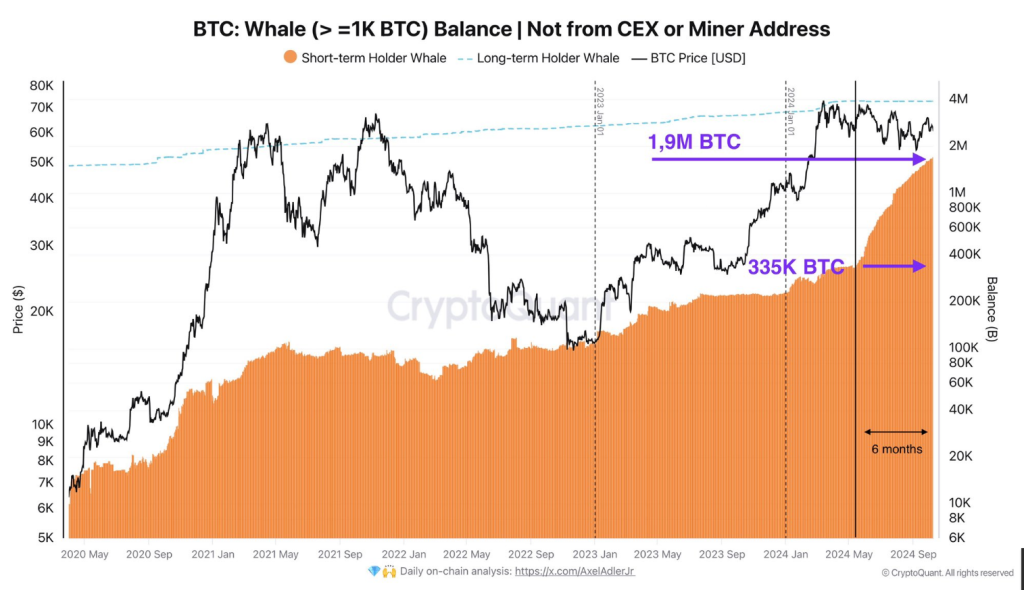

Bitcoin whales have stockpiled $90 billion in BTC since May, a period marked by range-bound market conditions. According to an open disclosure by Axel Adler Jr. of CryptoQuant, investors holding over 1,000 BTC have seen rapid growth in their balances.

Whale Appetite Grows

Over the past six months, they accumulated about 1.5 million BTC, representing a massive inflow of capital worth approximately $90 billion at an average price of $60,000. However, these tokens came from weaker hands that sold at a loss.

1.5M BTC has been accumulated by whales (with >1K BTC on balance) over the last 6 months.

There’s really nothing to discuss here. pic.twitter.com/7cAVWVEK15

— Axel

Adler Jr (@AxelAdlerJr) October 10, 2024

Adler Jr (@AxelAdlerJr) October 10, 2024

Data shows significant growth among whales, who held only 335,000 BTC in early May when Bitcoin traded between $60,000 and $65,000. While prices remained in that range, whales continued to accumulate, and now hold around 1.9 million BTC, indicating strong short-term confidence among high-net-worth investors.

Netflow Metrics Of Large Holders

Recent data shows that accumulation sprees haven’t cooled off, despite recent price corrections. For example, yesterday, BTC fell below $59K for the first time this month, leading to massive liquidations.

Don’t believe that whales accumulated 1.5M BTC and wonder where they got it from?

How about taking a look at the loss-making sales on exchanges?

In the last 24 hours, 24.1K BTC were sold at a loss. pic.twitter.com/tAgeCI6qhe

— Axel

Adler Jr (@AxelAdlerJr) October 11, 2024

Adler Jr (@AxelAdlerJr) October 11, 2024

Yet, large holders, who account for 0.1% of the circulating supply, netted +629 BTC yesterday. Two days ago, this figure was even higher, with an influx of 2,480 BTC.

Furthermore, CryptoQuant statistics indicate that Bitcoin’s exchange reserve has fallen from 2.576 million tokens at the start of October to 2.571 million tokens, reflecting ongoing accumulation.

As of this writing, Bitcoin was pegged at $61,690 having lost 1.68% for the week. DMI had +DI standing at 18.3 with -DI placed at 23.3, which were a couple of points above but declining continuously.

It simply means that despite the relentless selling pressures, they are somewhat weak. As it currently stands at -40.74, Williams %R is on the neutral side. From this, Bitcoin might get stuck in this range until strong buying or selling pressure will come up.

Experienced analyst Peter Brandt holds that Bitcoins will reach an all-time high of $150,000 for this cycle but warns that inability to break out of the current range will cause the price to shatter and will go way down, 75% at worst.

Featured image from Pexels, chart from TradingView

2 weeks ago

25

2 weeks ago

25

English (US) ·

English (US) ·