Exploring the Best Flash Loan Arbitrage Bots for Ethereum in 2025: Features and Benefits

Flash loan arbitrage is a strategy where traders take advantage of price discrepancies across different decentralized finance (DeFi) platforms using flash loans. These loans allow users to borrow large sums of cryptocurrency without collateral, provided they repay the loan within the same transaction. This tactic has gained significant traction in the crypto market, especially for Ethereum and Solana trading pairs, where price fluctuations can be leveraged for profit. The growing use of DeFi platforms has made flash loan arbitrage a popular method for exploiting these discrepancies.

Flash Loan Arbitrage Bots

Flash Loan Arbitrage BotsThe importance of automated bots in executing flash loan arbitrage strategies is paramount, as these bots can quickly analyze and execute trades across multiple exchanges. Manual execution would be too slow to capture the fleeting opportunities presented by arbitrage. As the market evolves, the demand for sophisticated flash loan arbitrage bot development increases, ensuring bots can operate seamlessly across networks like Ethereum and Solana. This blog will delve into the best flash loan arbitrage bots for 2025, showcasing the tools that drive efficiency and profitability in this innovative trading space.

Table of the Content

What is Flash Loan Arbitrage?Why Choose Ethereum and Solana for Flash Loan Arbitrage?

Key Features to Look for in a Flash Loan Arbitrage Bot

Top Flash Loan Arbitrage Bots for Ethereum and Solana in 2025

· 1. Furucombo

· 2. Uniswap Flash Loan Bot:

· 3. Arbix Finance:

· 4. Flashbots:

· 5. 0x API:

· 6. Serum DEX

· 7. Raydium

· 8. Mango Markets

· 9. Project Serum:

· 10.Solana Program Library (SPL)

How to Choose the Best Flash Loan Arbitrage Bot for You

The Future of Flash Loan Arbitrage in 2025

Conclusion

FAQ

What is Flash Loan Arbitrage?

Flash loan arbitrage is a strategy that leverages flash loans in decentralized finance (DeFi) to capitalize on price discrepancies between different exchanges. Flash loans are uncollateralized loans that allow users to borrow large amounts of cryptocurrency for a very short time, typically within a single transaction block. Arbitrage trading involves buying an asset at a lower price on one platform and selling it at a higher price on another, profiting from the difference. While this strategy offers high-profit potential, it carries risks such as market volatility, transaction fees, and the complexity of executing trades swiftly within tight timeframes.

Why Choose Ethereum and Solana for Flash Loan Arbitrage?

Ethereum and Solana offer fast, efficient platforms with high liquidity, making them ideal for flash loan arbitrage strategies.

Ethereum:

Dominance in the DeFi Ecosystem:

Ethereum remains the leading blockchain in the decentralized finance (DeFi) space, hosting a large number of decentralized exchanges (DEXs), lending platforms, and liquidity pools. Its vast ecosystem provides significant opportunities for flash loan arbitrage, allowing traders to exploit price differences across various platforms.

Smart Contract Capabilities:

Ethereum’s robust smart contract functionality plays a crucial role in enabling flash loans. These contracts facilitate complex transactions, like borrowing large sums of assets without upfront capital, making it ideal for arbitrage opportunities. Smart contracts on Ethereum automatically execute trades when certain conditions are met, reducing the need for intermediaries and ensuring trustless transactions.

Solana:

Lower Fees and Faster Transaction Speeds:

Solana stands out for its low transaction fees and incredibly fast processing times. With high throughput capabilities and minimal gas costs, Solana offers an efficient platform for executing arbitrage strategies, especially when speed and cost-effectiveness are essential to capitalizing on market differences.

Growing DeFi Adoption:

While Solana’s DeFi ecosystem is still growing compared to Ethereum, it has seen significant growth and adoption. As more liquidity and projects move to Solana, it is becoming a competitive player in the DeFi space, offering additional arbitrage opportunities that leverage its low-cost and high-speed advantages.

Comparison:

Transaction Speed: Solana significantly outperforms Ethereum in transaction speed, with block times averaging just 400 milliseconds, compared to Ethereum’s average of 13 seconds. This faster execution allows for quicker arbitrage opportunities on Solana.

Fees:

Solana’s network is known for its extremely low transaction fees, often less than a cent, making it more cost-effective for frequent and high-volume arbitrage trades. In contrast, Ethereum’s gas fees can be high, particularly during network congestion, eating into potential profits.

