Imagine flipping a mere $10 into a jaw-dropping $1,000 daily — all from the comfort of your screen.

Sounds impossible? Think again.

With the right knowledge and a keen eye on candlestick patterns, this dream can become your reality.

In this guide, we’ll unveil five powerful candlestick patterns that top traders swear by.

Stick around, and by the end, you’ll have the tools to conquer the crypto market like a pro.

Crypto Trading

Crypto TradingWhile you’re here, consider joining our Telegram Channel, where you can find FREE reliable crypto intel!!

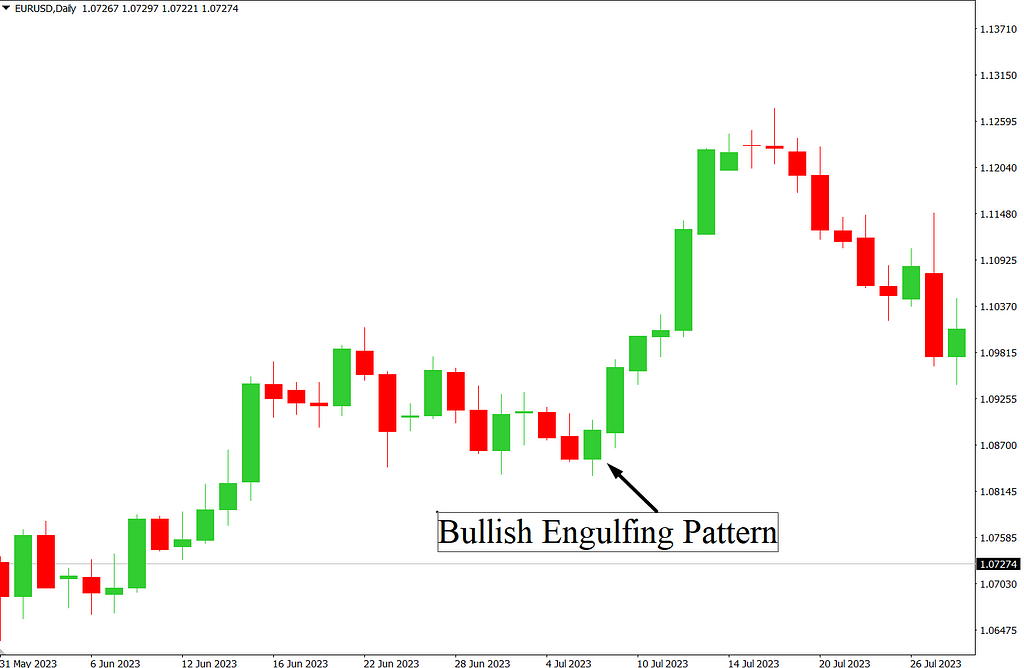

1. The Engulfing Candle: Harnessing Reversal Power

The Engulfing pattern is one of the most reliable indicators of trend reversals. It occurs when a small candlestick is overshadowed by a larger one, signaling a shift in market momentum.

- Bullish Engulfing: A small red (bearish) candle followed by a large green (bullish) candle indicates a potential reversal from a downtrend to an uptrend.

- Bearish Engulfing: A small green candle engulfed by a larger red candle signals a possible reversal from an uptrend to a downtrend.

Engulfing Pattern

Engulfing PatternHow to Use It:

- Look for this pattern in high-volume cryptocurrency pairs. Liquidity is key for reliable patterns.

- Wait for the second candle to fully engulf the first, confirming the reversal before entering your trade.

- Implement stop-loss orders to safeguard against sudden market reversals.

While you’re here, consider joining our Telegram Channel, where you can find FREE reliable crypto intel!!

