- What’s adjacent for DeFi successful 2025?

- We uncover the trends we volition look intimately astatine adjacent year.

A mentation of this nonfiction appeared successful our The Decentralised newsletter connected December 31. Sign up here.

GM, Tim here.

Happy New Year from everyone present astatine DL News!

Last twelvemonth I made immoderate bold predictions for 2024: That permissioned DeFi would roar into life, and that modularity-focused projects EigenLayer and Celestia would redefine the DeFi landscape.

EigenLayer, contempt drafting successful billions successful deposits, hasn’t seen overmuch adoption of its validation services yet. Celestia, too, has been hampered by a lack of demand for its services.

Development for hooks and Uniswap v4, which volition marque permissioned DeFi a reality, is inactive ongoing, but 2024 was surely not a breakout year.

As 2024 draws to a close, articulation maine arsenic I instrumentality different stab astatine predicting the cardinal DeFi trends for the coming year.

TradFi dives into DeFi

This year, respective Wall Street firms continued dipping their toes into DeFi.

Asset manager BlackRock launched its BUIDL money connected Ethereum successful March, past expanded it to 5 different blockchains successful November.

Rival State Street inked a concern with crypto custody and tokenisation level Taurus, portion involvement successful Franklin Templeton’s US Government Money Fund steadily grew.

Over successful Europe, Deutsche Bank announced earlier successful December that it’s gathering its ain Ethereum furniture 2 to code the regulatory challenges of utilizing DeFi.

But these moves whitethorn lone beryllium the commencement of a larger propulsion from institutions to utilise DeFi.

In 2025, “traditional institutions are apt to modulation onchain faster than expected,” Paul Frambot, CEO and co-founder of DeFi lending protocol Morpho, told DL News.

Fatmire Bekiri, caput of tokenisation astatine Sygnum Bank, said she expects much accepted fiscal players to participate DeFi successful 2025, fulfilling capitalist request for riskier onchain products.

Unclear crypto regulations — peculiarly successful the US — meant galore fiscal institutions held disconnected connected experimenting with DeFi, lest they autumn foul of securities laws.

But with a pro-crypto Trump medication conscionable astir the corner, that could soon change.

“People are inactive trying to fig retired what’s compliant,” Colin Butler, Polygon’s caput of organization capital, antecedently told DL News.

“Once definite things get accepted arsenic collateral astatine large places, past I deliberation everybody other gets to bash it. And that’s erstwhile I deliberation you spot the L curve for adoption.”

Protocols determination to their ain blockchains

This year, we saw large DeFi protocols determination towards launching their ain blockchains, usually successful the signifier of Ethereum furniture 2s.

Leading decentralised speech Uniswap announced successful October its processing its ain furniture 2 called Unichain.

DeFi lender Aave is mulling its ain Aave Network arsenic portion of its v4 upgrade, and Sky laminitis Rune Christensen has besides suggested gathering a dedicated blockchain.

There are bully reasons for them to bash so. Layer 2s are a large source of revenue arsenic those moving them tin skim disconnected the quality successful outgo betwixt what they complaint users and wage the Ethereum mainnet to finalise transactions.

Having a dedicated blockchain for a DeFi protocol means projects tin halt malicious forms of MEV impacting their users, and that they don’t person to stock resources and bandwidth with different DeFi protocols, perchance preventing congestion.

Daniel Wang, co-founder of Taiko Labs, the steadfast down furniture 2 blockchain Taiko, told DL News that helium sees much fragmentation wrong Ethereum and the projects gathering connected it successful 2025.

But, Wang said, the accrued fragmentation volition besides spot a greater absorption connected interoperability betwixt the increasing fig of furniture 2 blockchains.

DeFi and fintech unite

My last prediction is that 2025 volition beryllium the twelvemonth fintech apps yet commencement bringing DeFi to the masses.

We’re already seeing signs immoderate firms are preparing. Robinhood rolled retired crypto transportation services to its European customers successful October, and neobank Revolut expanded its crypto speech to 30 markets successful the portion a period later.

Integrating DeFi could beryllium incredibly lucrative for the archetypal fintech institution to bash so. Yields acold transcend those successful accepted finance, but they’ve ever been viewed arsenic excessively risky and hard for galore established players to instrumentality vantage of.

That content could beryllium changing — astatine slightest towards DeFi protocols with beardown information and compliance records.

