- Airdrops are fashionable with DeFi users.

- DefiLlama's 0xngmi explores however they payment the projects that conducted them.

0xngmi is simply a developer for DefiLlama. Opinions are his own.

Airdrops person go 1 of the biggest draws for users successful DeFi.

Hopeful hunters heap into caller blockchains successful the anticipation of becoming eligible for aboriginal rewards of invaluable tokens.

For the chains themselves, airdrop token launches are seen arsenic almighty selling tools, boosting their idiosyncratic counts and galvanising their communities.

This year, respective chains rewarded users with token airdrops. But conscionable however effectual were the launches successful drafting successful users? Let’s look astatine the data.

Maintained activity

Blockchains launching their ain tokens often trigger sustained peaks successful enactment and make lasting engagement. Optimism is 1 illustration wherever enactment accrued and stayed precocious aft launching its OP token successful 2022.

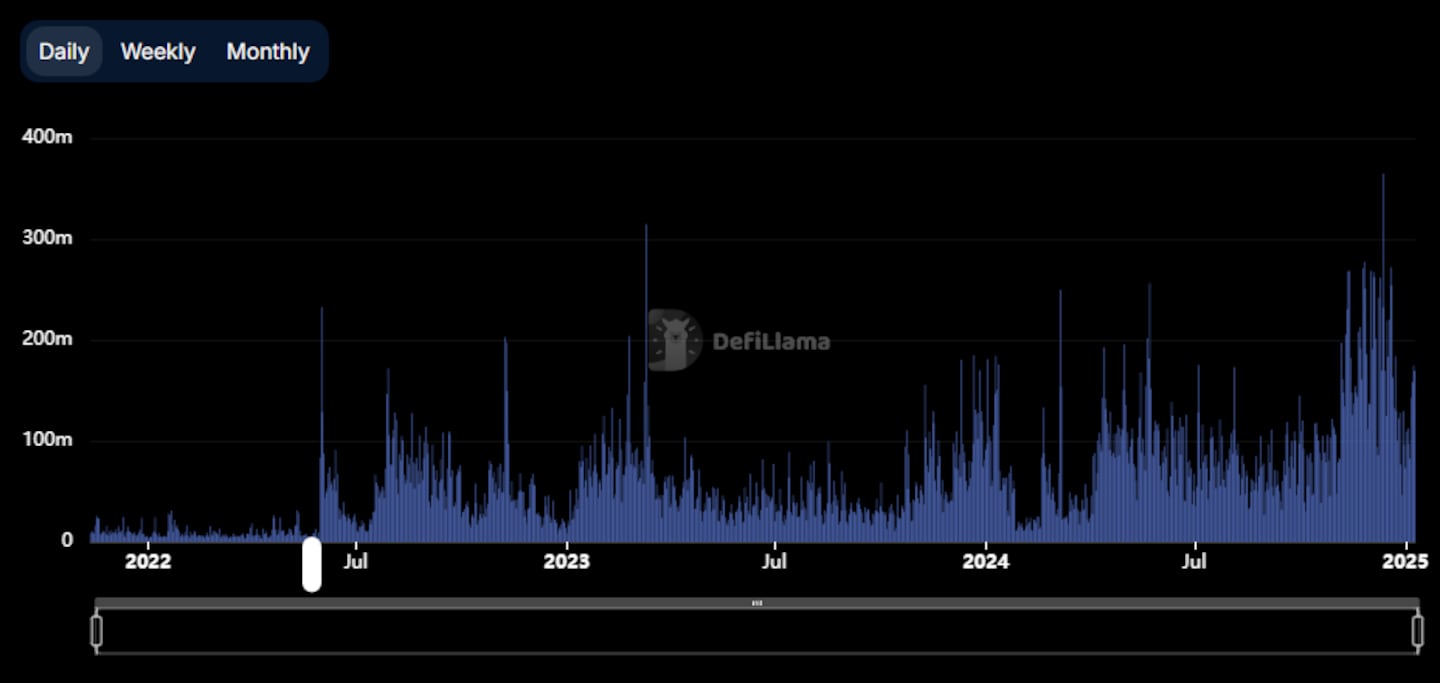

DEX measurement connected Optimism with the OP token motorboat marked successful white. (DefiLlama)

Many property this effect to inducement programmes aft token launches, which committedness rewards to users who span implicit funds.

