Image Source: Google

Image Source: GoogleRegenerative Finance (ReFi) is emerging as a transformative approach within the financial sector, emphasizing the importance of sustainability and social equity. Unlike conventional financial systems that often prioritize short-term profits, ReFi seeks to create a holistic financial ecosystem that nurtures both environmental health and community well-being. By utilizing blockchain technology, ReFi enhances transparency, accountability, and inclusivity in financial transactions, making it easier for investors to support projects that resonate with their values. This shift is not merely a trend but a necessary evolution in response to the growing awareness of climate change and social injustice. As businesses and individuals increasingly seek to align their financial activities with their ethical standards, ReFi offers a compelling alternative that integrates social responsibility into the very fabric of finance.

Understanding the Concept of Regenerative Finance

At its core, regenerative finance embodies principles derived from both the regenerative economy and decentralized finance (DeFi). This unique combination allows for innovative financial solutions that prioritize ecological restoration and social equity. ReFi encourages investments in projects such as renewable energy, sustainable agriculture, and conservation efforts, aiming to create a circular economy where resources are reused and regenerated rather than depleted. By focusing on long-term impacts rather than immediate returns, ReFi fosters a mindset shift among investors and businesses alike. The goal is not just to mitigate harm but to actively contribute to the regeneration of ecosystems and communities. This approach recognizes that financial success can coexist with environmental stewardship and social responsibility, paving the way for a more sustainable future.

Key Principles of Regenerative Finance

1. Sustainability: The principle of sustainability is at the heart of regenerative finance. It emphasizes the need for investments that restore ecosystems and promote biodiversity rather than deplete natural resources. By prioritizing projects that have a positive environmental impact, ReFi encourages practices such as reforestation, renewable energy development, and sustainable agriculture. This focus on sustainability not only benefits the planet but also creates economic opportunities in emerging green sectors.

2. Transparency: Transparency is another foundational principle of regenerative finance. The use of blockchain technology provides clear visibility into how funds are allocated and the impact of investments. This transparency builds trust among stakeholders, including investors, project developers, and communities. By making information readily accessible, ReFi empowers individuals to make informed decisions about where to invest their money, ensuring that their contributions are directed toward projects that align with their values.

3. Inclusivity: Inclusivity is essential for creating a truly regenerative financial system. Regenerative finance seeks to ensure access to financial services for underserved communities and individuals who have historically been excluded from traditional financial systems. By promoting inclusive practices, ReFi aims to bridge gaps in access to capital and resources, enabling diverse voices to participate in decision-making processes. This inclusivity not only strengthens communities but also enhances the resilience of financial systems by incorporating a wider range of perspectives and experiences.

The Role of Blockchain in Regenerative Finance

Blockchain technology plays a pivotal role in the development of regenerative finance by providing a secure and decentralized platform for transactions. One of its most significant advantages is its ability to ensure that all transactions are recorded transparently on an immutable ledger. This feature reduces the potential for fraud and mismanagement of funds, which can undermine trust in financial systems. In addition, blockchain enables the creation of smart contracts — self-executing agreements coded into the blockchain — that automate transactions based on predefined conditions. This automation streamlines processes and ensures that funds are released only when specific milestones are met.

Moreover, blockchain facilitates tokenization — the process of converting real-world assets into digital tokens — allowing for fractional ownership and broader access to investment opportunities. For example, individuals can invest small amounts in large-scale renewable energy projects or conservation initiatives through tokenized assets. This democratization of investment opportunities aligns with the principles of inclusivity and sustainability inherent in regenerative finance.

Benefits of Blockchain in ReFi

Decentralization: One of the most compelling aspects of blockchain technology is its decentralized nature. By eliminating intermediaries such as banks or brokers, blockchain allows for direct transactions between parties. This decentralization not only reduces transaction costs but also increases efficiency by streamlining processes that would otherwise require multiple layers of approval or oversight.

Smart Contracts: Smart contracts play a crucial role in enhancing trust within regenerative finance initiatives. These self-executing contracts automatically enforce agreements based on predetermined conditions without requiring human intervention. For instance, a smart contract could release funds for a renewable energy project only when specific performance metrics are met, ensuring accountability and alignment with sustainability goals.

Tokenization: Tokenization opens up new avenues for investment by allowing real-world assets — such as land or carbon credits — to be represented digitally on the blockchain. This process enables fractional ownership, meaning that multiple investors can collectively fund large-scale projects without needing substantial capital individually. Tokenization not only democratizes access to investment opportunities but also creates liquidity in markets traditionally characterized by illiquid assets.

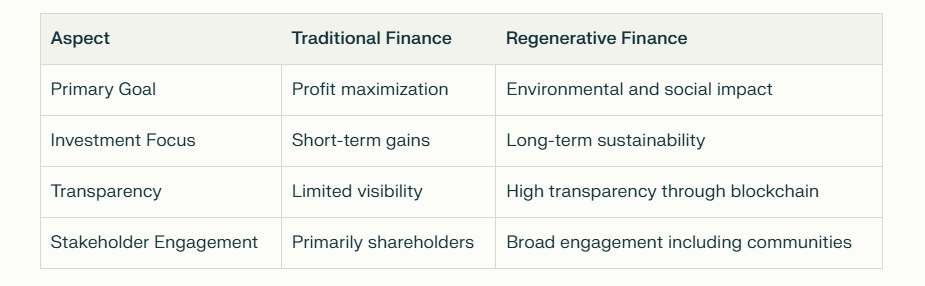

How Regenerative Finance Differs from Traditional Finance

Traditional finance primarily focuses on maximizing shareholder value — a practice often criticized for neglecting environmental and social considerations. In contrast, regenerative finance emphasizes long-term sustainability by considering the ecological impact of investments alongside financial returns. This fundamental shift reflects an evolving understanding that economic success should not come at the expense of our planet or society.