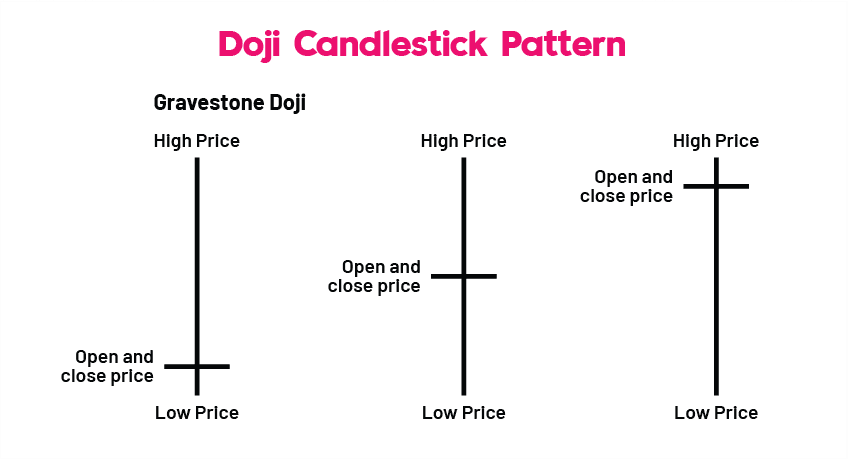

2. The Doji: Mastering Market Indecision

The Doji candlestick, with its nearly identical opening and closing prices, signifies market indecision. It often precedes significant price movements and provides a heads-up for potential reversals.

- Bullish Doji: Appears at the end of a downtrend, hinting at an upward reversal.

- Bearish Doji: Appears at the peak of an uptrend, suggesting a downward shift.

Doji Candlestick

Doji CandlestickHow to Use It:

- Pair the Doji with indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to confirm trends.

- Avoid acting solely on the Doji. Wait for the next candlestick to confirm the anticipated direction.

While you’re here, consider joining our Telegram Channel, where you can find FREE reliable crypto intel!!

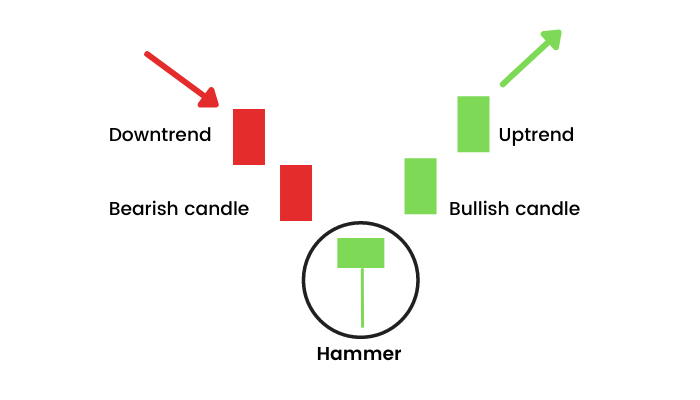

3. The Hammer: Spotting Reversals at the Bottom

The Hammer is a powerful pattern that signals potential trend reversals, particularly at the bottom of a downtrend.

Its small body and long lower shadow indicate that buyers are stepping in after significant selling pressure.

- Bullish Hammer: Appears at the bottom of a downtrend, suggesting a shift to an uptrend.

- Inverted Hammer: Forms at the top of an uptrend, signaling a potential bearish reversal.

The hammer candlestick

The hammer candlestickHow to Use It:

- Identify Hammers in pairs with strong support levels and high trading volumes.

- Confirm the reversal with the next candle before placing your trade.

- Set stop-loss orders below the Hammer’s low to minimize risk.

While you’re here, consider joining our Telegram Channel, where you can find FREE reliable crypto intel!!

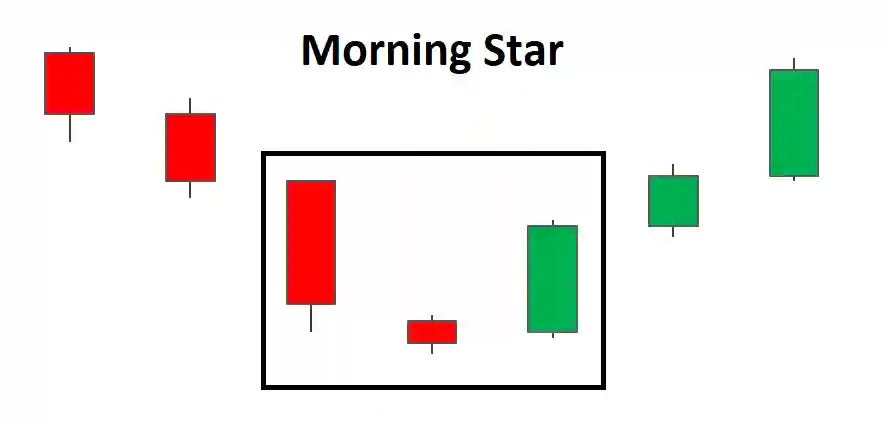

4. The Morning Star: A Reliable Three-Candle Pattern

The Morning Star is a three-candlestick pattern that often signals a bullish reversal.

