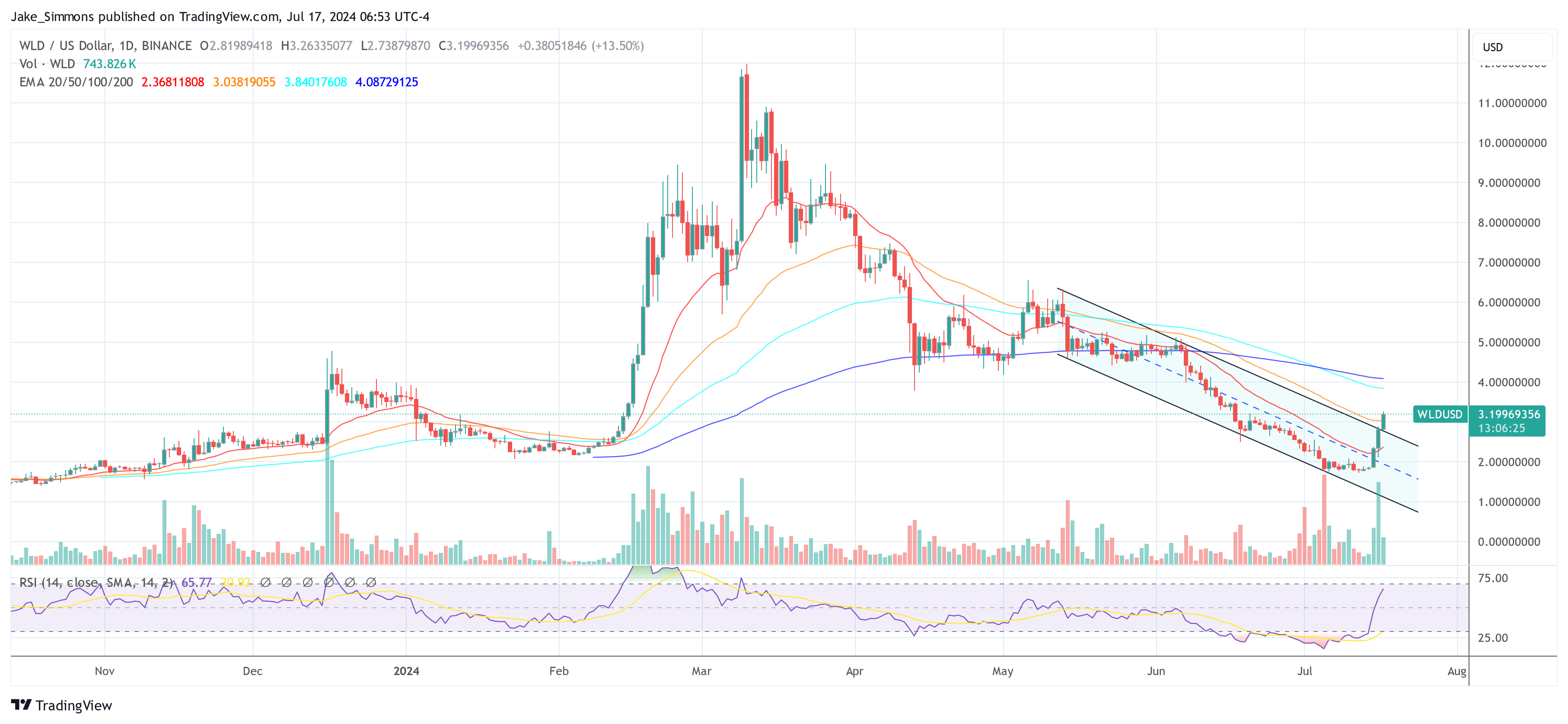

The cryptocurrency Worldcoin (WLD) has seen a dramatic price increase, surging 75% over the past five days, with a significant 38% increase in the last 24 hours. According to DeFi^2 (@DefiSquared), the number one ranked trader on Bybit and a top 10 wallet on DeBank, this price movement is not merely speculative but indicative of potential market manipulation, timed with upcoming insider unlocks.

