Exploring the Best Flash Loan Arbitrage Trading Bots for Crypto Success in 2025

Flash loan arbitrage in the crypto market refers to a strategy where traders borrow a large sum of cryptocurrency through a flash loan, execute a series of transactions across different platforms to take advantage of price discrepancies, and then repay the loan, keeping the profit. This process happens in a single transaction block, making it highly efficient and cost-effective. The volatility and liquidity of the cryptocurrency market provide ample opportunities for flash loan arbitrage, but it also comes with significant risks, including the potential for price slippage and transaction failure.

In this fast-paced and often unpredictable crypto market, trading bots play a crucial role. They automate complex trading strategies, allowing traders to react in real-time to market fluctuations and execute transactions faster than manual trading ever could. As the demand for efficient arbitrage opportunities grows, trading bots designed for flash loan arbitrage become indispensable tools for optimizing profits and minimizing risks. This blog aims to identify and explore the best flash loan arbitrage trading bots to consider for 2025, offering insights into the tools that can help traders stay ahead of the competition in the rapidly evolving market.

Table of the Content

Understanding Flash Loan ArbitrageWhy Flash Loan Arbitrage Bots Are Essential in Crypto Trading

Key Features to Look for in the Best Flash Loan Arbitrage Bots

The Top 10 Flash Loan Arbitrage Trading Bots for Crypto in 2025

· 1. Furucombo

· 2. Hegic Flash Loans Bot

· 3. Arbitrage Finder

· 4. JetFuel Finance

· 5. Flashloan Arbitrage Bot (Open Source)

· 6. Fantom Flash Loan Arbitrage Bot

· 7. Degen TradeBot

· 8. Uniswap Arbitrage Bot (Customizable)

· 9. Aave Flash Loan Arbitrage Bot

· 10. Balancer Arbitrage Bot

How to Choose the Right Flash Loan Arbitrage Trading Bot

Conclusion

FAQ

Understanding Flash Loan Arbitrage

Flash loan arbitrage involves borrowing a significant amount of cryptocurrency without collateral, executing a series of trades across different platforms to exploit price differences, and repaying the loan within a single transaction. This strategy relies on speed and precision, making it ideal for automated solutions. Flash loan arbitrage trading bots development has become crucial in optimizing this process, enabling traders to capitalize on arbitrage opportunities in real-time while minimizing human error. These bots utilize advanced algorithms and quick execution times, allowing users to take advantage of the highly volatile crypto market efficiently.

Why Flash Loan Arbitrage Bots Are Essential in Crypto Trading

Flash Loan Arbitrage Bots are essential tools in crypto trading, offering several advantages in volatile markets:

- High Frequency and Quick Decision-Making: Flash loan arbitrage bots can execute trades in fractions of a second, capitalizing on price discrepancies between different platforms. Their speed allows them to take advantage of even the smallest market inefficiencies, providing traders with a competitive edge.

- Cost-Effectiveness: Flash loans enable traders to borrow large amounts of capital without collateral, making them a cost-effective solution for arbitrage opportunities. This eliminates the need for upfront investment while still allowing traders to leverage significant sums of money.

- Reducing Manual Intervention and Errors: Flash loan arbitrage bots automate the trading process, reducing the risk of human error. With bots handling trade execution, there is less likelihood of mistakes that could result from fatigue, emotional decision-making, or slow reaction times.

- Benefits for Both Experienced Traders and Beginners: These bots are beneficial for both seasoned traders and newcomers. Experienced traders can optimize their strategies, while beginners can easily tap into arbitrage opportunities without extensive technical knowledge, making crypto trading more accessible to a wider audience.

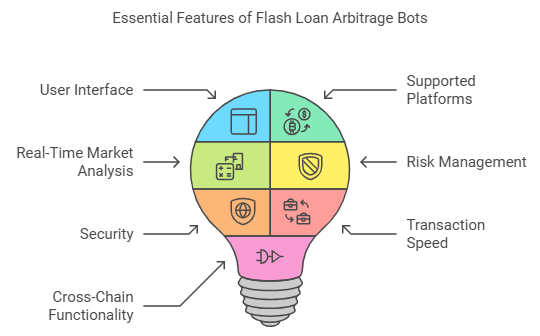

Key Features to Look for in the Best Flash Loan Arbitrage Bots

When selecting the best Flash Loan Arbitrage Bots, several key features are essential to ensure optimal performance and security in crypto trading:

Flash Loan Arbitrage Bots

Flash Loan Arbitrage Bots- User Interface: A simple and intuitive user interface is critical for both beginners and experienced traders. The best bots should offer ease of use with customizable options, allowing users to adjust settings according to their strategies. A clean design and easy navigation can help reduce the learning curve, making it easier to monitor and manage trades.