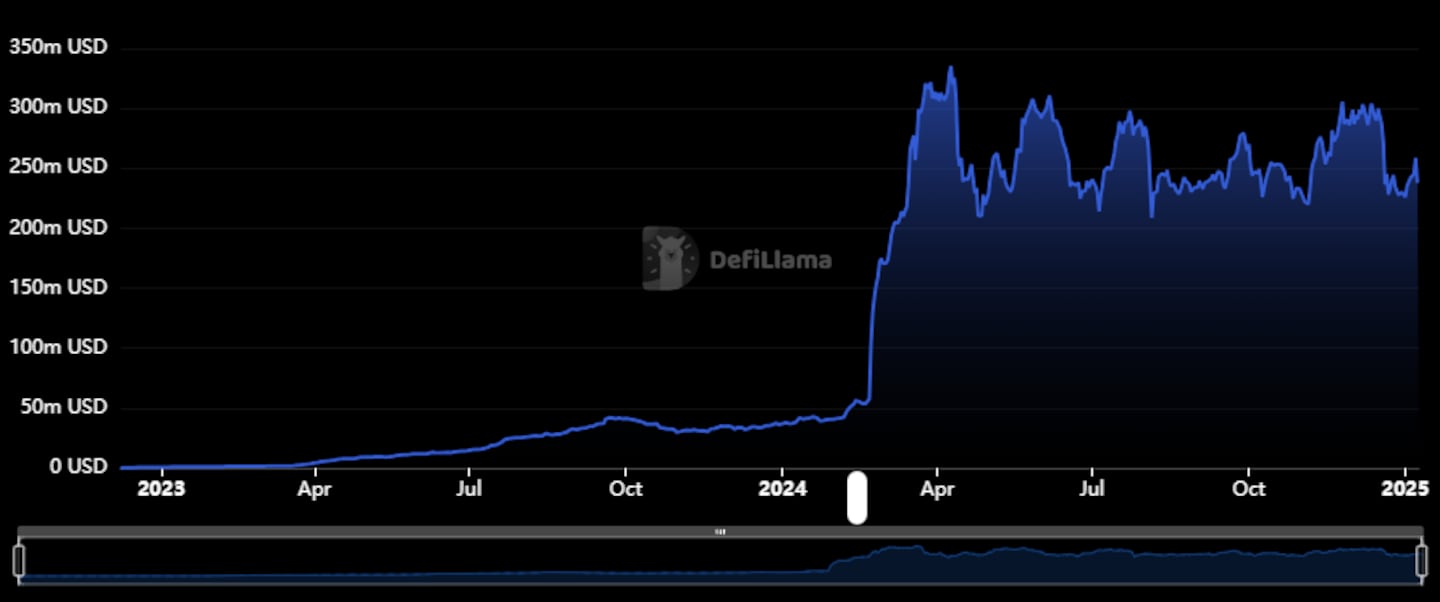

However, adjacent chains that don’t explicitly connection oregon advertise specified campaigns, specified arsenic Starknet, besides support higher levels of deposits aft launching their tokens.

Starknet full worth locked — TVL — remained elevated aft its STARK token launch, marked successful white. (DefiLlama)

Another illustration is perpetual futures trading level Hyperliquid.