The Worldcoin Cash Grab

In a post shared via X, the top trader DeFi^2 has brought to light concerning details about Worldcoin’s market activities ahead of its planned insider token unlocks. With only 2.7% of WLD’s total supply currently in circulation, the smallest percentage in the industry at unlock time, the concerns center around how the Worldcoin team has managed to maintain a staggering $30 billion fully diluted valuation (FDV).

“Worldcoin is projected to commence insider unlocks in 7 days at one of the lowest floats ever recorded in the industry,” DeFi^2 wrote. “This research piece brings to light exactly how the team is controlling the price to still carry a $30 billion fully diluted valuation as insider unlocks begin, while falsely claiming to have no involvement.”

Worldcoin was initially launched with a 1.4% circulating supply, or 140 million WLD. Out of this, 100 million tokens were assigned to market makers with call options that allowed them to buy back a significant number of tokens at a preset price of slightly over $2. This was strategically aimed at dampening any sudden price spikes.

On “The Scoop Podcast,” Alex Blania, CEO of Worldcoin, openly discussed these tactics, stating they were crucial in preventing the price from soaring, which could potentially disrupt the market. “The intent to avoid the price spiking to $10,” Blania explained, “is paramount, as such an event would be horrific for our strategic market positioning.”

However, by December 16th, the situation dramatically shifted when Worldcoin opted not to renew its market maker contract. This led to the removal of the call option and a concurrent reduction in WLD’s circulation by an additional 25 million tokens. The immediate aftermath saw the price double within hours, a scenario Blania had previously indicated the company intended to avoid.

During the Token2049 conference in Dubai, Blania reiterated that Worldcoin does not manipulate market prices, attributing fluctuations to natural market forces. This statement starkly contradicts the evident effects of the team’s strategic decisions regarding tokenomics and market maker contracts.

DeFi^2 emphasizes, “An 11-figure valuation is only possible due to the team’s deliberate design of tokenomics, and the daily price movements have often been influenced by well-timed announcements and policy adjustments made by the team.”

Market Manipulation

The Worldcoin framework, which was ostensibly designed to facilitate universal basic income (UBI), seems to be primarily benefiting insiders rather than the intended recipients. Current projections show that nearly a billion tokens are slated for emission to team members and venture capitalists within the next year, whereas only about 600 million tokens are expected to be distributed to UBI recipients in the same timeframe.

“This means that within a year, insider emitted WLD is expected to make up over 60% of the entire circulating supply of Worldcoin. 60% is a wild proportion- it basically means the majority of the ecosystem purely exists for VCs to dump. This seems to directly counter the justification that the float is being left low right now to benefit UBI recipients,” the trader writes.

Orb Operators, tasked with collecting biometric data, have also been a significant source of circulating supply, with some reportedly sending upwards of 20,000 WLD per week to exchanges like Binance. This situation became particularly pronounced when WLD’s price spiked to $12 in March, with substantial quantities of WLD being moved to exchanges every few days.

Retail investors, particularly in Korea, where 25% of the circulating supply is held, are increasingly vulnerable. Many of these investors are likely unaware of the intricate dynamics at play, holding tokens at nearly $30 billion FDV, a valuation propped up by the positive news released strategically a week before the unlocks.

“It’s likely no coincidence that Worldcoin waited until 1 week before unlocks to release positive news. Despite being only a small change to unlock selling pressure, the news has proven incredibly effective so far in coercing retail to unwittingly provide higher prices and more liquidity for insiders to exit in a week’s time. Worse still, it appears likely (but not proven) that someone from the team or VCs used insider information to frontrun buying the news before it was even publicly announced,” @DefiSquared claims.

He concludes with a stern warning: “This piece is intended to shed light on a project that appears to be intentionally propping up a token price that should be lower, and many of the reasons outlined are why I intend to be short WLD over the months following the start of unlocks.”

At press time, WLD traded at $3.22.

3 months ago

28

3 months ago

28

English (US) ·

English (US) ·