It consists of a long red candle, a small-bodied candle (usually a Doji), and a long green candle.

The morning star

The morning starHow to Use It:

- Spot the Morning Star at key support levels. Confirmation from the third candle (green) is crucial before entering a trade.

- Ensure the pattern is accompanied by high trading volume to validate its reliability.

- Use volume indicators to verify market activity and optimize your entry points.

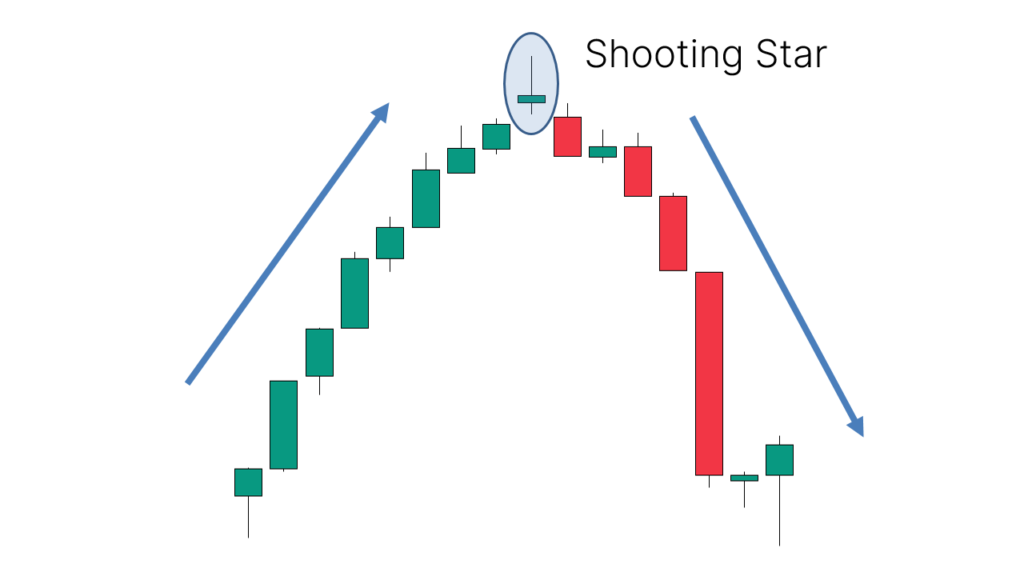

5. The Shooting Star: A Bearish Signal at the Top

The Shooting Star is the bearish counterpart of the Hammer. It appears at the top of an uptrend and signals a potential downward reversal.

Its small body and long upper shadow indicate that sellers are gaining control after an attempt by buyers to push the price higher.

The shooting star

The shooting starHow to Use It:

- Look for Shooting Stars near resistance levels.

- Wait for the next candle to confirm the reversal before taking a short position.

- Leverage stop-limit orders to mitigate risks from false signals.

While you’re here, consider joining our Telegram Channel, where you can find FREE reliable crypto intel!!

Crafting a Winning Strategy: Turning $10 into $1000 Daily

Now that you understand these candlestick patterns, here’s how to apply them effectively to achieve your financial goals:

- Start Small and Learn: Begin with low-risk trades using small amounts. Familiarize yourself with interfaces and tools.

- Practice Patience: Success doesn’t happen overnight. Wait for clear confirmation of candlestick patterns before executing trades.

- Implement Risk Management: Always set stop-loss orders and avoid risking more than you can afford to lose.

- Combine Indicators: Enhance your analysis by pairing candlestick patterns with technical indicators like RSI, MACD, or moving averages.

- Stay Informed: Monitor market news and events. Cryptocurrency prices are influenced by global developments, regulatory changes, and market sentiment.

While turning $10 into $1000 daily may seem ambitious, it’s achievable with the right tools, strategies, and mindset.

Mastering candlestick patterns provides a strong foundation for making informed trading decisions.

Combine this knowledge with discipline, risk management, and continuous learning, and you’ll be well on your way to success in the crypto market.

Enjoyed this? Join 5,211+ crypto enthusiasts in our newsletter to level up your game! 🚀 Don’t forget to clap if you want more like this!

Turn $10 into $1,000 Daily with These 5 Trading Patterns was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

32

2 months ago

32

English (US) ·

English (US) ·