- Supported Platforms: The bot should be compatible with a wide range of blockchain networks, including Ethereum, Binance Smart Chain, Solana, and others. This flexibility enables traders to access a variety of markets, maximizing their opportunities for arbitrage across different platforms.

- Real-Time Market Analysis: A top-tier flash loan arbitrage bot must have the capability to analyze the market in real-time. It should continuously scan different exchanges, looking for price differences that can be leveraged for arbitrage. The ability to act swiftly on these opportunities is vital for success in the fast-paced crypto market.

- Risk Management: Built-in risk management features are crucial for minimizing potential losses. The bot should allow users to set stop-loss limits, automated risk controls, and even take-profit strategies. These features help protect users from sudden market swings and ensure consistent profitability.

- Security: Given the increasing prevalence of cyber attacks in crypto, the bot must have robust security protocols in place. This includes encryption, secure APIs, and regular security audits to protect the bot from exploits, hacks, and vulnerabilities.

- Transaction Speed: Speed is crucial in arbitrage trading. The best bots should minimize transaction delays and slippage, ensuring quick execution of trades to capture fleeting opportunities. Fast transactions are essential for securing profits before prices converge.

- Cross-Chain Functionality: The ability to perform arbitrage across multiple blockchains is an advanced feature that enhances a bot’s utility. This allows traders to exploit price differences between chains, broadening the scope of profitable opportunities and maximizing efficiency.

The Top 10 Flash Loan Arbitrage Trading Bots for Crypto in 2025

The top 10 flash loan arbitrage trading bots for crypto in 2025, designed to maximize profits through automated, high-speed trades.

1. Furucombo

Furucombo is a decentralized platform for creating complex DeFi strategies via a drag-and-drop interface. It enables users to design custom flash loan arbitrage bots without coding skills, making it accessible for both developers and non-developers.

Key Features:

- Flash Loan Capabilities: Facilitates borrowing assets with no collateral to execute arbitrage strategies.

- Multi-Chain Support: Works across various blockchains, increasing flexibility.

- Integration with Major DeFi Protocols: Includes platforms like Aave, Uniswap, and MakerDAO for streamlined operations.

Why in 2025: Furucombo’s continuous improvements and user-friendly design ensure it remains a top tool for automating DeFi strategies, making it ideal for flash loan arbitrage traders seeking efficiency and customization.

2. Hegic Flash Loans Bot

Hegic is a decentralized options trading protocol with a bot tailored for flash loan arbitrage. The bot enables users to take out flash loans to exploit price discrepancies across multiple decentralized exchanges (DEXs).

Key Features:

- Flash Loan Execution: Allows users to borrow assets without collateral and trade them for arbitrage profits.

- Risk Management Tools: Offers built-in features to minimize potential losses, such as stop-loss and slippage control.

- Real-Time Arbitrage Opportunities: Continuously scans the market for profitable arbitrage opportunities, ensuring quick execution.

Why in 2025: Hegic’s focus on risk mitigation and real-time arbitrage, combined with its advanced algorithms for profitability, makes it a highly reliable tool for traders looking to capitalize on decentralized finance opportunities in 2025.

3. Arbitrage Finder

Arbitrage Finder is a tool designed to identify arbitrage opportunities across various cryptocurrency exchanges. It enables users to create flash loan arbitrage bots that automate the entire process, from loan acquisition to realizing profits.

Key Features:

- Cross-Platform Arbitrage Monitoring: Scans multiple exchanges for price discrepancies, identifying profitable trades.

- Flash Loan Integration: Supports flash loans from platforms like Aave and dYdX to execute trades without collateral.

- Alerts for Opportunities: Provides real-time alerts for arbitrage opportunities, ensuring timely action.

Why in 2025: With seamless integration into major flash loan protocols and its focus on real-time arbitrage, Arbitrage Finder will remain a critical tool for automated trading, helping traders take advantage of market inefficiencies in 2025.

