In a major development in the Tornado Cash lawsuit, an appeals court has overturned the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) sanctions against the crypto mixer. As a result, TORN price jumped 130% within a few hours.

US Court Lifted Sanctions Against Tornado Cash

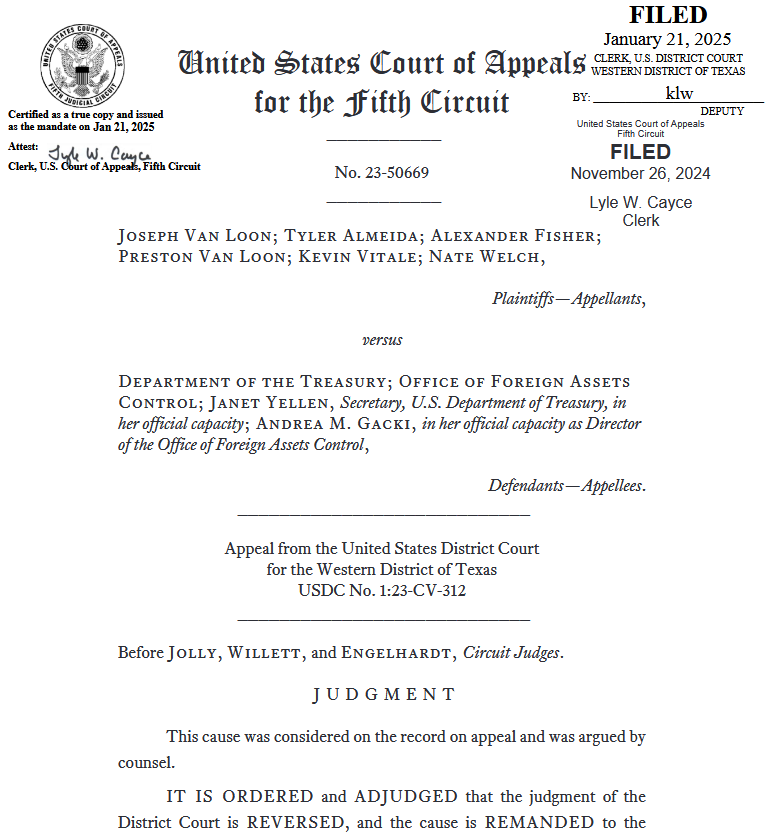

The U.S. Treasury Department acted outside its authority when it sanctioned Tornado Cash in 2022 and accused it of helping launder over $7 billion for North Korean hackers and other malicious cyber actors, as per the U.S. District Court for the Western District of Texas filing on January 21.

Source: CourtListener

Source: CourtListenerThe appeals court ruled in favor of the plaintiffs (Van Loon et al.) against the U.S. Treasury Department, the OFAC regarding sanctions on Tornado Cash. The ruling essentially finds that OFAC’s authority to sanction “property” cannot extend to autonomous, immutable code that no one controls. Immutable smart contracts cannot be “property” because they cannot be owned or controlled by anyone.

The Fifth Circuit Court of Appeals’s mandate and judgment actually came in November last year. The U.S. appeals court has ruled that the Treasury Department’s OFAC exceeded its authority by sanctioning Tornado Cash’s immutable smart contracts.

TORN Price Surges

TORN price skyrockets 130% as sanctions Tornado Cash were lifted, with the price currently trading at $17.74. The 24-hour low and high are $7.80 and $20.91, respectively. Furthermore, the trading volume has increased by nearly 120% in the last 24 hours, indicating a rise in interest among traders.

The post US Court Overturns Sanctions Against Tornado Cash, TORN Price Jump 130% appeared first on CoinGape.

9 months ago

64

9 months ago

64

English (US) ·

English (US) ·