Liquidity:

Ethereum benefits from deeper liquidity due to its larger DeFi ecosystem, making it a go-to platform for high-value arbitrage trades. Solana, while growing, still lags in liquidity compared to Ethereum, which may limit the size and frequency of arbitrage opportunities. However, its lower fees and faster speeds make it increasingly attractive as its ecosystem matures.

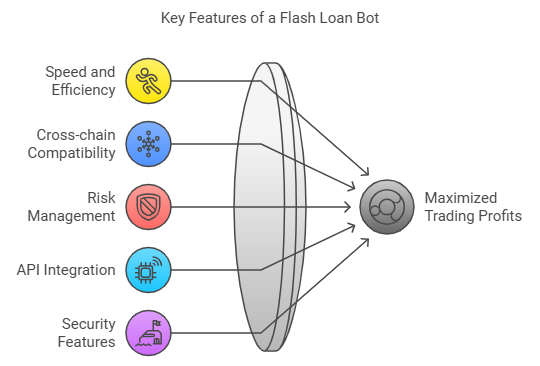

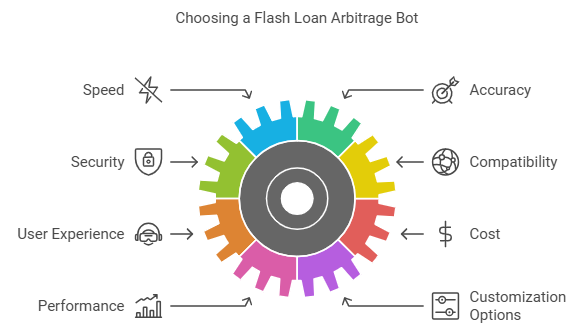

Key Features to Look for in a Flash Loan Arbitrage Bot

The key features to consider when choosing a flash loan arbitrage bot for maximizing crypto trading profits.

Flash Loan Arbitrage Bot

Flash Loan Arbitrage BotSpeed and Efficiency:

Fast transaction execution is crucial for a flash loan arbitrage bot to capitalize on price differences before they disappear. Speed ensures that the bot can complete trades in milliseconds, taking advantage of fleeting opportunities. Delays can erode profits, making efficient execution algorithms vital for maintaining a competitive edge in the market.

Cross-chain Compatibility:

Cross-chain functionality allows the bot to operate between different blockchain networks, such as Ethereum and Solana. This enables it to exploit arbitrage opportunities across multiple chains, increasing profit potential. Handling transactions across chains requires specialized protocols and smart contract interactions to ensure smooth execution without delays, bridging liquidity from one network to another.

Risk Management:

Effective risk management features, such as stop-loss mechanisms and slippage protection, help minimize exposure to volatile market movements. By adjusting trade parameters, a bot can prevent executing trades that could lead to significant losses. Additionally, monitoring price fluctuations in real-time and having contingencies in place are essential to safeguarding capital during unexpected market shifts.

API Integration:

Seamless integration with exchanges and liquidity pools via APIs is crucial for a flash loan arbitrage bot. APIs enable the bot to access real-time market data, execute trades, and monitor account balances across various platforms. Reliable and fast API connections ensure that the bot can interact with multiple exchanges and pools without interruptions, securing optimal trade conditions.

Security Features:

Robust security measures are critical to protect user funds and prevent exploits. Flash loan arbitrage bots should use encryption protocols, multi-signature wallets, and smart contract audits to safeguard transactions. Additionally, implementing measures like two-factor authentication (2FA) and continuous monitoring of unusual activities can help prevent unauthorized access and mitigate risks of funds being compromised or stolen.

Top Flash Loan Arbitrage Bots for Ethereum and Solana in 2025

Explore the top flash loan arbitrage bot development solutions for Ethereum and Solana in 2025 to maximize trading profits.

1. Furucombo

Furucombo

FurucomboFurucombo is a decentralized finance (DeFi) platform designed to simplify complex DeFi transactions into a single, streamlined process. It enables users to create custom DeFi strategies using a drag-and-drop interface, allowing them to combine multiple protocols and actions into a single transaction, improving efficiency and lowering gas costs.

Pros:

- User-friendly interface with a no-code approach, suitable for both beginners and experienced DeFi users.

- Facilitates multi-protocol strategies in a single transaction, saving time and fees.

- Supports numerous DeFi protocols, including Aave, Uniswap, and Compound.

- Reduces complexity in DeFi investing and automates repetitive tasks.

