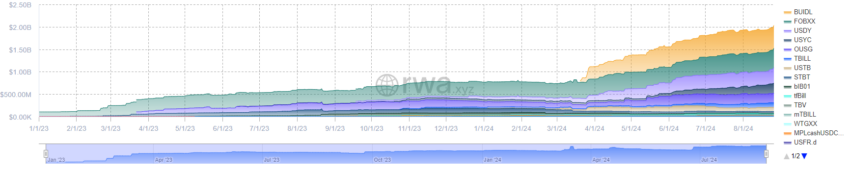

According to RWA.xyz data, the tokenized treasury market has recently reached a significant milestone. In just five months, it has exceeded a $2 billion market capitalization.

As this market continues to evolve, the pressing question is: What lies ahead for tokenized treasuries?

Key Players Driving the Tokenized Treasury Boom

The recent surge in the tokenized treasury sector is largely attributed to the impressive performance of several key players. For instance, as of August 25, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) leads the market with a capitalization of $502.67 million.

Following closely behind BUIDL are two other major products—Franklin Templeton’s Franklin OnChain US Government Money Fund (FOBXX) and Ondo Finance’s Ondo US Dollar Yield (USDY). FOBXX has successfully captured a market capitalization of $425.46 million, while USDY has a market cap of $364.04 million. Beyond these major players, other significant products in the market include Hashnote’s US Treasury Yield (USYC) and Ondo Finance’s Ondo Short-Term US Government Bond Fund (OUSG), both of which substantially contribute to the remaining market share.

Read more: What Are Synthetic Assets?

Tokenized Treasury Market Capitalization. Source: RWA.xyz

Tokenized Treasury Market Capitalization. Source: RWA.xyzTokenized treasuries represent digital versions of traditional US Treasury securities, allowing investors to trade them seamlessly on public blockchains like Ethereum, Solana, and Stellar. This innovation enhances accessibility for individual and institutional investors, broadening the potential investor base by attracting international participants who may not have direct access to US Treasury markets.

Beyond the $2 Billion Mark: What’s Next?

Industry experts are confident that the growth trajectory of tokenized treasuries is far from over. The vast potential of this market is underscored by the enormous size of the broader US Treasury securities market, valued at $27 trillion as of May 2024, based on Statista data. With such a significant portion of assets yet to be tokenized, the opportunity for further expansion remains substantial.

21.co’s analyst Tom Wan projected that the tokenized treasury market could reach $3 billion by the end of the year. Increasing interest from decentralized autonomous organizations (DAOs) and decentralized finance (DeFi) projects will drive this growth. These entities are keen to integrate tokenized US Treasuries into their portfolios to access stable, risk-free yields while remaining within the blockchain ecosystem.

Eugene Ng, co-founder of OpenEden, reaffirms this projection. He emphasizes the growing demand for secure, high-yield investments in today’s economic environment.

“In a high interest-rate environment, the demand for higher-yielding, secure assets is strong. Tokenized Treasury bills, offering competitive returns with the backing of government securities, are poised to attract significant capital,” Ng remarked.

Kingsley Advani, founder and CEO of Allo.xyz, also shared similar sentiments. He envisions a broader adoption of tokenized treasuries as part of a diversified investment strategy within the DeFi ecosystem.

“We’re projecting a very strong Q4 this year. Stablecoins are about $200 billion. In TVL, we have treasuries at about a few billion dollars. Private credit at about $10 billion. Treasuries, stablecoins, and private credit are early movers in the space, and we’ll see a continuation of that,” Advani elaborated to BeInCrypto.

Indeed, the potential applications of tokenized treasuries extend beyond just investment. The capability to develop DeFi products, like yield-bearing stablecoins backed by tokenized Treasury bills, represents a significant opportunity for the market. These products could offer users additional benefits, such as offsetting transaction fees, further enhancing the appeal of tokenized treasuries.

Read more: RWA Tokenization: A Look at Security and Trust

Despite the potential, many see the tokenized treasury market’s trajectory will also depend on macroeconomic factors, including interest rate changes. However, a recent report from research firm Kaiko highlighted that in a scenario where the Federal Reserve implements rate cuts but real interest rates remain stable, Treasuries, including tokenized versions, might maintain their appeal due to their inherent liquidity and safety. This aspect showcases the ongoing relevance of tokenized treasuries as a stable investment in uncertain economic times.

The post Tokenized Treasury Market Cap Surpasses $2 Billion: Exploring Future Growth and Challenges appeared first on BeInCrypto.

2 months ago

28

2 months ago

28

English (US) ·

English (US) ·