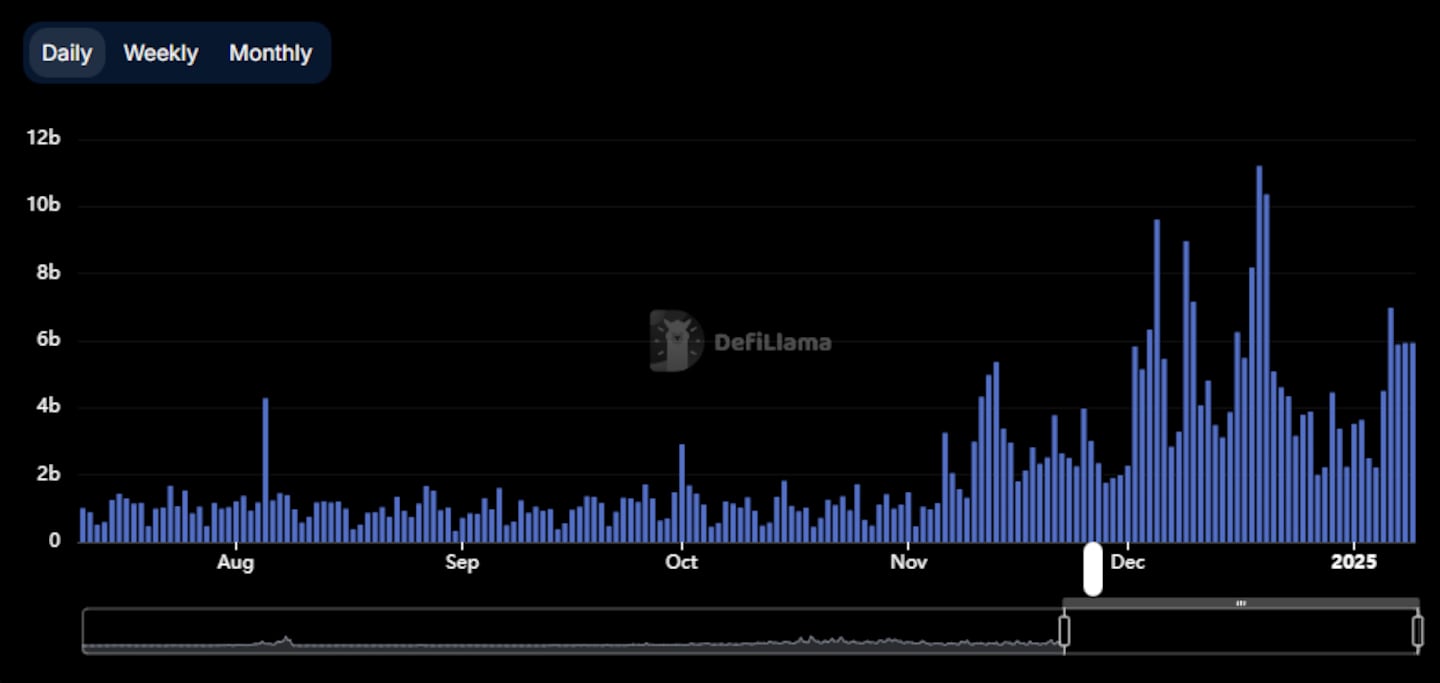

The pursuing is simply a illustration of lone perpetual futures measurement earlier and aft its HYPE token motorboat and airdrop. The illustration excludes spot measurement of the platform’s HYPE token.

HYPE perpetual futures measurement is astir negligible connected the chart, accounting for astir 5% of regular volume, truthful each measurement is halfway measurement of their perps product, not measurement driven by users trading their ain token.

Hyperliquid perpetual futures measurement shot up aft its precocious November token launch, marked successful white. (DefiLlama)

The HYPE airdrop led to a immense summation successful non-HYPE trading connected Hyperliquid.