Cons:

- Limited protocol support compared to larger DeFi aggregators.

- Potentially higher gas fees for complex transactions, depending on network congestion.

- Security risks inherent in using smart contract-based platforms.

Performance Metrics:

While specific metrics are not readily available, Furucombo’s ability to combine multiple actions and protocols in a single transaction can improve transaction speed and cost efficiency.

Pricing and Accessibility:

Furucombo is free to use, but users need to pay gas fees for transactions. Accessible through its web app on the Ethereum network.

2. Uniswap Flash Loan Bot

Uniswap Flash Loan Bot

Uniswap Flash Loan BotThe Uniswap Flash Loan Bot is an automated tool designed to execute flash loans on the Uniswap decentralized exchange. Flash loans allow users to borrow assets without collateral, provided the loan is repaid within the same transaction. This bot automates the process, enabling users to leverage flash loans for arbitrage opportunities, liquidations, or other DeFi strategies.

Pros:

- Allows users to access uncollateralized loans on the Uniswap platform.

- Automates the borrowing and repayment process, saving time and effort.

- Can be used for arbitrage opportunities across different DeFi protocols.

- Potential for profit without the need for initial capital investment.

Cons:

- Flash loan operations require in-depth knowledge of smart contract interactions and DeFi markets.

- High transaction costs, especially during periods of network congestion.

- Risk of losses if the loan is not repaid successfully within the block.

Performance Metrics:

Performance is measured based on the successful execution of arbitrage strategies or other DeFi use cases, though data is often private.

Pricing and Accessibility:

The bot is free to use, but users must cover transaction and gas fees. Accessible via smart contracts on the Ethereum blockchain.

3. Arbix Finance

Arbix Finance

Arbix FinanceArbix Finance is a decentralized finance (DeFi) platform focused on providing automated arbitrage opportunities between decentralized exchanges (DEXs). It leverages smart contracts to facilitate arbitrage trading strategies, allowing users to profit from price discrepancies between different crypto assets on various exchanges.

Pros:

- Provides automated arbitrage trading, requiring minimal user intervention.

- Helps users take advantage of price differences across decentralized exchanges (DEXs).

- The platform uses advanced algorithms to optimize profits and minimize risks.

- Supports a wide variety of tokens and DeFi protocols.

Cons:

- Arbitrage opportunities can be scarce and highly competitive, leading to lower potential profits.

- Risk of high transaction fees during times of network congestion.

- Requires users to have some knowledge of DeFi and arbitrage strategies to maximize returns.

Performance Metrics:

Arbix Finance’s performance depends on the volatility and liquidity of supported markets. It has shown successful arbitrage execution, but detailed metrics are typically internal.

Pricing and Accessibility:

Arbix Finance is free to use, but users must cover transaction and gas fees. It is accessible via its web interface on the Ethereum blockchain.

4. Flashbots

Flashbots

FlashbotsFlashbots is a research and development organization focused on mitigating the negative effects of miner extractable value (MEV) on blockchain networks, particularly Ethereum. Flashbots provides tools to enable fairer, more transparent MEV extraction, including Flashbots Auction, which allows users to send transactions directly to miners to minimize front-running and sandwich attacks.

Pros:

- Promotes a fairer MEV ecosystem by enabling transparent bidding for transaction inclusion.

- Helps reduce the negative impact of miner extractable value on users.

- Provides advanced tools like Flashbots Auction and Flashbots Protect to enhance transaction privacy and efficiency.

- Supports decentralized finance (DeFi) developers by allowing them to integrate MEV solutions into their platforms.

Cons:

- Flashbots are complex and require technical understanding to implement effectively.

- Its tools are mainly designed for DeFi developers and advanced users, limiting accessibility for beginners.

- Potential centralization risks if too many miners rely on Flashbots for MEV extraction.

Performance Metrics:

Flashbots has reduced the negative impact of MEV on Ethereum by providing a transparent bidding system, but specific performance data is generally internal.

Pricing and Accessibility:

Flashbots tools are free to use but require Ethereum gas fees for transaction execution. They are accessible through their web interface and API.

5. 0x API

0x API

0x API0x API is a decentralized exchange (DEX) aggregation platform that facilitates peer-to-peer trading of ERC-20 tokens across multiple decentralized exchanges. It consolidates liquidity from various DEXs to provide users with the best price and lowest slippage for token swaps, enhancing the trading experience in the DeFi ecosystem.

