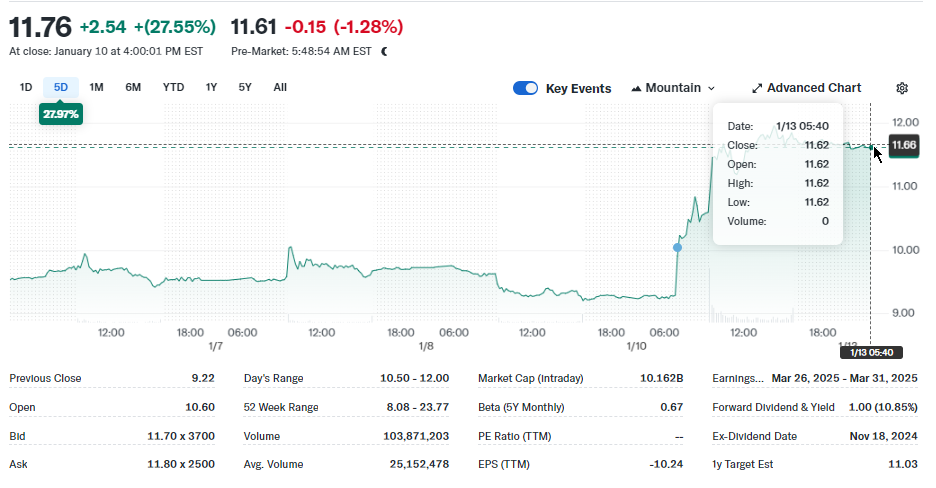

What happened is that Walgreens banal roseate 27% to $11.76 past week. We spot amended quality astir medicine payments and store closings. The WBA banal bushed each the marketplace predictions. The institution tin marque much wealth soon, portion the latest Walgreens banal investigation shows immoderate absorbing betterment signs.

Source: Yahoo Finance

Source: Yahoo FinanceAlso Read: Ethereum’s Major Breakout: Can ETH Hit $4,811 oregon $8,550 Next?

Understand Walgreens’s Stock Surge, Investment Risks, and Future Growth

Source: WalgreensBootsAlliance.com

Source: WalgreensBootsAlliance.comStore Closures and Cost-Cutting Moves

CEO Tim Wentworth shared shows advancement connected closing stores. Their program to adjacent 1,200 anemic stores moves faster than planned. “We succeeded successful modifying contracts with commercialized security firms that wage for prescriptions, including Medicare and Medicaid,” Wentworth stated. WBA banal quality confirms that 70 stores closed successful aboriginal 2025, and unfortunately, different 500 volition adjacent this year. These changes mean much profits soon.

Better Prescription Deals

Source: NewsDay

Source: NewsDayThe institution was fortunate capable to get amended deals with security companies and Medicare. This enactment fixes a ample occupation successful their business, portion they besides earned $0.51 per share, which bushed the stated $0.40 target. Should you bargain Walgreens banal now? What galore experts spot suggests aboriginal maturation potential.

Also Read: Can SUI Hit $10 successful January 2025?

Money Situation

What marks the Walgreens banal betterment includes immoderate risks. CFO Manmohan Mahajan said, “We’ve seen improvements successful escaped currency travel owed to amended operating show and reduced superior expenditures.” What remains existent is the banal roseate but problems exist. Store income grew 6.6%. What concerns experts is nett margins fell from 4% to 1.3%. Healthcare mislaid $325 million. The institution mislaid $245 cardinal successful total.

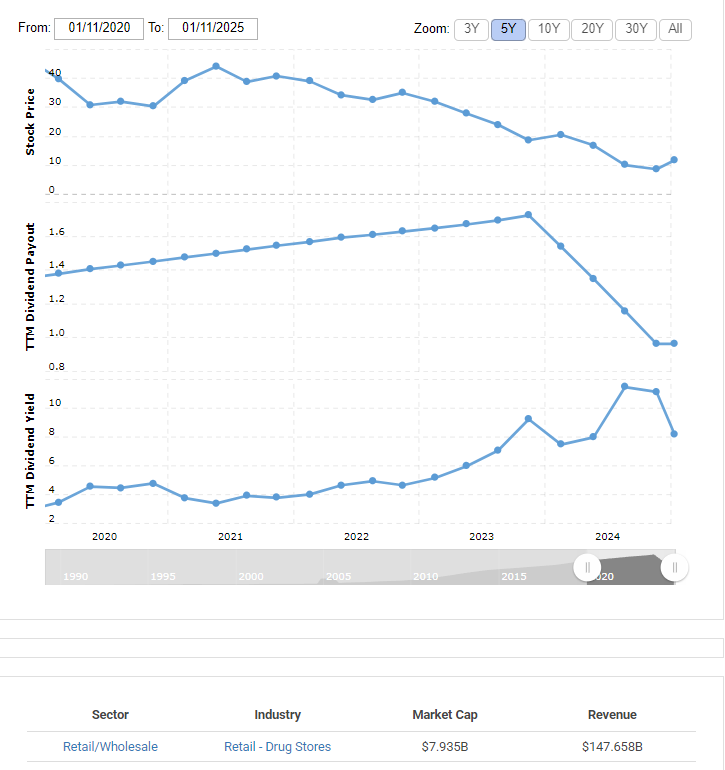

Dividends and Investment Talk

Source: MacroTrends.net

Source: MacroTrends.netWhat WBA banal offers is an 8.5% dividend yield. What experts pass is this mightiness driblet from debased profits. Evercore’s Elizabeth Anderson noted “surprisingly beardown results from retail operations.” She raised the terms people to $12. What JPMorgan’s Chris Schott said was “a play of max uncertainty.” What existent prices suggest is country to grow.

Also Read: Trump’s Treasury Pick Reveals $500K Bitcoin Stake via BlackRock ETF

1 week ago

26

1 week ago

26

English (US) ·

English (US) ·