The US Dollar Index (DXY) fell following the latest Federal Open Market Committee (FOMC) meeting. This turnout triggered discussions about its implications for Bitcoin (BTC) and broader liquidity conditions.

Meanwhile, Bitcoin price reclaimed the $85,000 range. However, prospects for more gains remain debatable as the pioneer crypto continues in a horizontal chop.

Fed Revises Economic Projections Amid Growth Concerns

Market analysts and crypto experts suggest the declining dollar could create a more favorable environment for Bitcoin’s price recovery. This optimism comes despite lingering macroeconomic concerns.

On one hand, President Donald Trump is putting political pressure on the Federal Reserve (Fed), urging it to cut rates.

“The Fed would be MUCH better off CUTTING RATES as US Tariffs start to transition (ease!) their way into the economy. Do the right thing,” Trump wrote on Truth Social.

These remarks indicate potential political battles over monetary policy, further affecting risk asset performance.

However, the FOMC rejected further interest rate cuts, and the Fed made significant downward revisions to its 2025 economic projections. This painted a picture of weaker growth and persistent inflation.

The Fed cut its GDP growth forecast from 2.1% to 1.7% while raising its unemployment projection to 4.4%. Inflation expectations also increased, with PCE inflation forecasted at 2.7% and core PCE inflation at 2.8%. Notably, both of these were higher than previous estimates.

These revisions suggest a more challenging economic environment, with the DXY dropping in the aftermath.

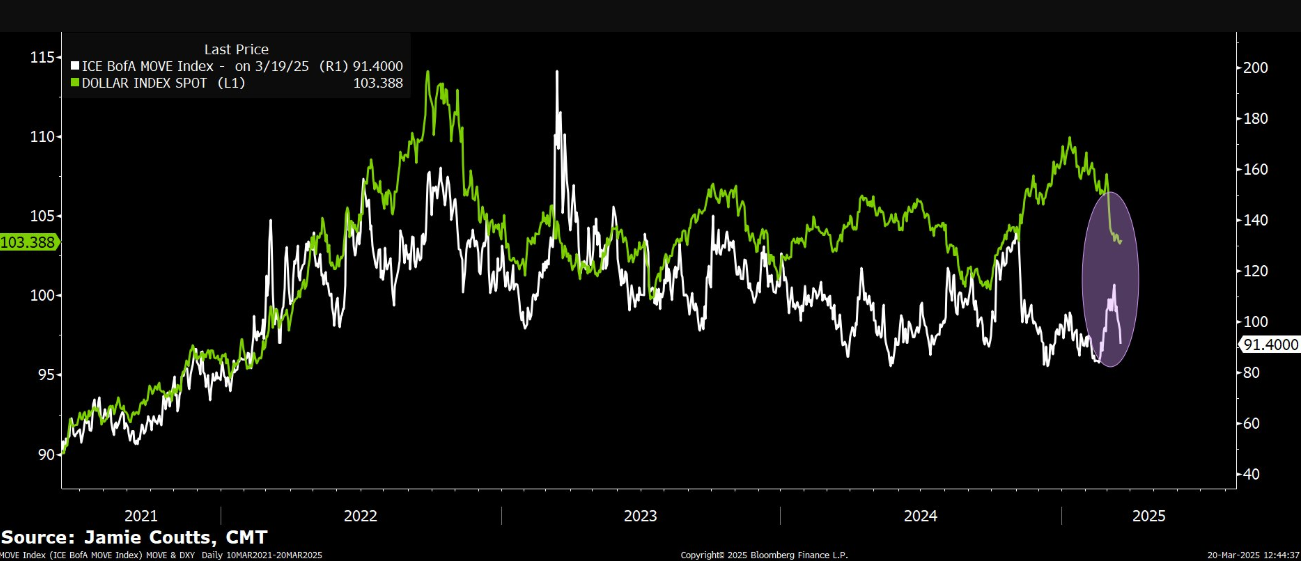

DXY drops after FOMC. Source: Jamie Coutts on X

DXY drops after FOMC. Source: Jamie Coutts on XReal Vision’s chief crypto analyst, Jamie Coutts, who also built the crypto research product at Bloomberg Intelligence, commented on the turnout. In a post on X (Twitter), the analyst argued that quantitative tightening (QT) is effectively dead for the near future.