Pros:

- Aggregates liquidity from several DEXs, ensuring optimal trading prices.

- Minimizes slippage and reduces transaction costs for users.

- Offers a flexible API that developers can integrate into their own decentralized applications (dApps).

- Supports a wide variety of ERC-20 tokens and DeFi protocols.

Cons:

- Only supports ERC-20 tokens, limiting its use to the Ethereum network.

- Relies on third-party liquidity sources, meaning trades may not always be as seamless as on a single DEX.

- Gas fees can still be high, depending on network congestion.

Performance Metrics:

The 0x API performs well in terms of liquidity aggregation and price optimization, but specific metrics on success rates and user trading volumes are typically not publicly disclosed.

Pricing and Accessibility:

0x API is free to use for developers, though users must pay Ethereum gas fees for transactions. It is accessible via its public API on the Ethereum blockchain.

6. Serum DEX

Serum DEX

Serum DEXSerum is a decentralized exchange (DEX) built on the Solana blockchain, offering fast and low-cost trading. As a non-custodial platform, it provides users full control over their funds, aligning with the decentralized finance (DeFi) ethos.

Pros:

- Speed and Low Fees: Leveraging Solana’s high throughput, Serum enables fast transaction processing and minimal trading fees, making it an attractive option for high-frequency traders.

- Advanced Trading Features: Includes limit orders, market orders, and other professional-grade tools.

- Liquidity: Offers high liquidity due to integration with Solana’s ecosystem and its centralized order book.

Cons:

- Complexity: The user interface may be complex for beginners, especially compared to simpler DEXs like Uniswap.

- Solana Network Risk: Being built on Solana, Serum is susceptible to the network’s outages or congestion.

Performance Metrics:

Serum processes thousands of transactions per second, benefiting from Solana’s scalability.

Pricing and Accessibility:

Serum is free to use with standard transaction fees on the Solana network (usually under $0.01). Access requires a Solana wallet.

7. Raydium

Raydium

RaydiumRaydium is a decentralized exchange (DEX) built on the Solana blockchain, offering high-speed trading and liquidity solutions. It serves as an automated market maker (AMM) and provides decentralized finance (DeFi) services like yield farming, staking, and swapping. Raydium leverages Solana’s fast transaction speeds and low fees, making it an attractive platform for users looking to minimize costs and maximize speed.

Pros:

- High Speed: Built on Solana, Raydium supports fast and low-cost transactions.

- Liquidity Aggregation: Connects with Serum’s order book for deeper liquidity.

- Advanced Features: Supports yield farming, staking, and lending.

- Scalability: Can handle high transaction volumes without network congestion.

Cons:

- Solana Dependency: Subject to risks tied to Solana’s performance and network issues.

- User Interface: Can be challenging for beginners compared to other DEXs.

Performance Metrics:

Raydium has consistently maintained high trading volumes, especially during market surges, due to its liquidity pool integration with Serum.

Pricing and Accessibility:

Raydium charges a small fee per trade, which is lower than traditional centralized exchanges. The platform is accessible to anyone with a Solana wallet and a basic understanding of decentralized finance.

8. Mango Markets

Mango Markets

Mango MarketsMango Markets is a decentralized trading platform that allows users to trade digital assets, particularly in the realms of DeFi (Decentralized Finance). It offers margin trading, lending, and a suite of tools aimed at enabling efficient and cost-effective trading experiences on the Solana blockchain. Mango’s decentralized nature means users retain control over their assets, with an emphasis on low-latency, high-performance trades.

Pros:

- Low Fees: Mango Markets provides a cost-effective trading experience with minimal fees.

- Decentralized: Full control over funds with no centralized authority.

- Advanced Trading Features: Margin trading, lending, and stop-loss features.

- Speed: Built on Solana, offering high-speed transaction processing.

Cons:

- Solana Network Risk: The platform is reliant on the Solana blockchain, which has experienced network downtimes in the past.

- Complexity: The platform might be challenging for beginners due to its advanced features.

Performance Metrics:

Mango Markets is known for its fast execution times due to Solana’s high throughput. The platform regularly reports strong liquidity for trading pairs.

Pricing & Accessibility:

Free to use with no sign-up fees, though trading fees apply based on activity and assets.

9. Project Serum

Project Serum

Project SerumProject Serum is a decentralized exchange (DEX) built on the Solana blockchain, offering high-speed, low-cost trading. It enables fast order matching, liquidity, and cross-chain functionality, positioning itself as a competitor to Ethereum-based DEX platforms. Serum provides a decentralized order book for trading, a feature often lacking in other decentralized exchanges, and it has been adopted by various projects in the Solana ecosystem.

