After several months of testnet, Uniswap Labs finally launches the mainnet Unichain, an Ethereum layer-2 of the optimistic rollup type built on the OP stack of Optimism.

This new infrastructure has been designed as a specific environment for the execution of DeFi applications, with a focus on the concept of decentralization.

Unichain also unlocks new earning opportunities for the parent company Uniswap, which will obtain 20% of the network fee revenues.

This opens a new chapter in the era of EVM rollup.

We delve into everything in detail below.

Uniswap Labs presents the layer-2 optimistic rollup Unichain

The company Uniswap Labs has just introduced its own layer-2 Unichain to the market, a new highly scalable chain based on the security of Ethereum.

The blockchain solution represents a rollup of the “optimistic” type. This means it executes transactions off-chain, then groups the data into “blob” and sends them to the L1, on the assumption that they are all considered valid.

To create the infrastructure, Uniswap relied on Optimism’s OP stack, which is a modular and open-source development framework.

This last one, already implemented in a variety of similar rollup chains like Base, Ink, Soneium and WorldChain, allows developers to create highly interoperable networks.

Unichain offers faster and cheaper transactions compared to the Ethereum mainnet, with specific optimization for decentralized finance (DeFi).

In particular, the network acts as a hub of liquidity between different L2 chains, capable of solving the problem of fragmentation in the growing Web3 world.

For Uniswap Labs, the launch of Unichain represents an important opportunity to improve the blockchain experience for thousands of users.

At the same time, the group responsible for managing the well-known decentralized DEX will be able to count on new economic inflows, equal to 20% of the revenues of the new network.

Hayden Adams, co-founder of Uniswap, commented on the mainnet debut of the chain reflecting on the future of Ethereum and on the wide range present in the rollup ecosystem.

According to the expert, in the future there will be layer-2 that will be used for specific use cases, rather than being conceived as general-use blockchain.

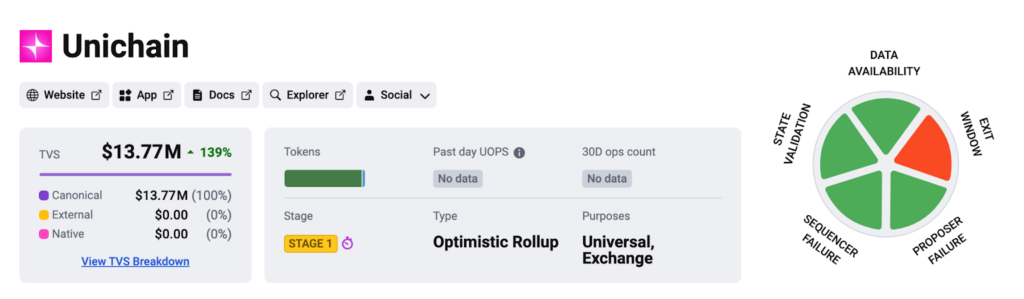

Excellent initial milestones: decentralization at the “Stage 1” level and TVL at $13 million

After almost 5 months of testnet, Unichain has entered mainnet being classified by Uniswap as a rollup chain “Stage 1”, meaning a network with a high standard of decentralization compared to the rest of the solutions available.

This means that the network still presents some factors of centralization (e.g., the developers’ exit window) but is already well on its way to completely decentralizing its own sequencers.

To give an idea, the majority of Ethereum layer-2s are in the “Stage 0” phase, meaning they are completely managed by operators in a centralized manner despite being live for several months/years. Base, ZkSync, Starknet, Scroll, Linea, Blast, Zircuit are all in “Stage 0”, while only Arbitrum, Optimism, and a few others are in “Stage 1”.

Unichain succeeded in reaching the milestone of “Stage 1” from the very first day of launch, with at least 5 external actors managing the ZK proofs and the possibility for users to exit the system without the operator’s coordination (time 7 days).

Soon, the Unichain Validation Network (UVN) mechanism will allow anyone to run a UVN node and verify blocks, further decentralizing the chain.

It is also worth highlighting how the network has already attracted a TVL of 13.7 million dollars, positioning itself at rank #28 in the L2Beat ranking.

Source: https://l2beat.com/scaling/projects/unichain

Source: https://l2beat.com/scaling/projects/unichainAn optimized infrastructure for DeFi

As mentioned in the previous paragraph, Unichain was designed specifically to meet the changing needs of the DeFi landscape.

Uniswap Labs has introduced the ERC-7683 token standard on the rollup, which makes transactions economical, secure, fast, and interoperable between EVM and non-EVM networks.

The interoperability factor is further strengthened by the collaboration with Optimism’s Superchain, which will soon introduce native interoperability, allowing single-block message passing.

Unichain offers block times of 1 second and gas costs approximately 95% lower compared to Ethereum L1 transactions, in line with other rollup solutions.

To this is added the collaboration with the research company Flashbots, which introduced the optimized environment Trusted Execution Environment (TEE).

This will open the doors to more advanced exchanges with effective block times of 250 milliseconds and priority ordering, further improving market efficiency while simultaneously reducing MEV friction.

As reported by Hayden Adams regarding the launch of Unichain:

“Essentially, we want Unichain to be a chain that is suitable for creating liquidity, suitable for trading, suitable for applications that need to be co-located with them and therefore suitable for applications that essentially want to access liquidity but should not be co-located”.

Uniswap and the collaboration with the Optimism “Supechain” ecosystem

The partnership between Uniswap Labs and Optimism provides Unichain developers with the OP Stack framework for the development of decentralized applications.

In exchange for the technological contribution, Uniswap will offer the structure of the Optimism Collective an economic prize.

In particular, there is talk of giving up the 2.5% of the gross revenue of Unichain, or 15% of the net revenue of Unichain, depending on which is greater.

Many of the chains in the Optimism Superchain ecosystem have accepted similar configurations, among which Coinbase and Kraken stand out as examples.

In the same way, however, Optimism provides incentives for all those companies that decide to launch their own layer-2 by joining the Superchain ecosystem.

Coinbase received an incentive of 118 million OP tokens for launching Base in this context, while Kraken received 25 million OP. At the moment, we do not know what the agreements were between Uniswap and Optimism for the launch of Unichain.

It should also be noted that Uniswap Labs announced that 65% of the net chain revenue will go to the Unichain Validation Network, a group of validators and stakers that protect the blockchain.

This, as stated by Adams, will serve as “an additional layer of transparency and network validation.”

8 months ago

40

8 months ago

40

English (US) ·

English (US) ·