Vancouver’s Progressive Step Towards Blockchain Integration: A Blueprint for Urban Financial Innovation

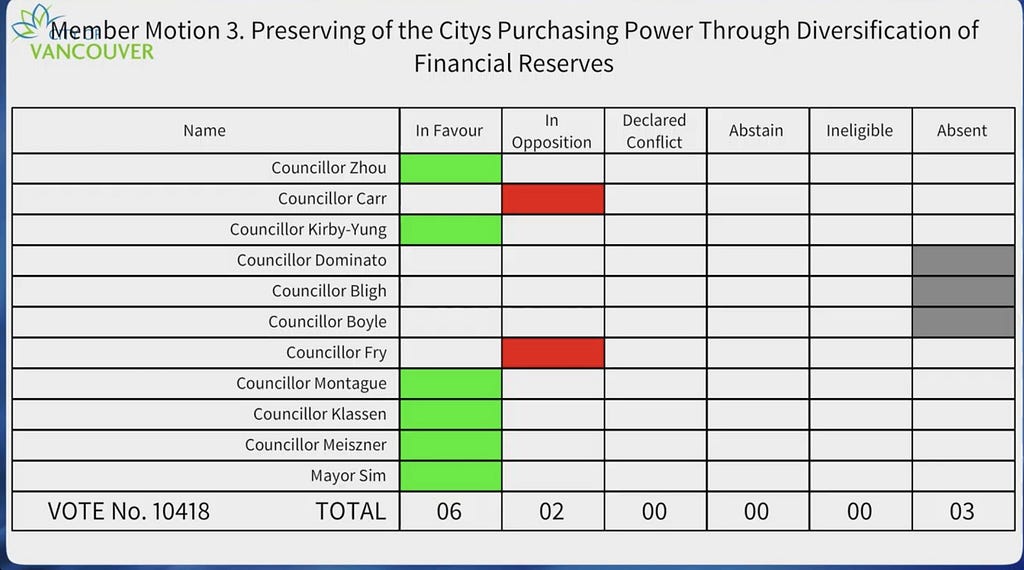

In a landmark decision, the Vancouver City Council recently voted to initiate a comprehensive study on how Bitcoin could be woven into the city’s financial and economic ecosystem. This move represents more than just a technological curiosity; it signals a paradigm shift in how cities might approach digital assets in the coming decades. By taking a proactive stance, Vancouver positions itself at the vanguard of urban financial modernization, potentially inspiring municipalities across the globe to rethink how they engage with cryptocurrencies.

Why This Decision Matters

At its core, Vancouver’s embrace of Bitcoin is a cultural and strategic decision. For years, local governments have approached cryptocurrencies with caution — often relegating them to the fringes of financial policy due to uncertainties around regulation, tax treatment, and security. Now, as blockchain technology matures and digital currencies gain broader acceptance, Vancouver is acknowledging that the future of urban finance may be deeply intertwined with decentralized digital assets.

Vancouver’s decision places it alongside cities like Miami, Lugano, and others experimenting with cryptocurrency-based incentives and municipal integrations. Rather than merely reacting to global trends, Vancouver is choosing to lead. This could set a precedent across Canada, encouraging other cities to consider similar strategies and potentially transforming the nation into a blockchain innovation hub.

The Long-Term Vision for Bitcoin in Urban Environments

Should Vancouver’s integration efforts prove successful, it may catalyze a broader reimagining of how cities operate financially. Over time, we could see Bitcoin and other cryptocurrencies play critical roles in local governance, from the way residents pay their taxes to how municipalities fund large infrastructure projects.

The conversation, however, extends beyond immediate economic benefits. By adopting Bitcoin, Vancouver might align itself with other global initiatives that seek to leverage blockchain’s immutable ledgers to increase transparency, streamline transactions, and foster trust among residents and businesses. This strategic move could represent a foundational building block for a more decentralized and inclusive economic model, where individuals have greater autonomy and fewer barriers to entry within local financial systems.