Pros:

- High-speed transactions due to Solana’s blockchain infrastructure.

- Low transaction fees compared to Ethereum-based DEXs.

- Decentralized order book enables trustless trading and liquidity.

- Cross-chain interoperability enhances its accessibility across different blockchains.

Cons:

- Limited adoption compared to larger DEXs like Uniswap or SushiSwap.

- Solana’s network vulnerabilities can impact Serum’s performance during congestion.

- Relatively new with ongoing platform improvements.

Performance metrics:

Serum has demonstrated fast transaction speeds with low fees, processing thousands of transactions per second, but it still faces scalability challenges during high demand.

Pricing and accessibility:

Serum’s trading platform is free to use, but transaction fees apply on the Solana network. Access is available through various crypto wallets that support Solana.

10. Solana Program Library (SPL)

Solana Program Library (SPL)

Solana Program Library (SPL)The Solana Program Library (SPL) is a collection of on-chain programs (smart contracts) that run on the Solana blockchain, designed to simplify the development of decentralized applications (dApps). SPL includes essential modules like token standards (SPL Token), governance systems, and decentralized finance (DeFi) protocols, making it a valuable toolkit for developers on Solana’s high-performance network.

Pros:

- Scalability: Solana’s blockchain provides high throughput, enabling SPL to process transactions quickly and at a low cost.

- Comprehensive: Includes a range of features for DeFi, NFTs, and other blockchain functionalities.

- Developer-friendly: Offers open-source libraries and easy integration into projects.

Cons:

- Complexity: While powerful, Solana’s ecosystem can be complex for new developers.

- Adoption: Despite its performance, Solana’s ecosystem still faces challenges in adoption compared to Ethereum.

Performance:

SPL benefits from Solana’s ability to handle 65,000 transactions per second (TPS), providing fast, cost-effective solutions for decentralized applications.

Pricing and Accessibility:

SPL is free to use, but developers may incur costs related to Solana’s transaction fees.

How to Choose the Best Flash Loan Arbitrage Bot for You

Choosing the best flash loan arbitrage bot involves evaluating speed, accuracy, security, and compatibility with Ethereum and Solana networks.

Flash Loan Arbitrage Bot

Flash Loan Arbitrage BotUser Experience:

When selecting a flash loan arbitrage bot, consider your experience level. Beginner-friendly bots offer intuitive interfaces and automated features, requiring little technical knowledge. Intermediate users may prefer bots with more advanced features, while experienced traders will value high customization options, detailed analytics, and manual intervention possibilities. Choose a bot that aligns with your expertise for smoother operation.

Bot Cost:

Evaluate the cost of using a flash loan arbitrage bot, including subscription and commission fees. High fees may erode profits, especially with frequent trading. Compare the bot’s pricing structure to its historical performance and potential profitability. Consider whether the bot offers a free trial or money-back guarantee to assess its effectiveness before committing significant funds.

Performance:

Assess the bot’s performance by reviewing its historical track record, backtesting results, and user feedback. A reliable bot should show consistent profits over a range of market conditions. Look for performance metrics such as win rates, returns on investment (ROI), and execution success. User reviews and third-party audits provide insights into the bot’s reliability and profitability.

Customization Options:

A good flash loan arbitrage bot should offer customization options to match your trading strategy. Look for features like adjustable risk parameters, customizable stop-loss settings, and the ability to adjust the frequency and size of trades. The more control you have over trade execution, the better the bot can align with your risk tolerance and profit goals.

Security Measures:

Security is paramount when choosing a flash loan arbitrage bot. Ensure that the bot uses encrypted communication for data protection, secures wallet connections, and follows best practices in cybersecurity. Regular audits and smart contract checks minimize the risk of exploits. Multi-signature wallets and two-factor authentication (2FA) also enhance protection against unauthorized access.

Support and Community:

A strong support system is crucial for troubleshooting and optimizing bot performance. Look for bots that offer responsive customer service and detailed documentation. Additionally, a thriving community of users can provide valuable insights, tips, and strategies for maximizing profits. Check forums, Discord channels, or social media groups to gauge the bot’s community engagement and support quality.

