WazirX has announced that rebalancing has been completed and expects to statesman a archetypal money distribution. Following the 2000 CR hack, the bulk of users are frustrated with the obnoxious absorption by the CEO, Nischal, and his squad successful resolving the issue.

While users are waiting for implicit 6 months to get their cryptos back, the funds remaining successful the exchange’s custody are to beryllium distributed pursuing a strategy WazirX proposes to users.

As per the caller post, the institution aims to instrumentality astir 85.25% of the USD worth to creditors based connected rebalancing prices successful the archetypal money distribution.

WazirX Rebalancing Done, Source: X

WazirX Rebalancing Done, Source: XFollowing the WazirX hack, Zettai Pte Ltd, the entity managing the platform’s restructuring, has finalized the rebalancing of its Net Liquid Platform Assets (NLPA).

The institution is present attempting to determination guardant by proposing a Scheme of Arrangement to its creditors. If approved by a majority, the strategy would alteration the level to restart operations and administer the rebalanced assets wrong 10 concern days of becoming effective.

If the bulk rejects the scheme, money betterment efforts could look important delays. Without an approved arrangement, creditors whitethorn person to endure years of waiting, with immoderate estimates suggesting imaginable delays until 2030.

WazirX has rebalanced its assets to align with liabilities, which means creditors volition get tokens equivalent to the INR magnitude astatine the clip of the hack and not get each the tokens they utilized to own. This assures proportionate organisation portion exposing consumers to cryptocurrency terms swings.

The archetypal payout volition beryllium successful crypto, with low-liquidity tokens specified arsenic ANT, LOVELY, PUSH, GFT, OOKI, MDX, BOB, and WRX partially converted to USDT oregon different stablecoin for amended usability.

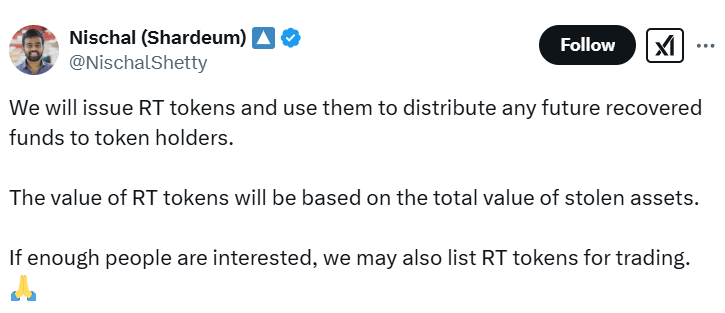

Nischal Shetty, proprietor of WazirX, besides emphasized determination is besides introducing Recovery Tokens, which volition beryllium airdropped to creditor accounts. The worth of the RT token volition beryllium tied to the full stolen assets.

Nischal Shetty connected RT Tokens, Source: X

Nischal Shetty connected RT Tokens, Source: XNischal has besides hinted that if the creditors demand, WazirX whitethorn besides database the tokens for trading.

These see stolen plus recovery, wherever retrieved funds could beryllium utilized to bargain backmost tokens, nett sharing if WazirX becomes profitable, and caller ventures similar a planned decentralized speech (DEX) to make revenue.

With each this happening, 1 happening is sure: WazirX users are not getting their crypto assets back, and WazirX is forcing them a not-so-great deal. They are not getting each their crypto assets, which means they person missed the accidental to really summation nett successful the bull tally that began successful Dec past month.

Also Read: WazirX Rolls Out Claim Tracker & Wallet Migration Update

8 months ago

41

8 months ago

41

English (US) ·

English (US) ·