One key distinction between these two approaches lies in their investment focus. While traditional finance tends to prioritize short-term gains driven by market fluctuations, regenerative finance seeks investments that yield lasting benefits for both people and the environment over time. This long-term perspective encourages investors to think critically about where their money goes and what kind of impact it has on future generations.

Comparison Table: Traditional Finance vs. Regenerative Finance

Applications of Regenerative Finance

Regenerative finance is being applied across various sectors to promote sustainability through innovative funding mechanisms:

1. Renewable Energy Projects: One prominent application of ReFi is in funding renewable energy initiatives such as solar farms or wind energy projects through community investments. By allowing local residents to invest directly in these projects via tokenized offerings or community bonds, ReFi not only provides necessary capital but also fosters a sense of ownership among participants who benefit from cleaner energy sources.

2. Sustainable Agriculture: Another significant area where ReFi is making an impact is sustainable agriculture. Investments aimed at supporting organic farming practices can enhance soil health while promoting biodiversity through responsible land management techniques. By financing farmers who adopt regenerative practices — such as crop rotation or permaculture — ReFi helps create resilient food systems that prioritize ecological balance alongside productivity.

3. Conservation Efforts: Conservation initiatives benefit greatly from regenerative finance as well; funding reforestation projects or wildlife conservation efforts can be achieved through tokenized contributions from individuals passionate about environmental protection. These contributions can be tracked transparently on blockchain platforms, ensuring accountability while incentivizing participation from those who wish to support biodiversity preservation.

Case Studies in Regenerative Finance

Several organizations are leading the way in implementing regenerative finance principles effectively:

Toucan Protocol: This innovative platform focuses on tokenizing carbon credits, allowing individuals and businesses alike to offset their carbon emissions effectively while contributing positively towards climate action goals globally. By providing easy access to carbon markets via blockchain technology, Toucan facilitates transparent transactions that support sustainable practices across various industries.

Regen Network: Regen Network aims at creating an ecological marketplace where goods and services related specifically to ecological health are traded seamlessly among stakeholders involved — ranging from land stewards practicing regenerative agriculture techniques through land restoration efforts aimed at enhancing ecosystem services provided by nature itself. Their platform incentivizes landowners who adopt sustainable practices while offering consumers an opportunity to invest directly into projects benefiting both people & planet alike.

Challenges Facing Regenerative Finance

Despite its potential benefits, regenerative finance faces several challenges that must be addressed for widespread adoption:

Regulatory Uncertainty: The evolving regulatory landscape surrounding blockchain technologies poses significant challenges for ReFi initiatives seeking legitimacy within traditional financial frameworks. Navigating compliance requirements while maintaining operational flexibility can prove daunting, especially when regulations vary widely across jurisdictions.

Market Adoption: Convincing traditional investors — who often prioritize short-term returns over long-term sustainability — to embrace this model focused on ecological restoration may require extensive education about its merits. Establishing trust among stakeholders will be crucial if we hope to see increased capital flow toward these types of initiatives.

Technical Barriers: Developing user-friendly platforms capable of attracting broader audiences remains another hurdle facing many projects within this space. Ensuring accessibility & usability across diverse demographics will be vital if we hope to engage more people interested in participating within this new paradigm.

Future Outlook for Regenerative Finance

The future outlook for regenerative finance appears promising as more businesses recognize the importance of sustainability within their operations. As awareness grows regarding climate change impacts & social injustices, we can expect increased investment directed towards green technologies & practices aimed at addressing these pressing issues head-on. Additionally, advancements in artificial intelligence integrated alongside blockchain could further enhance measurement capabilities concerning environmental impacts while streamlining processes within ReFi frameworks.

Moreover, collaboration between various stakeholders — including governments, NGOs, corporations, & local communities — will play an essential role in driving growth within this sector. By working together towards shared goals around regeneration & sustainability, we can create robust ecosystems capable of generating lasting positive change across multiple dimensions.

Conclusion

Regenerative finance represents an innovative approach aligning financial systems with ecological sustainability & social responsibility. By harnessing blockchain technology effectively, ReFi provides a framework for creating lasting positive change in communities around the world. As businesses increasingly seek to engage in sustainable practices, exploring partnerships with DeFi development companies becomes crucial.

If you are interested in integrating regenerative finance principles into your business model or exploring DeFi development services, consider reaching out Codezeros today. Their expertise can guide you through this transformative journey towards a more sustainable future.

The Rise of Regenerative Finance: A Green Revolution in Blockchain was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

4 days ago

11

4 days ago

11

English (US) ·

English (US) ·