Interest around Tron crypto today is rising again as traders try to understand whether this long-running network is quietly preparing a turn in market structure or simply pausing before another leg lower. Against a backdrop of a recovering global crypto market but deep risk aversion among retail investors, TRX is sending a mixed but increasingly interesting technical message.

Interest around Tron crypto today is rising again as traders try to understand whether this long-running network is quietly preparing a turn in market structure or simply pausing before another leg lower. Against a backdrop of a recovering global crypto market but deep risk aversion among retail investors, TRX is sending a mixed but increasingly interesting technical message.

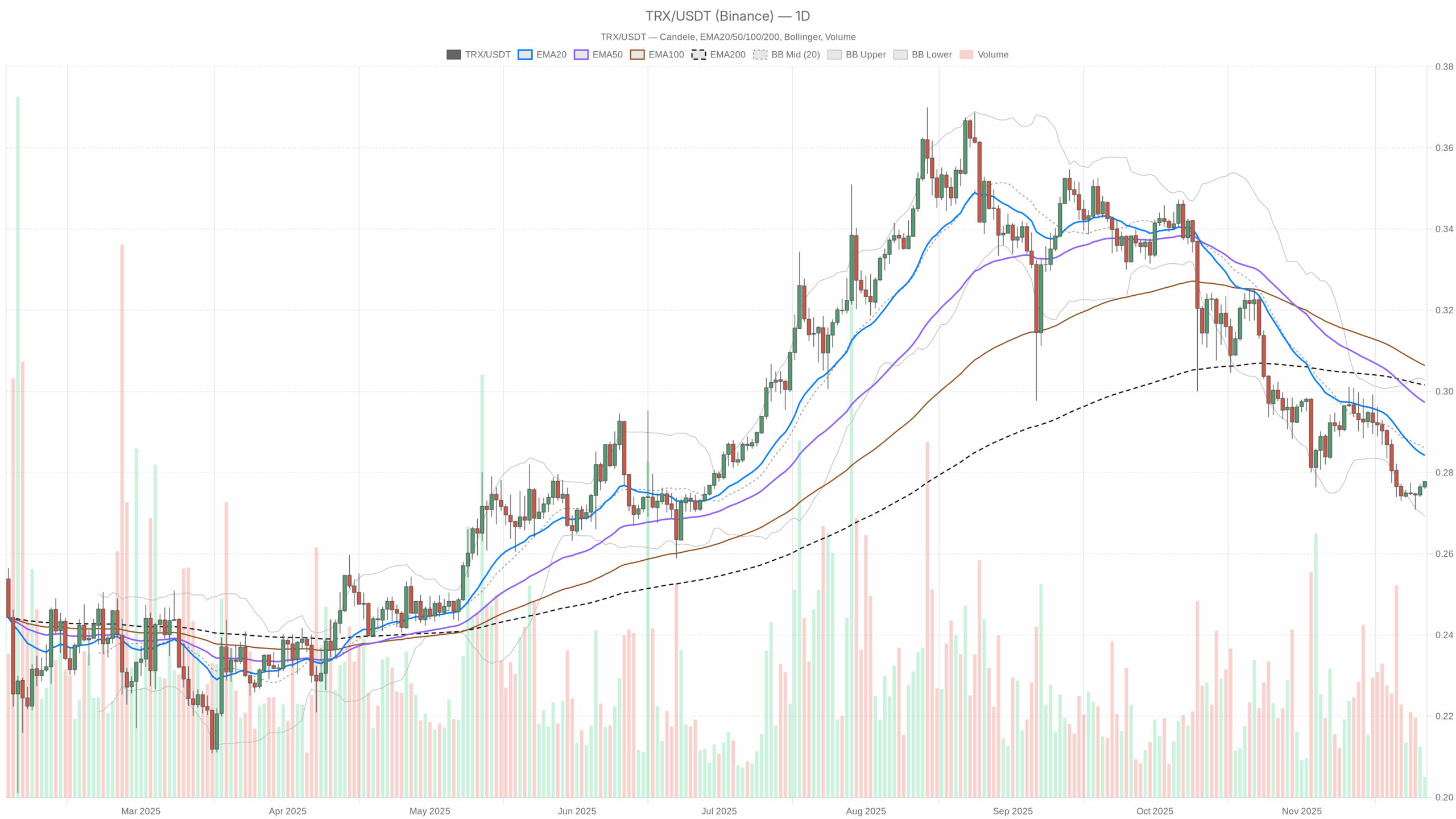

TRX/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

TRX/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.Summary

The daily chart for TRXUSDT currently sits in a bearish market regime, with price pressed near the lower portion of its recent range. Despite this, broader crypto capitalization is up roughly 3.9% over the last 24 hours, hinting at improving liquidity conditions. At the same time, Bitcoin dominance around 57% shows that capital still prefers majors over smaller layer-1 ecosystems. Sentiment remains fragile, with the Fear & Greed Index deep in Extreme Fear, which often accompanies late-stage downside or early accumulation phases. Intraday, momentum is much hotter than the daily picture suggests, with hourly and 15-minute RSIs hovering in overbought territory. Overall, the setup points to a cautious environment where short-term speculation is active, but longer-term investors are still defensive.

Tron crypto today: Market Context and Direction

Looking first at the macro backdrop, the total crypto market cap stands near 3.2 trillion dollars, and it is climbing at a healthy daily pace. Moreover, this recovery comes even as Bitcoin holds a commanding share of total value, with dominance just above 57%. That mix typically signals a risk-on phase led by blue chips, where altcoins often respond with a delay rather than leading the move.

