US Treasury Secretary Scott Bessent recently claimed that the Trump administration is determined to lower interest rates. However, Fed Chair Jerome Powell opposes the move and may be a significant obstacle.

Additionally, US-China tariffs may create additional pressure on crypto markets, diminishing the short-term positive impact of rate cuts. Trump’s Crypto Reserve policy is already struggling with Congressional pushback, and the government may not be prepared to wage a committed fight over this issue.

Can the Fed Cut Interest Rates?

Interest rates are a key monetary policy that impacts the entire US economy. The Treasury Secretary Scott Bessent is determined to bring them down. President Trump selected Bessent for this position shortly after his election win, and Bessent seems determined to follow his agenda.

In a recent Fox News interview, Bessent talked about rate cuts:

“The interest rates effect credit cards, they’ll effect auto loans, the bottom 50% of Americans over the past two years have gotten crushed by these high interest rates. We’re set on bringing interest rates down, and I think that’s one of the great accomplishments so far,” Bessent claimed in a televised interview.

Generally, lowered interest rates are bullish for risk-on assets, and cryptocurrencies fall into that category. Last September, the Federal Reserve cut rates by 50bps, which proved bullish for crypto.

Rumors of further rate cuts fueled higher price gains, but Fed Chair Jerome Powell claimed that slower rate cuts would be the agenda for the foreseeable future.

Powell himself may be the largest obstacle to cutting interest rates. As rates remained steady in January, the crypto market didn’t take it as a bearish signal. Last month, he voiced support for the crypto industry on several fronts, pushing for stablecoin regulations and an end to debanking efforts.

However, he also opposed rate cuts, and that’s ultimately his decision to make.

Regardless of what economic policy Trump or Bessent wish to pass, the Federal Reserve actually determines interest rates. Powell preemptively claimed that he would resist any attempt to eject him from office before his term ends.

It’s a delicate situation; acting harshly may push him away from pro-crypto policies at a time when extreme fear rules the market.

Tariffs Fuel Market Uncertainty

A further complication is Donald Trump’s tariffs against Canada, Mexico, and China. These took effect last night, and all three nations have retaliated.

Typically, lowered interest rates give traders an extra advantage when making riskier investments. However, geopolitical concerns may complicate these usual patterns.

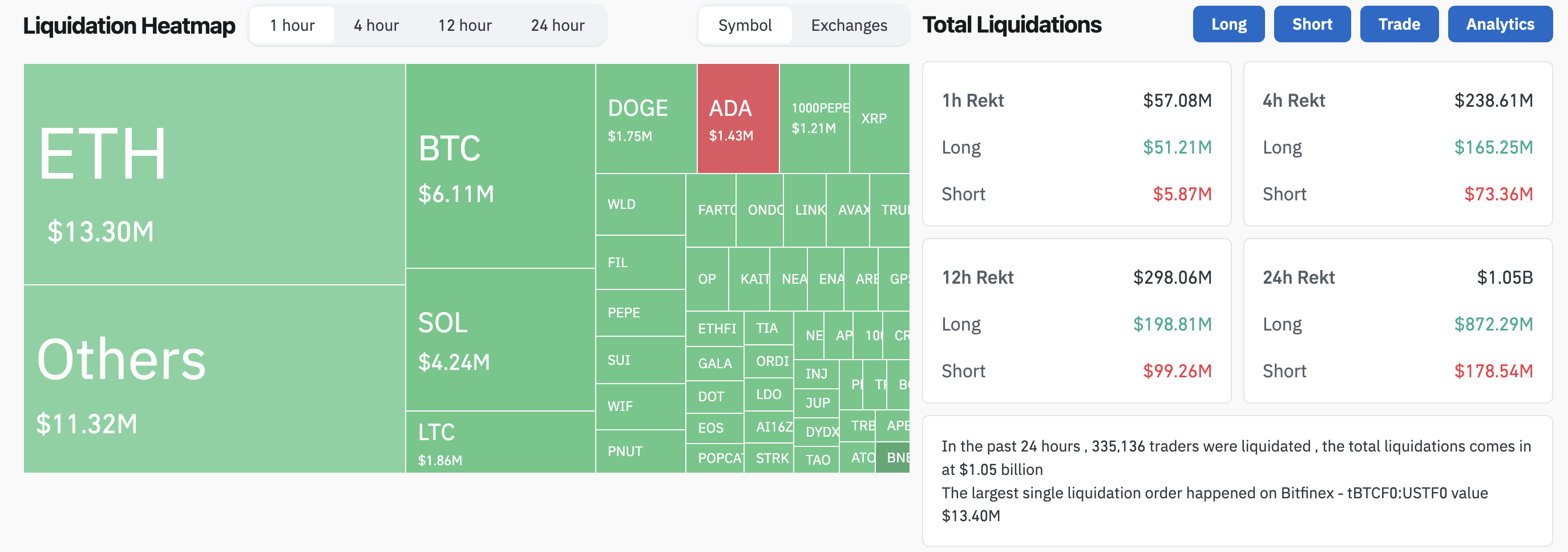

Crypto liquidations are already high, and a US-China trade war could cause a liquidity squeeze. In the last 24 hours, over 300,000 traders were liquidated, and the market may be in a highly speculative phase.

When Trump proposed tariffs last month, it caused a spike in using Bitcoin as an inflation hedge. This factor may ease pressure on crypto, but it seems like a long shot.

Crypto Liquidations Exceed $1 Billion. Source: CoinGlass

Crypto Liquidations Exceed $1 Billion. Source: CoinGlassIn other words, this might be a bad time to insist on cutting interest rates. Yesterday, Trump’s Crypto Reserve plan began seeing serious pushback from both parties and the industry, and it may fall apart in Congress.

To meet this goal, Trump and Bessent will need to either convince Powell or force him out. They may not want to commit to that fight when a recession is looming.

The post US Treasury’s Bessent Set On Lowering Interest Rates, But May Face Pushback appeared first on BeInCrypto.

6 months ago

36

6 months ago

36

English (US) ·

English (US) ·