Virtuals Protocol (VIRTUAL) has been on an impressive uptrend, setting multiple all-time highs (ATH) throughout December. The altcoin reached yet another ATH in the last 24 hours, climbing to $4.14.

However, this strong performance could face challenges, as historical patterns suggest potential price drawdowns following significant rallies.

Virtuals Protocol Faces Selling

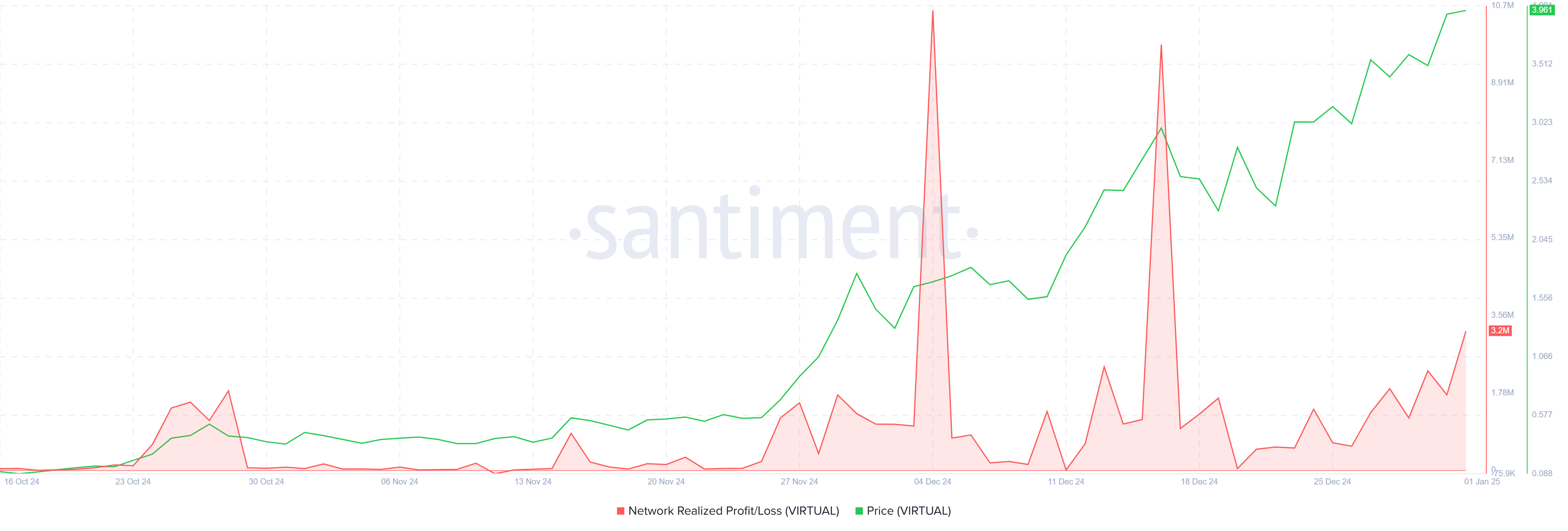

Realized profits for VIRTUAL holders have spiked, indicating that investors are actively securing their gains. This behavior often follows a price surge as holders capitalize on profits. While this signals market confidence, it also raises the risk of a drawdown, as selling pressure tends to weaken the asset’s momentum.

The current uptrend has encouraged many VIRTUAL holders to take profits, a pattern seen during previous price rallies. If this trend persists, the likelihood of a price pullback increases in the coming days. However, the magnitude of the drawdown will depend on broader market conditions and investor sentiment.

