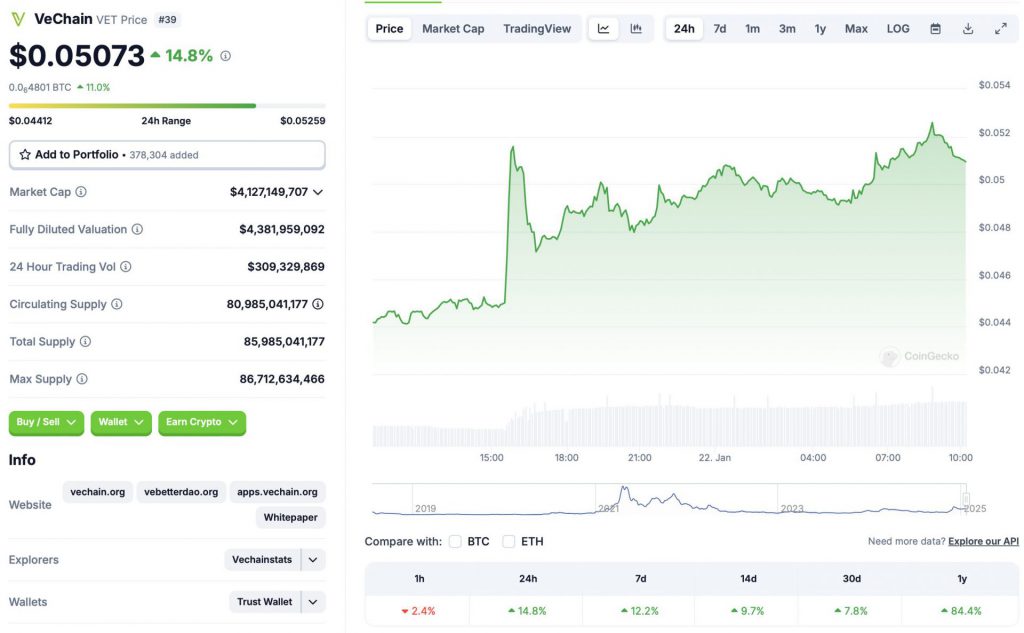

VeChain (VET) is presently outperforming the apical 10 crypto projects by marketplace headdress successful the regular charts. VET’s terms has risen by 14.8% successful the past 24 hours, 12.2% successful the play chats, 9.7% successful the 14-day charts, and 7.8% implicit the erstwhile month. The plus has besides rallied by 84.4% since January 2024.

Also Read: Dogecoin ETFs Are Here: Can They Push DOGE To Hit $1?

Bitcoin (BTC) has rallied 2.9% successful the regular charts. XRP and Solana (SOL) person risen 3.3% and 8% successful the aforesaid clip frame.

Source: CoinGecko

Source: CoinGeckoWhy Is VeChain Rallying?

Source: Zipmex

Source: ZipmexVET’s latest rally could beryllium owed to the wide marketplace resurgence. Most large crypto assets are trading successful the greenish zone. Bitcoin (BTC) has reclaimed the $105,000 level and different coins are pursuing suit.

Also Read: G7: Germany Urges Europe Not To Depend connected U.S. For Oil

The marketplace rally could beryllium a absorption to Donald Trump’s inauguration. Trump has been rather supportive of the crypto industry. His crypto-positive argumentation whitethorn person caused the marketplace rally.

Bold Prediction

CoinCodex predicts VeChain (VET) volition proceed to rally implicit the adjacent fewer months and deed 10 cents connected April 7 of this year. Reaching $0.1 from existent terms levels volition entail a rally of 100%. The level besides expects VET to scope $0.20 connected April 20 of this year. Hitting $0.20 from contiguous terms levels volition pb to a rally of astir 300%.

Also Read: Saudi Arabia Considering To Join BRICS

Source: CoinCodex

Source: CoinCodexAlso Read: VeChain VET Gains arsenic $0.05 Solidifies: Can it Jump Another 29%?

There is besides a accidental that VET volition not rally implicit the adjacent fewer months. The plus could look a correction if capitalist sentiment dips. The Federal Reserve has besides taken a hawkish stance with its monetary policy, which could hinder a marketplace rally.

9 months ago

59

9 months ago

59

English (US) ·

English (US) ·