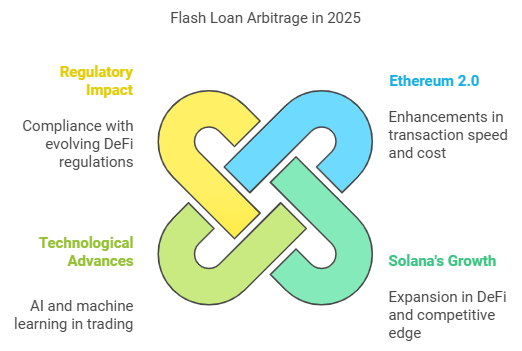

The Future of Flash Loan Arbitrage in 2025

Explore the future of flash loan arbitrage in 2025, as evolving technology and markets unlock new opportunities for traders.

f Flash Loan Arbitrage

f Flash Loan ArbitrageEthereum 2.0:

Ethereum 2.0’s upgrade to a proof-of-stake (PoS) consensus mechanism will significantly improve transaction speeds and lower gas fees, making it more efficient for flash loan arbitrage. The enhanced scalability of Ethereum will reduce congestion, providing faster execution times for arbitrage bots. These improvements will attract more DeFi projects, boosting liquidity and opening up new arbitrage opportunities.

Solana’s Growth:

As Solana continues to expand within the DeFi space, it will become an increasingly competitive platform for flash loan arbitrage. Lower transaction costs and faster speeds will attract more liquidity and trading volume, creating more opportunities for arbitrage. As DeFi projects migrate to Solana, the network’s growing ecosystem will offer bots new arbitrage strategies across both Ethereum and Solana.

Technological Advances:

AI and machine learning will revolutionize flash loan arbitrage bots by optimizing trade execution, predicting market trends, and enhancing risk management. These technologies can process vast amounts of data to detect price discrepancies more effectively. Machine learning models will continuously improve based on historical performance, adapting to market changes and improving bot efficiency and profitability over time.

Regulatory Impact:

Regulatory changes in DeFi could reshape how flash loan arbitrage bots operate. Increased scrutiny from regulators may lead to stricter compliance requirements, including KYC/AML procedures and more transparent transaction reporting. Bots will need to adapt by incorporating features that align with evolving regulations, ensuring legal compliance while maintaining profitability in the changing regulatory landscape of decentralized finance.

Conclusion

The top flash loan arbitrage bot development solutions for Ethereum and Solana in 2025 offer innovative tools to enhance trading strategies. It’s essential to choose the right bot based on individual preferences, such as speed, cost-efficiency, and ease of use. As flash loan arbitrage bot development continues to evolve, conducting thorough research and testing before full deployment will help ensure optimal performance and profitability. This approach minimizes risks while maximizing potential returns in the rapidly changing DeFi landscape.

FAQ

1. What is a flash loan arbitrage bot?

A flash loan arbitrage bot is an automated trading program that borrows assets via a flash loan (without collateral) and uses those assets to take advantage of price discrepancies across different exchanges. The bot executes this strategy in a matter of seconds, ensuring the borrowed funds are returned in the same transaction, profiting from the price differences without using its own capital.

2. How do flash loan arbitrage bots work on Ethereum and Solana?

On Ethereum and Solana, these bots work by analyzing price differences between decentralized exchanges (DEXs) on each network. When a discrepancy is detected, the bot borrows funds via a flash loan, performs the arbitrage trade, and repays the loan — all within one transaction block. The profit generated from the trade is then kept as the bot’s earnings.

3. Can I use a flash loan arbitrage bot if I’m a beginner in crypto trading?

Yes, some flash loan arbitrage bots are designed for beginners. These bots typically offer user-friendly interfaces, pre-set trading strategies, and automated features to simplify the process. However, it’s important for beginners to understand basic DeFi concepts and the risks involved before using any bot.

4. What are the risks of using flash loan arbitrage bots?

The primary risks include market volatility, which can lead to price changes between when the loan is taken and repaid, slippage, and network congestion that can delay or prevent trades from executing. Additionally, bots that are not properly secured can be vulnerable to hackers or exploits.

5. How do I select the right flash loan arbitrage bot for my needs?

Choose a bot based on your experience level, risk tolerance, and desired trading volume. If you’re a beginner, look for bots with simple setups and user guides. For more experienced traders, look for bots offering advanced features like real-time analytics, multi-chain support, and customizable parameters to fit specific trading strategies.

The Top Flash Loan Arbitrage Bots for Ethereum and Solana in 2025? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

3 months ago

43

3 months ago

43

English (US) ·

English (US) ·