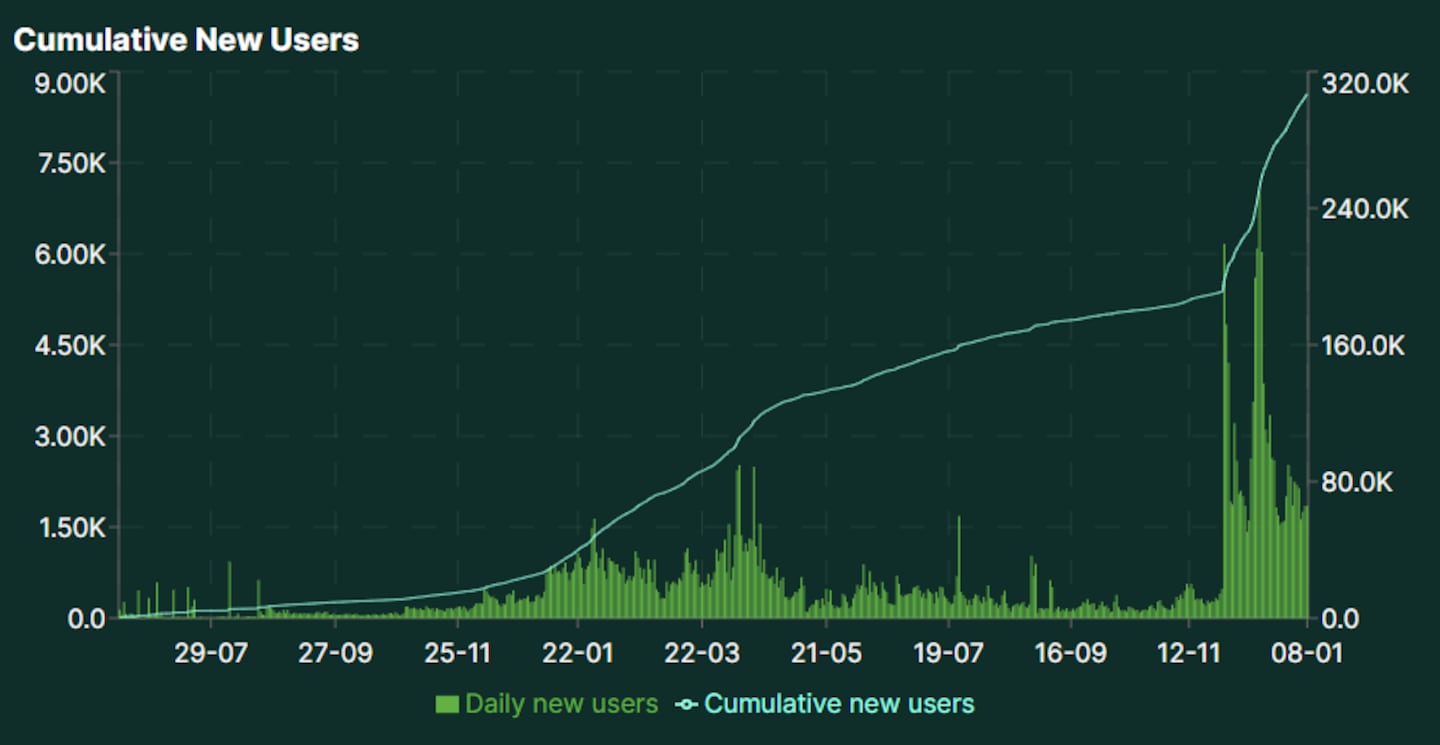

We tin spot this effect again successful a illustration showing the maturation of caller Hyperliquid users.

New users connected Hyperliquid skyrocketed aft its token launch. (Hyperliquid)

Looking astatine different chains, this signifier repeats frequently: the autochthonal token airdrop is simply a important maturation catalyst that leads to caller users and accrued maturation that successful galore cases sustains implicit time.

Overcoming inertia

So wherefore does this happen?

Part of it is astir apt owed to the dense summation successful attraction that the concatenation receives arsenic everyone successful crypto shifts their attraction towards it for a fewer days, and immoderate of that attraction converts to caller users similar successful immoderate different product.

But I hypothesise that the main crushed wherefore we spot this signifier is that participating successful the token motorboat — investing successful oregon trading the newly-launched token — is an enactment that tin often lone beryllium done connected that token’s chain.

In the existent crypto environment, chains person go commoditised.

They each person decentralised exchanges, oregon DEXs, wherever users tin commercialized bridged versions of large crypto assets similar Bitcoin and Ethereum, lending protocols wherever they tin get funds, perpetual futures protocols for leverage trading, and truthful on.

Basically, you tin bash beauteous overmuch each the large crypto activities connected immoderate chain.

So if each large needs are served, wherefore span to different chains? It’s the aforesaid communicative for each products: erstwhile a user is already utilizing a merchandise and there’s a rival that’s somewhat better, successful astir cases, users won’t power due to the fact that of inertia and switching costs.

But erstwhile a caller concatenation token launches, you tin commercialized it lone connected that chain, truthful this is simply a catalyst that forces anyone that wants to commercialized it to span into the concatenation and effort the products there, past if they similar them, they mightiness support utilizing them oregon afloat power to them.

That’s what I deliberation happened with Hyperliquid — users came to commercialized HYPE and ended up moving their perpetual futures trading determination due to the fact that they liked the product.

Case study: Scroll

A large lawsuit survey that supports my mentation is Scroll’s token launch, successful October. It was a highly anticipated concatenation token motorboat similar the different ones we’ve covered, but successful this lawsuit Scroll chose to motorboat with a large Binance partnership.

Scroll’s SCR token was tradable connected Binance from the infinitesimal it launched, and the concatenation gave Binance a batch of tokens for liquidity. What’s more, Scroll besides gave Binance a batch of tokens that users could gain connected the exchange.

Due to these factors, the champion spot to commercialized SCR connected its motorboat wasn’t the Scroll concatenation itself, but Binance.