VIRTUAL Realized Profits. Source: Santiment

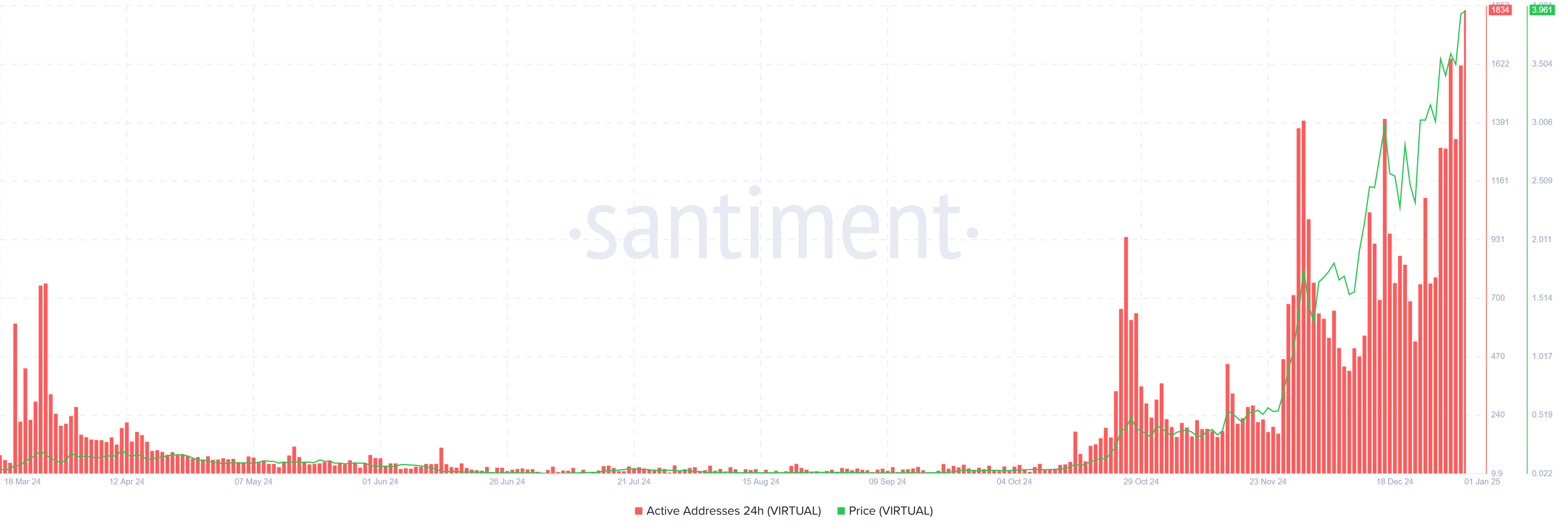

VIRTUAL Realized Profits. Source: SantimentVIRTUAL’s active addresses have reached an all-time high, reflecting unprecedented participation in the network. The altcoin’s recent ATH has drawn significant attention, leading to increased activity among investors. This heightened engagement highlights the growing interest in VIRTUAL and its potential for further growth.

Increased participation could counteract some of the selling pressure, as strong investor interest supports price stability. The sustained activity in the protocol highlights its growing adoption, which may help mitigate the risk of a sharp drawdown. However, continued momentum will depend on balancing new demand with profit-taking behavior.

VIRTUAL Active Addresses. Source: Santiment

VIRTUAL Active Addresses. Source: SantimentVIRTUAL Price Prediction: Another ATH Inbound

VIRTUAL is currently trading at $3.94, just below its ATH of $4.14, achieved after a 17% rise in the last 24 hours. This ascent has positioned VIRTUAL as one of the standout performers in the market, but mixed signals suggest caution in the short term.

The interplay of selling pressure and increased participation could result in a brief period of consolidation. VIRTUAL’s price may stabilize above $3.26 while struggling to surpass $4.14. This range could serve as a baseline for its next move, depending on market conditions.

VIRTUAL Price Analysis. Source: TradingView

VIRTUAL Price Analysis. Source: TradingViewShould bullish momentum strengthen, VIRTUAL could break past its ATH and continue its upward trajectory. However, if profit-taking dominates, the price might fall below $3.26, potentially declining to $2.00 or lower. This scenario would invalidate the bullish outlook and shift sentiment towards caution.

The post VIRTUAL Sees Massive Sell-Off After Hitting All-Time High appeared first on BeInCrypto.

2 days ago

13

2 days ago

13

English (US) ·

English (US) ·