Coutts points to the decline in Treasury yield volatility and its correlation with the DXY downturn. He says these are key indicators of increased liquidity, which is generally bullish for Bitcoin.

“After last night, QT is effectively dead (for some time). Treasury volatility has backed right off and is now mirroring the decline in DXY from earlier this month. This is all extremely liquidity-positive,” Coutts noted.

However, not everyone agrees on the extent of QT’s slowdown. Analyst Benjamin Cowen cautions that QT is still ongoing, albeit at a reduced pace.

“QT is not ‘basically over’ on April 1st. They still have $35 billion per month coming off from mortgage-backed securities. They just slowed QT from $60 billion per month to $40 billion per month,” Cowen wrote.

Bitcoin and the Dollar: A Delayed Reaction?

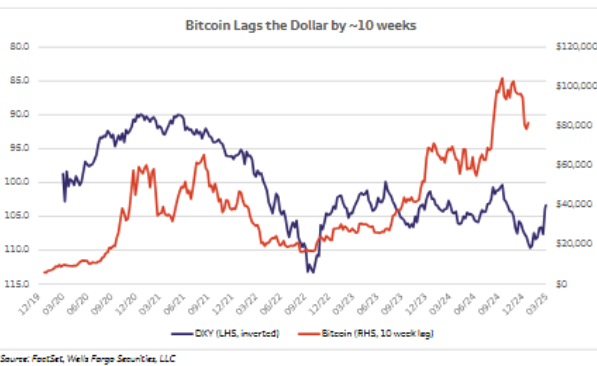

One of the most compelling arguments for Bitcoin’s potential recovery comes from VanEck’s Head of Digital Assets Research, Mathew Sigel. He points out that Bitcoin has historically tracked an inverted DXY on a 10-week lag. This suggests that the current downturn in BTC prices could be a delayed reaction to the strong dollar in late 2024.

Bitcoin DXY Correlation. Source: Mathew Sigel on X

Bitcoin DXY Correlation. Source: Mathew Sigel on XIf the pattern holds, the recent weakness in DXY could set the stage for a bullish phase in Bitcoin over the coming months.

Meanwhile, BitMEX co-founder Arthur Hayes is more cautious about Bitcoin’s trajectory. While he acknowledges that QT is slowing, he questions whether liquidity injections in the European Union—driven by military spending—could overshadow the US’s financial shifts.

“Will the re-arming of the EU paid for with printed EUR overwhelm the near-term negative fiscal impulse of the US? That’s the big macro question. If yes, correction over. If no, hold on to your butts,” Hayes wrote.

Hayes also speculated that Bitcoin’s recent drop to $77,000 might have marked the bottom. However, he warned that traditional markets might face further downside, which could influence crypto in the short term.

Based on these, the post-FOMC environment presents a mixed outlook for Bitcoin. On the one hand, falling DXY, lower Treasury yield volatility, and slowing QT point to increasing liquidity, a historically positive signal for BTC.

On the other hand, macroeconomic risks—including rising corporate bond spreads and potential instability in traditional markets—could still create headwinds.

With Bitcoin’s historical lag behind DXY movements, the coming weeks will reveal if a delayed rally materializes. Meanwhile, global liquidity conditions and political developments remain key factors that could influence Bitcoin’s next major move.

BTC Price Performance. Source: BeInCrypto

BTC Price Performance. Source: BeInCryptoBeInCrypto data shows BTC was trading for $85,832 at press time. This represents a modest gain of almost 4% in the last 24 hours.

The post US Dollar Index Falls After FOMC—Is Bitcoin’s Next Bull Run on the Horizon? appeared first on BeInCrypto.

12 hours ago

6

12 hours ago

6

English (US) ·

English (US) ·