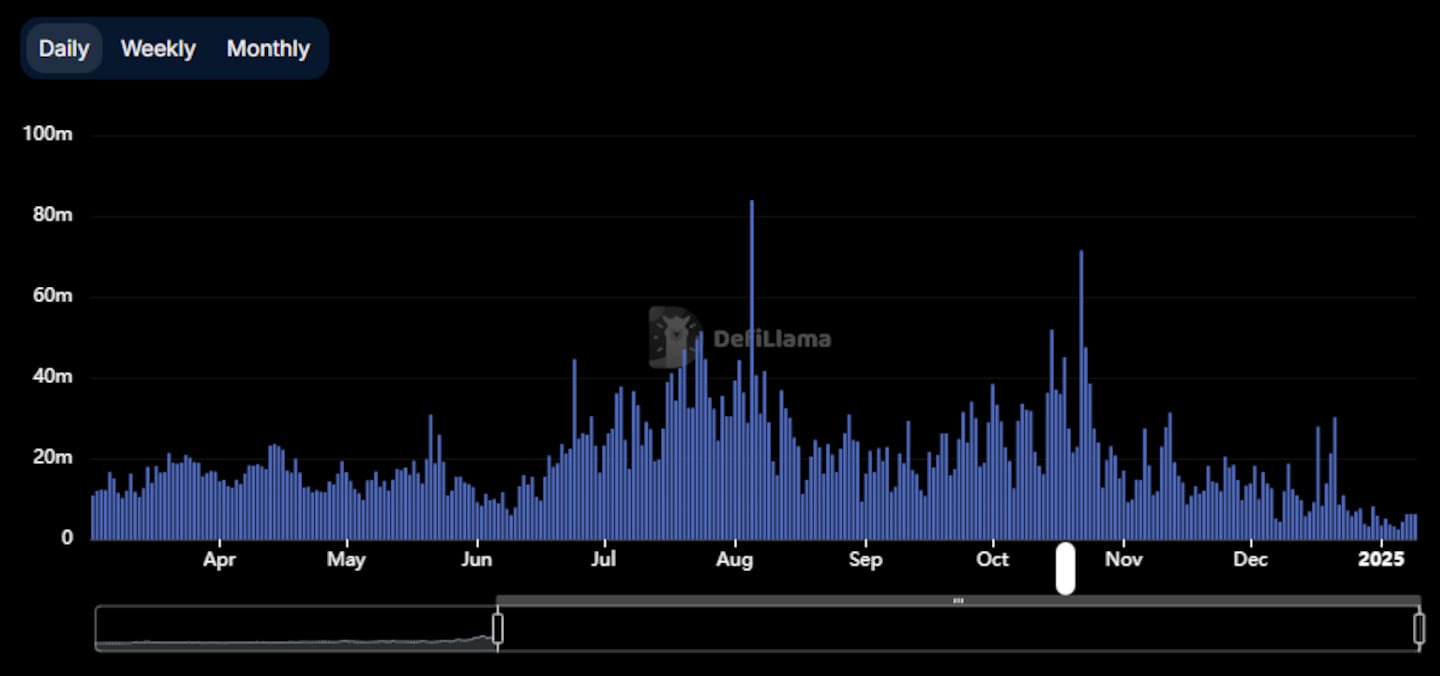

When you look astatine Scroll’s DEX measurement post-airdrop, it shows a precise antithetic signifier versus the different cases we looked at, with usage diminishing. Users that wanted to commercialized the token didn’t person to usage the chain, truthful galore didn’t get onboarded similar successful the different cases.

Scroll's DEX measurement tailed disconnected aft launching its token successful October. (DefiLlama)

Similar catalysts

When we look astatine different caller maturation catalysts, they’re similar: it’s astir having thing that tin lone beryllium done connected your chain.

A immense portion of the archetypal maturation communicative for Coinbase’s Base concatenation was SocialFi level Friend.tech. Users moved to Base due to the fact that it was the lone spot wherever they could commercialized X profiles and they wanted to bash that.

Arbinyan, a protocol wherever users deposited Ether to gain the protocol’s NYAN token, created a akin effect. It launched soon aft the Arbitrum concatenation went unrecorded and generated a immense buzz arsenic users rushed successful to workplace it.

However, specified maturation catalysts aren’t easy reproducible.

Nobody predicted that Friend.tech would beryllium a deed earlier it launched. The erstwhile SocialFi experiments by its laminitis had mostly flopped, and attempts to replicate Arbinyan led to DeFi users farming and dumping projects heavy since everyone already knew however the crippled would play out.

The tokens subsequently went to zero.

In comparison, launching a autochthonal token is 1 of the fewer catalysts that a chain’s squad gets to afloat control.

What’s absorbing is that precocious we’ve seen 2 large blockchains, Move and Abstract, propulsion this distant by launching their tokens connected different concatenation earlier their ain concatenation is live.

When the chains yet launch, these teams volition person a large instrumentality missing successful their arsenal, and portion it’s wholly imaginable to turn without the token motorboat boost, arsenic proven by Base, it volition apt marque it much hard for them.

Tim Craig edited this article.

1 month ago

45

1 month ago

45

English (US) ·

English (US) ·