You can sit back and watch the magic happen.

The Big Picture Here…

AMPL is pioneering a revolutionary approach to cryptocurrency: one that can be used reliably for loans, contracts, and other financial applications without needing banks or governments to keep it stable.

It’s like having a self-adjusting measuring tape that always shows you the correct distance, regardless of the conditions around it.

Stay tuned for our next article in the series, where we’ll dive deeper into how AMPL’s rebase mechanism works and what it means for you as a user!

Got questions? Drop them in the comments below! Remember, if we can’t explain it to our golden retriever friends, we haven’t explained it well enough! 🐕

Get Involved!

Join our community:

- Discord: Join here

- Forum: Discuss here

- Twitter: @AmpleforthOrg

- Official Docs

- GitHub Repo

- Official Website

P.S. Find this helpful? Support more no-BS crypto content.

Note: This article simplifies complex concepts for better understanding. For technical details and exact mechanisms, please consult official project sources.

Important: Cryptocurrencies are volatile assets that carry significant risks. Never invest more than you can afford to lose. This content is for informational purposes only. Always do your own research (DYOR) and seek professional advice for investment decisions.

The Pizza That Grows When You’re Hungry: A Beginner’s Guide to AMPL Coin was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

38

2 months ago

38

English (US) ·

English (US) ·