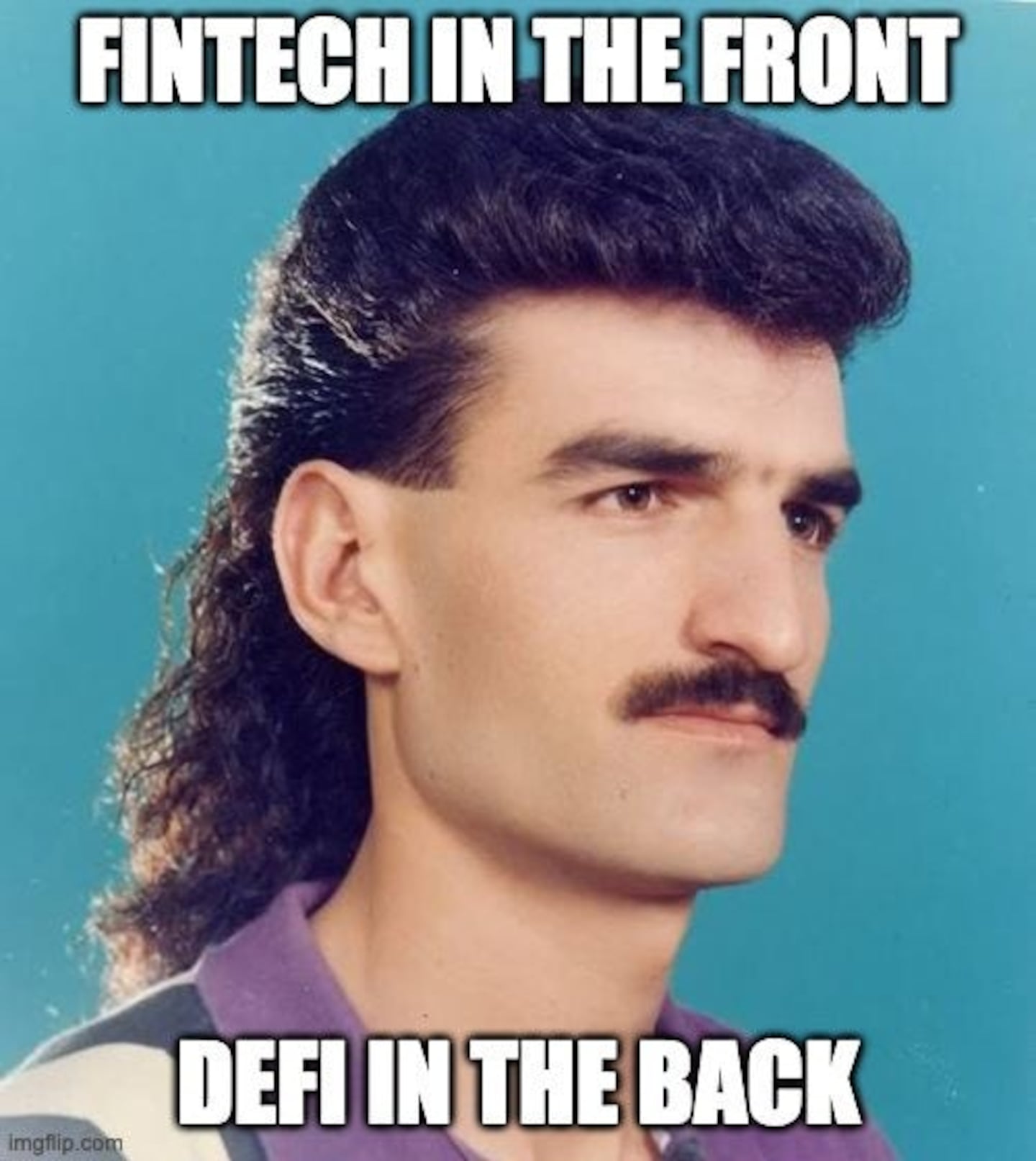

“In 2025, we’ll spot the long-awaited adoption of the ‘DeFi mullet’ — wherever fintech apps integrate DeFi protocols similar Aave oregon Morpho straight for safer and amended fiscal products,” Thomas Mattimore, CEO of ABC Labs, the squad down Reserve Protocol, told DL News.

The DeFi mullet (Bankless)

The “DeFi mullet” refers to the thought that fintech apps volition abstract distant the complexity and mediocre idiosyncratic acquisition of existent DeFi protocols, and unfastened entree to their users.

Mattimore’s not alone.

Morpho’s Frambot besides predicts that successful 2025, entree to and adoption of DeFi volition beryllium propelled by partnerships with fintech companies.

Like with institutions, the much favourable regulatory situation nether the Trump medication should springiness fintechs the assurance to integrate DeFi.

The bigger question is whether DeFi protocols are acceptable for a ample imaginable influx of investors from fintech apps. Only clip volition tell.

Got a extremity astir DeFi? Reach retired astatine [email protected].

2 months ago

96

2 months ago

96

English (US) ·

English (US) ·