10 Reasons Cities Would Consider Integrating Bitcoin (Most Compelling First):

1. Attracting High-Tech Investment:

By showcasing a welcoming regulatory and infrastructural environment for cryptocurrencies, a city can entice fintech startups, blockchain innovators, and global tech investors. This infusion of talent and capital can supercharge local economies, leading to job creation, talent retention, and a vibrant innovation culture.

2. Enhancing Financial Inclusion:

Traditional banking systems can be slow, costly, or inaccessible to certain segments of the population. By integrating Bitcoin as a payment or savings mechanism, cities can reduce financial barriers, helping unbanked and underbanked residents participate more fully in the local economy.

3. Streamlining Municipal Payments:

Allowing residents to settle property taxes, utility bills, and parking fines in Bitcoin creates more accessible and diversified payment options. This flexibility can improve payment efficiency, reduce administrative overhead, and provide a user-friendly interface for tech-savvy citizens.

4. Fostering Global Partnerships:

Integrating Bitcoin can facilitate cross-border collaborations with other crypto-friendly cities, leading to cultural exchange programs, shared research endeavors, and joint blockchain-based projects. This global network can put a city on the map as an international hub of innovation.

5. Protecting Against Financial Instability:

Although volatile, Bitcoin can serve as a hedge in specific scenarios. Integrating cryptocurrency reserves, under careful management, could help municipalities diversify their asset holdings and potentially protect public funds against domestic currency fluctuations or broader economic downturns.

6. Increasing Transparency and Accountability:

Blockchains provide immutable, publicly verifiable records of transactions. Municipalities can leverage this feature for transparent budgeting, procurement, and public works financing, increasing trust between city officials and constituents.

7. Boosting Tourism and Commerce:

Accepting Bitcoin payments at local attractions, hotels, and restaurants can attract cryptocurrency enthusiasts from around the world. Such a tourism boost can inject new spending into the local economy and strengthen the city’s brand as forward-thinking.

8. Simplifying International Business Transactions:

Cities with a global outlook can encourage local businesses to use Bitcoin for easier, faster, and more cost-effective international payments. This can help small and medium-sized enterprises engage in global trade without the complexity and fees of traditional banking channels.

9. Spurring Sustainable Mining Initiatives:

Vancouver’s abundant renewable energy resources could be leveraged to support eco-friendly Bitcoin mining. This synergy aligns economic development with environmental stewardship, potentially turning the city into a model of sustainable cryptocurrency operations.

10. Educating and Empowering Residents:

Integrating Bitcoin can be an educational tool, prompting schools, universities, and community groups to offer workshops and courses. By doing so, the city invests in digital literacy, ensuring its residents remain competitive and informed in a rapidly evolving global economy.

Challenges to Address

Moving from theory to practice will not be without hurdles. Vancouver — and any city following its lead — must navigate a complex regulatory landscape, manage the inherent volatility of digital assets, and ensure robust cybersecurity measures are in place. Public perception and education will be paramount: a successful roll-out depends on clear communication and building trust among residents who may be unfamiliar or skeptical.

A Glimpse into the Future

Vancouver’s explorations into Bitcoin may prove transformative, marking the early days of a paradigm shift in urban governance and economics. If done responsibly, the lessons learned here will ripple outward, informing other municipalities and fueling a wave of decentralized, tech-driven growth. A city that successfully integrates Bitcoin sets the stage for a future where digital currencies, blockchain-based services, and inclusive financial frameworks coalesce to shape more resilient, equitable, and forward-looking urban societies.

As Vancouver embarks on this journey, the world watches with anticipation. If the city proves that cryptocurrencies can be responsibly integrated into public finance, it could spark a revolution in how cities everywhere approach economic development, public trust, and technological innovation.

Follow me on X https://x.com/jmoroles1981

Vancouver’s Progressive Step Towards Blockchain Integration: A Blueprint for Urban Financial… was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

1 month ago

32

1 month ago

32

English (US) ·

English (US) ·