This week, several significant events are poised to impact the crypto market. The FOMC interest rate decision, major token unlocks, and new ecosystem developments have the crypto space buzzing with anticipation.

Investors and market watchers closely monitor these events to gauge their potential influence on the market and asset prices. Here is a detailed look at what’s on the horizon.

Uniswap V4 Upgrade

The Uniswap V4 is going live this week. It inherits all of the capital efficiency gains of Uniswap v3 and then some. It would provide flexibility via hooks and gas optimizations across the entire lifecycle.

Uniswap V4 upgrade is set to enable the creation of highly customizable pools. According to the network, the upgrade would provide a far more efficient system that provides additional gas savings.

Like the V3 upgrade in 2021, which marked a watershed moment for on-chain liquidity and DeFi, this upgrade promises to enhance Uniswap’s infrastructure, including improvements to liquidity provision and support for hooks and integrations.

UNI Price Performance. Source: BeInCrypto

UNI Price Performance. Source: BeInCryptoThe upgrade could provide a stronger foundation for Uniswap, potentially boosting market confidence and, in turn, the price of UNI. Despite this expectation, BeInCrypto data shows Uniswap’s UNI token was trading at $10.55. It is down by almost 14% since the Monday session opened, relatively muted by the hype around the upgrade.

FOMC and Jerome Powell Speech

As BeInCrypto reported, the Federal Open Market Committee (FOMC) will convene this week for the January interest rate decision. Federal Reserve chair Jerome Powell’s press conference will follow, ranking among the top five US economic events expected to drive Bitcoin sentiment this week. The general expectation is that the Fed’s direction could set the tone for Bitcoin’s performance.

“Bitcoin’s Economic Rollercoaster will include FOMC, GDP, PCE, Unemployment, & More. Let’s hope they can give some needed confidence in the markets,” crypto investor and BTC maxi Mark Cullen noted.

Mode DeFAI Terminal Release

The Mode network will release its DeFAI terminal this week, an AI-powered interface that will simplify on-chain interactions. This is another crypto news item to watch this week.

“Mode’s AI terminal will become the default for interacting on-chain Bridge, swap, earn yield, deploy contracts, and manage agents all from one interface,” said James Ross, Mode network founder.

The DeFAI terminal will perform DeFi actions for end users, highlighting Mode’s role in the DeFi and AI intersection. It comes as the network pivots from Layer-2 (L2) to a full DeFAI ecosystem marketplace already running with 129 agents.

The Mode Network is also planning to introduce the synth Bittensor (TAO) subnet on the mainnet, expanding its ecosystem integration with AI-driven technologies.