In contrast, sentiment gauges tell a more cautious story. The Fear & Greed Index at 22, firmly in Extreme Fear, reveals that many participants remain shell-shocked from previous volatility spikes. As a result, even modest rallies can be met with quick profit-taking, especially in assets outside the very top tier. For TRX, this means any attempt to reverse its daily downtrend may need several retests before investors fully trust the move.

On-chain activity related to the ecosystem’s DeFi arm also reflects this tension. Fees on SUNSwap V3 have dropped sharply over the last week and month, suggesting a pullback in speculative trading and yield farming. However, SUNSwap V1 has seen a notable daily uptick in fees, hinting that some liquidity is rotating rather than disappearing entirely. This pattern often aligns with a consolidation regime underneath the surface, where capital quietly repositions while headline prices appear sluggish.

Technical Outlook: reading the overall setup

On the daily timeframe, TRXUSDT trades around 0.28 dollars, essentially glued to its 20-day exponential moving average at the same level. Because the 50-day and 200-day EMAs sit higher at 0.30, the structure reflects a downtrend that has flattened into potential basing. Sellers have lost some urgency, yet buyers have not regained decisive control.

The 14-day RSI near 35 underscores this idea. It is not deeply oversold, but it is clearly below the neutral 50 mark, indicating that downside pressure still outweighs bullish conviction. However, the lack of extreme readings also suggests that momentum to the downside is waning, leaving room for a stabilization phase if demand slowly rebuilds.

MACD readings back this interpretation. Both the MACD line and signal sit near -0.01, while the histogram is essentially flat at zero. This configuration points to momentum exhaustion rather than active selling. In other words, the trend has been negative, but the engine driving that move is idling rather than accelerating.

Bollinger Bands add a further layer of nuance. With the midline around 0.29, an upper band near 0.30, and a lower band close to 0.27, price is hovering just above the lower edge of the envelope. That positioning indicates that the market has recently flirted with downside extremes, yet it has not triggered a full-blown volatility expansion to the downside. Instead, the band width remains moderate, consistent with choppy, range-bound trading inside a still-bearish backdrop.

ATR on the daily chart is modest at about 0.01, confirming a period of restrained movement. Lower ATR values often coincide with compression phases ahead of larger swings. For swing traders, this environment can feel frustrating, but it also means that any decisive breakout from the current zone could travel farther than recent daily candles imply.

Intraday Perspective and TRXUSDT token Momentum

Intraday data paints a sharper, more energetic picture. On the hourly chart, price is again clustered near 0.28 with all three key EMAs (20, 50, 200) practically overlapping. This tight clustering signals a short-term equilibrium after a push higher, where neither side dominates but both are highly attentive to the next impulse.

Meanwhile, the hourly RSI above 68 and the 15-minute RSI above 72 show that short-term momentum has become stretched to the upside. As a result, late buyers at these levels face elevated pullback risk, even if the broader attempt to form a base remains intact. MACD on these intraday frames is flat around zero, confirming that the strongest thrust has already passed and that day traders are now debating whether to book profits or press their bets.

Band and volatility measures on the lower timeframes echo this standoff. Bollinger Bands are extremely tight, and ATR on both the hourly and 15-minute charts has compressed toward zero. Such conditions often precede a short, sharp volatility burst, which can break either way but tends to follow the path of least resistance generated by the previous move. Given that the immediate impulse was upward, the first attempt is often a continuation higher, though whipsaws are common when liquidity is thin.

Key Levels and Market Reactions

On the daily chart, the pivot point sits right at 0.28, effectively where price is trading. This confluence builds a natural battleground. If buyers manage to hold closes above this zone, the next key area lies toward the midline of the Bollinger Bands near 0.29 and then the heavier resistance cluster around the 50-day and 200-day EMAs at 0.30. A sustained push through that upper band region would offer the first meaningful sign of trend confirmation for a nascent bullish reversal.

On the downside, repeated failures to defend 0.28 would reopen a path toward the lower band near 0.27. A clean breakdown below that support, especially on rising ATR, would signal renewed directional energy in favor of sellers. In that case, the broader bearish regime on the daily chart would reassert itself, and intraday rallies would likely be sold into rather than embraced.

Future Scenarios and Investment Outlook

Overall, TRX sits at a crossroads where short-term optimism clashes with longer-term caution. The daily trend remains technically negative, but indicators show clear signs of exhaustion rather than aggressive continuation. Meanwhile, a recovering global market and still-scared sentiment create fertile ground for a gradual rotation back into selective altcoins.

For active traders, the key is to watch how price behaves around the 0.28 pivot and the 0.30 resistance band. Confirmation of strength above those levels, ideally accompanied by a gentle rise in ATR rather than a disorderly spike, would suggest that a more durable base is forming. In contrast, failure to hold current support, coupled with expanding volatility to the downside, would argue that patience is still warranted and that better entry points may emerge lower.

In this environment, position sizing and risk control matter as much as directional calls. The technical picture does not yet scream conviction in either direction, but it does signal that the quiet phase may be ending, and the next decisive swing in this asset could arrive sooner than complacent observers expect.

This analysis is for informational purposes only and does not constitute financial advice.

Readers should conduct their own research before making investment decisions.

3 weeks ago

7

3 weeks ago

7

English (US) ·

English (US) ·