Satoshi Nakamoto’s wallet, purportedly containing around 1 million Bitcoin, is not only a cryptographic masterpiece but also a testament to the resilience of Bitcoin’s design. Alongside Satoshi’s holdings, countless wallets remain dormant due to lost private keys or the death of their owners, forming a vast reserve of inaccessible Bitcoin. As quantum computing advances, these dormant wallets represent a critical focus in understanding the limits and robustness of Bitcoin’s cryptographic infrastructure. This exploration delves into Bitcoin’s cryptographic architecture, the theoretical threats posed by quantum computing, and why these wallets remain secure for the foreseeable future.

Bitcoin’s Robust Cryptographic Foundations

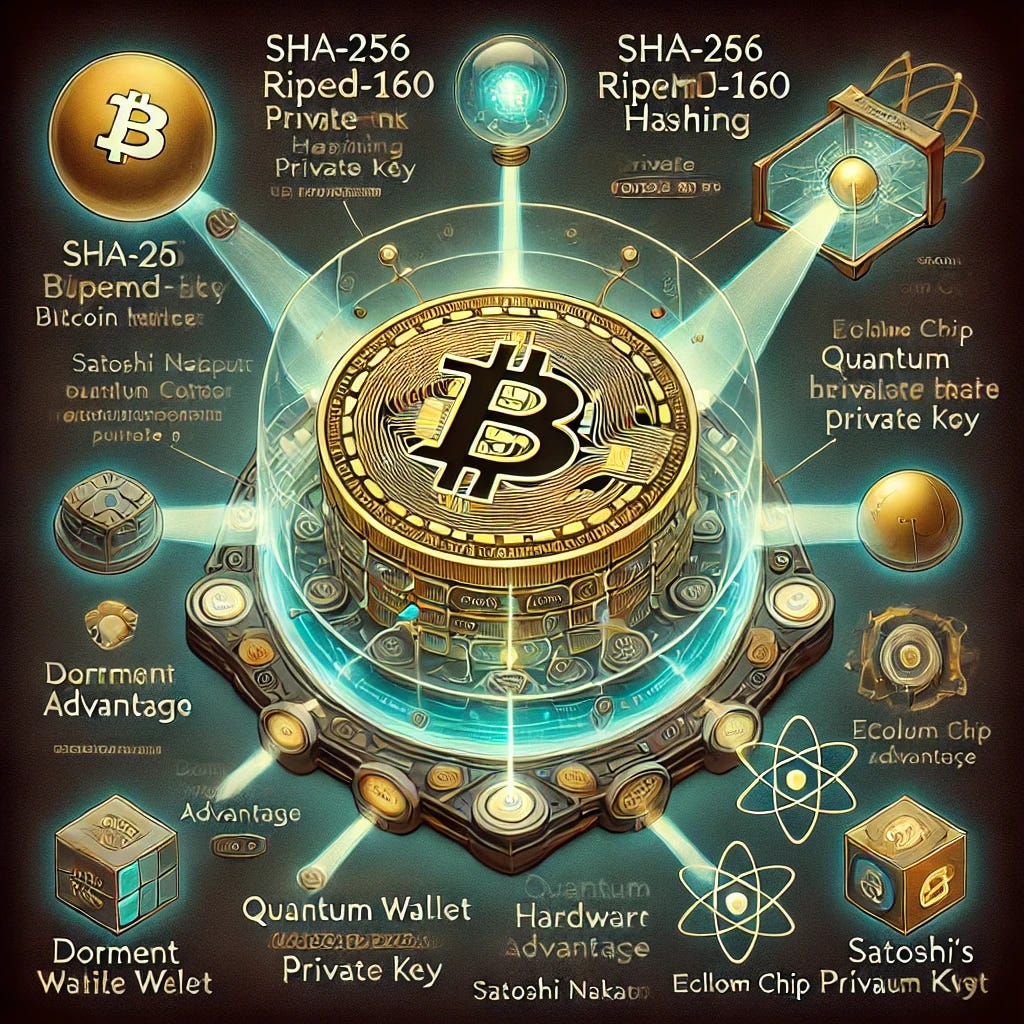

Bitcoin’s architecture is built on two cryptographic cornerstones:

- Elliptic Curve Digital Signature Algorithm (ECDSA): Responsible for generating private-public key pairs and securing transaction signatures.

- SHA-256 Hashing Algorithm: Ensures robust address protection and fortifies the blockchain.

In practice, private keys secure access to Bitcoin wallets, while public keys authenticate transactions. Addresses, such as those linked to Satoshi’s wallet or other dormant wallets, are derived through a dual application of SHA-256 and RIPEMD-160. The public keys associated with these addresses remain undisclosed until transactions occur. This cryptographic layering introduces significant complexity, making dormant wallets inherently resistant to attacks — even as computational threats evolve.