SUI Token Unlock

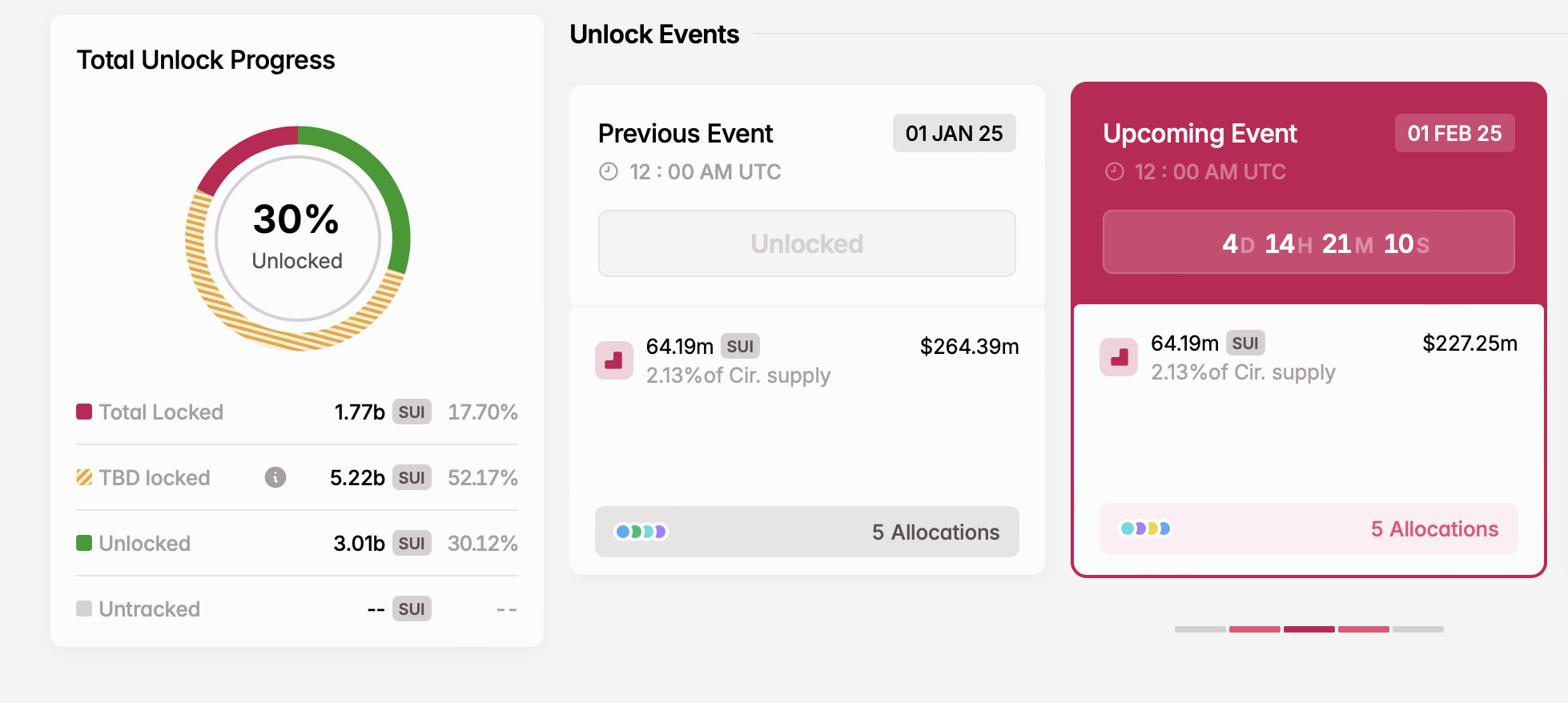

BeInCrypto also reported on the five token unlocks to watch this week. Among them is Sui, which is expected to unleash 64.19 million SUI tokens on the market on February 1.

At current rates, the tokens are valued at $227.25 million and constitute 2.13% of the circulating supply. These tokens will be allocated to the community, early contributors, the Mysten Labs treasury, and funding round participants.

SUI Token Unlock. Source: Tokenomist

SUI Token Unlock. Source: TokenomistA recent survey showed that 90% of unlocks create negative price pressure, with larger events causing sharper declines. The report showed that investor unlocks exhibit more controlled price behavior compared to team unlocks.

Quai Network Mainnet Launch

Another top crypto news this week is the mainnet launch of the Quai network, due on January 29. Quai Network distinguishes itself from other Proof-of-Work (PoW) blockchains due to its multi-threaded architecture. This model operates across three hierarchical layers of blockchains (Prime, Region, and Zone).

“The Quai team recognizes this milestone as the end of an era but also the beginning of a new one, the Quai Age. The world will now have access to the first decentralized global monetary system. Quai was built to be a public utility for the common good and the freedom and betterment of mankind,” the network said in a blog.

Alan Orwick, co-founder of Quai Network, said the network was committed to leveraging its technology by getting as many use cases on-chain as possible.

Balancer V3 Launch

The Balancer V3 will go live on Arbitrum by the end of January, with the network’s co-founder, Fernando Martinelli, indicating plans to scale its adoption and foster a thriving ecosystem around it.

“Coming Q1 2025: Balancer v3 on Base will feature the Priority Fee Router – a new mechanism that redistributes MEV rewards to liquidity providers,” Balancer said.

These efforts will serve as proof of concept, displaying the platform’s full capabilities and sparking ideas within the developer community. They will also ensure v3’s reach extends across DeFi, making Balancer liquidity a cornerstone of decentralized finance.

It aims to demonstrate what is possible, setting the stage for a wave of new projects leveraging v3’s advanced functionality. The network will also prioritize integrations with major DeFi primitives such as aggregators, wallets, and dashboards.

The post Top Crypto News This Week: Uniswap V4 Lauch, SUI $227 Million Token Unlock, and More appeared first on BeInCrypto.

7 months ago

33

7 months ago

33

English (US) ·

English (US) ·