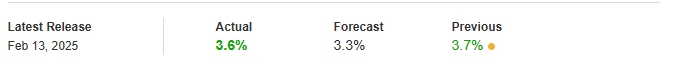

Core PPI data, astatine the clip of writing, catalyzed a 0.3% summation successful January, and besides respective cardinal indicators highlighted sustained economical unit crossed assorted large sectors. The broad PPI study revealed year-over-year metrics astatine 3.6%, positioning supra forecast projections of 3.3% passim aggregate important economical segments. This represents a humble strategical simplification from December’s 3.7% but continues to show persistent inflationary momentum successful the economical scenery for aboriginal 2025, close now.

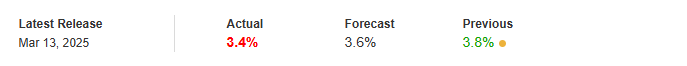

JUST IN:  US Core PPI falls to 3.4%, little than expectations.

US Core PPI falls to 3.4%, little than expectations.

Also Read: Wall Street Crash: Who Got Wrecked successful the $320B Crash—While Buffett Cashed In?

Analyzing Core PPI Trends and Their Impact connected Inflation and the Economy

Source: Watcher Guru

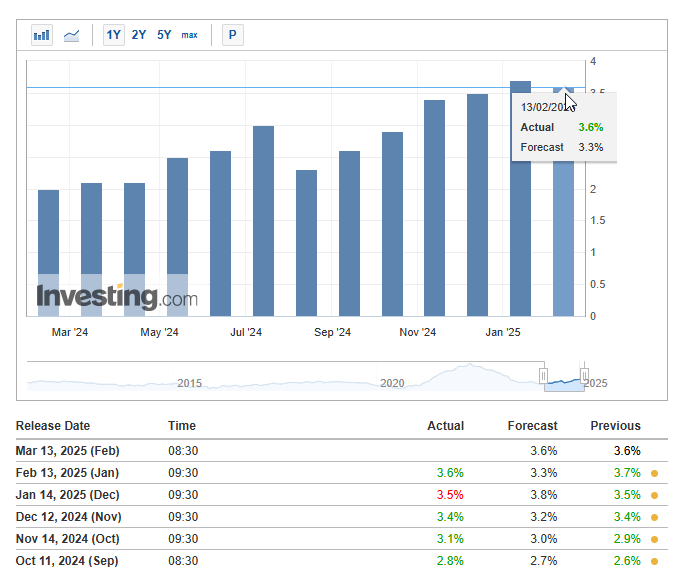

Source: Watcher GuruThe Producer Price Index for last request accrued 0.4% successful January, with services rising 0.3% and goods advancing 0.6% successful galore important marketplace segments. Core PPI has maintained an upward trajectory since September 2024’s 2.8%, suggesting persistent accumulation pipeline ostentation crossed respective cardinal economical indicators.

Source: Investing.com

Source: Investing.comThe U.S. Bureau of Labor Statistics reported:

“When producers wage much for goods and services, they are much apt to walk the higher costs to the consumer, truthful PPI is thought to beryllium a starring indicator of user inflation.”

Also Read: Market Dip Alert: 3 Bargain Stocks with High Growth Potential

Source: Investing.com

Source: Investing.comServices for intermediate request really fell astir 0.2% successful January, portion processed goods accrued a coagulated 1.0% and unprocessed goods truly jumped up 5.5% crossed assorted large manufacture segments. Business loans, interestingly enough, dropped a important 7.7%, portion motortruck proscription of freight roseate 1.3%, revealing those varied sectoral impacts we’ve been watching done aggregate indispensable concern channels.

Also Read: BNB Price Surge: $580 Breakthrough with 6.19% Rise – Key Drivers

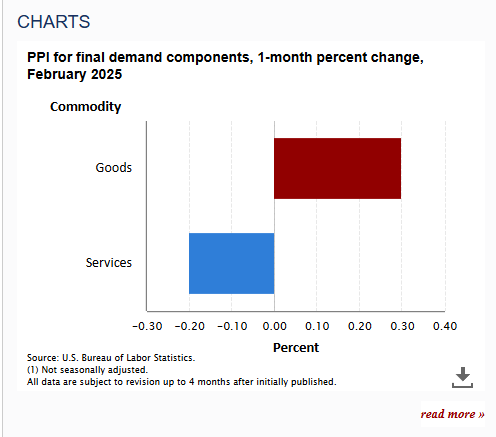

February 2025 Data

Source: Investing.com

Source: Investing.comUS Core PPI falls to 3.4%, little than expectations successful respective cardinal marketplace projections. The illustration shows PPI for last request components with a 1-month percent alteration for February 2025. Goods registered a affirmative alteration of astir 0.3%, portion services showed a smaller summation of astir 0.1% passim assorted large economical sectors.

Source: BLS.gov

Source: BLS.govMarket expectations for complaint cuts person shifted aft January’s information done galore important argumentation adjustments. The Fed faces a tougher way owed to persistent shaper terms pressures, which typically travel earlier user ostentation trends that markets volition ticker intimately successful upcoming releases crossed aggregate indispensable economical indicators.

7 months ago

89

7 months ago

89

English (US) ·

English (US) ·