Quantum Computing: Theoretical Threats vs. Practical Constraints

Quantum computing theoretically challenges Bitcoin’s cryptography through two primary algorithms:

- Shor’s Algorithm: Designed to efficiently solve discrete logarithms and factorize large integers, it could theoretically break ECDSA. However, executing Shor’s Algorithm at scale requires millions of fault-tolerant qubits — a capability that is far beyond current quantum systems.

- Grover’s Algorithm: Offers a quadratic speedup for brute-forcing hash functions like SHA-256, effectively reducing its security from 256 bits to 128 bits. Even so, the computational demands remain unattainable for existing quantum hardware.

These algorithms, while theoretically potent, are hampered by the current state of quantum computing, where hardware limitations and error rates prevent practical application against Bitcoin’s cryptographic defenses.

Why Dormant Wallets Remain Secure

Public Key Invisibility

The most significant defense for dormant wallets, including Satoshi’s, lies in their unrevealed public keys. Without a public key, Shor’s Algorithm cannot compute the corresponding private key. This cryptographic invisibility ensures that dormant wallets remain immune to direct quantum attacks.

Quantum Hardware Limitations

Today’s quantum systems, such as Google’s Sycamore or Willow chip, are experimental and lack the scale, stability, and error correction required to mount cryptographic attacks. The challenge of achieving millions of fault-tolerant qubits, essential for targeting Bitcoin’s ECDSA, remains an elusive milestone for the field.

Layered Security Architecture

Bitcoin’s dual-layer defenses — ECDSA fortified by SHA-256 and RIPEMD-160 hashing — introduce exponential complexity to potential attacks. Breaching a dormant wallet would involve two daunting steps:

- Reverse the SHA-256 and RIPEMD-160 Hashing: To derive the public key from the Bitcoin address.

- Apply Shor’s Algorithm: To compute the private key from the derived public key.

Both steps pose significant computational hurdles, even with theoretical advancements like Grover’s speedup.

Logistical and Physical Barriers

Building a quantum computer capable of breaching Bitcoin’s cryptographic defenses would require revolutionary breakthroughs in qubit coherence, error correction, and scalability. Moreover, the energy, infrastructure, and logistical demands of such a system render these attacks impractical with current technology.

The Implications of Lost Wallets

Dormant wallets, including those inaccessible due to forgotten private keys, represent a unique aspect of Bitcoin’s ecosystem. These wallets account for a substantial portion of Bitcoin’s circulating supply, and their inactivity inadvertently serves as a security mechanism. As long as the public keys of these wallets remain undisclosed, they retain an inherent cryptographic shield, effectively mitigating risks posed by quantum advancements.

Potential Future Quantum Risks

While dormant wallets remain secure today, potential advancements in quantum computing could introduce risks:

- Scalable Quantum Supremacy: The development of quantum systems with millions of fault-tolerant qubits could make Shor’s Algorithm viable against ECDSA.

- Innovations in Hash Function Cryptanalysis: Although improbable, breakthroughs in attacking SHA-256 or RIPEMD-160 could expose vulnerabilities in Bitcoin’s architecture.

- Delayed Post-Quantum Transition: A failure to adopt quantum-resistant cryptography could leave the Bitcoin network exposed to future quantum threats.

These risks highlight the importance of proactive measures to ensure Bitcoin’s continued security in an evolving computational landscape.

Safeguards for Bitcoin’s Future

Transitioning to Post-Quantum Cryptography

The Bitcoin network can adopt quantum-resistant cryptographic schemes, such as lattice-based or hash-based cryptography, to secure wallets and transactions against emerging quantum threats. These protocols would render Bitcoin resilient to quantum advancements.

Dormancy as a Defensive Mechanism

Inactive wallets inherently benefit from their cryptographic invisibility. As long as public keys remain undisclosed, these wallets maintain a significant security advantage over active addresses.

Decentralized Risk Mitigation

Even with theoretical quantum breakthroughs, targeting specific wallets, such as Satoshi’s, would require extraordinary resources and attract global scrutiny. The ethical and logistical implications of such attacks act as natural deterrents.

Conclusion: A Cryptographic Fortress

Satoshi Nakamoto’s wallet, alongside countless other dormant wallets, epitomizes the resilience of Bitcoin’s cryptographic design. The combination of unrevealed public keys, layered cryptographic defenses, and the technical constraints of quantum computing ensures that these wallets remain secure. As the quantum computing landscape evolves, the adoption of post-quantum cryptography will further solidify Bitcoin’s position as a robust and secure digital asset. For now, these dormant treasures remain untouched, safeguarded by the innovative principles that define Bitcoin.

The Safety of Satoshi’s Wallets in the Quantum Computing Era was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

1 month ago

24

1 month ago

24

English (US) ·

English (US) ·