4. JetFuel Finance

JetFuel Finance is an automated yield farming platform that also supports arbitrage strategies. It utilizes a flash loan system, allowing users to borrow uncollateralized funds for arbitrage trading, capitalizing on price discrepancies across various decentralized exchanges (DEXs).

Key Features:

- Automated Yield Farming with Arbitrage Options: Enables users to automate yield farming and integrate arbitrage strategies.

- Flash Loan Support: Facilitates uncollateralized loans to execute arbitrage trades without upfront capital.

- Multi-Chain Functionality: Supports multiple blockchains, including Ethereum and Binance Smart Chain, broadening trading opportunities.

Why in 2025: With its multi-chain approach and automation, JetFuel Finance is poised to remain a top choice for arbitrage traders in 2025, ensuring efficiency and profitability in the evolving DeFi landscape.

5. Flashloan Arbitrage Bot (Open Source)

Open-source flash loan arbitrage bots, available on platforms like GitHub, offer users the ability to customize and program their own strategies. These bots can be tailored to detect and capitalize on arbitrage opportunities across various decentralized platforms.

Key Features:

- Full Customization: Users can modify the code to fit specific trading strategies or risk management preferences.

- Integration with Major Platforms: Supports flash loans from protocols like Aave and executes trades on exchanges such as Uniswap and Sushiswap.

- Tailored Strategies: Allows for creating unique arbitrage strategies to maximize profits based on market conditions.

Why in 2025: The open-source and customizable nature of these bots ensures they will remain popular among developers and experienced traders in 2025, providing flexibility and full control over trading strategies.

6. Fantom Flash Loan Arbitrage Bot

The Fantom Flash Loan Arbitrage Bot is specifically designed for the Fantom blockchain. It leverages flash loans to exploit arbitrage opportunities across decentralized exchanges (DEXs) within the Fantom ecosystem, taking full advantage of the blockchain’s fast transaction speeds and low fees.

Key Features:

- Low Gas Fees: Fantom’s low-cost transactions make it ideal for executing high-frequency arbitrage trades with minimal fees.

- Flash Loan Automation: Automates the process of borrowing and trading assets for arbitrage, reducing manual intervention.

- Arbitrage Between Fantom DEXs: Targets price discrepancies within Fantom’s popular DEXs, such as SpookySwap and SpiritSwap.

Why in 2025: With Fantom’s expanding ecosystem and cost-effective transactions, this bot is well-positioned to capture profitable arbitrage opportunities in 2025, making it a top tool for DeFi traders.

7. Degen TradeBot

Degen TradeBot is an automated trading platform designed to support flash loan arbitrage. It scans multiple decentralized exchanges (DEXs) and blockchain networks in real-time, identifying and capitalizing on profitable arbitrage opportunities with minimal intervention.

Key Features:

- Integration with Multiple DEXs and Blockchains: Supports various networks, including Ethereum, Binance Smart Chain, and others, enabling cross-platform arbitrage.

- Advanced Algorithms: Uses sophisticated algorithms to analyze market trends and identify arbitrage opportunities quickly.

- Automated Execution and Risk Management: Automates trade execution while allowing users to set risk parameters, ensuring safety while optimizing profits.

Why in 2025: Degen TradeBot’s adaptability across different networks, along with its advanced algorithms and customizable risk settings, will make it a strong contender in 2025, offering traders flexibility and precision for arbitrage trading.

8. Uniswap Arbitrage Bot (Customizable)

The Uniswap Arbitrage Bot is tailored to exploit price discrepancies between Uniswap’s liquidity pools and other decentralized exchanges (DEXs). By utilizing flash loans, it allows users to borrow assets and execute arbitrage trades efficiently.

Key Features:

- Flash Loans from Aave or dYdX: Leverages uncollateralized loans to facilitate arbitrage trading without needing initial capital.

- Real-Time Price Monitoring: Continuously tracks price differences across Uniswap and other DEXs to identify profitable arbitrage opportunities.

- Fully Customizable Trading Strategies: Users can customize strategies based on asset pairs, slippage tolerance, and risk parameters.

Why in 2025: Uniswap’s continued dominance in the DEX space, combined with the bot’s ability to automate arbitrage trading, ensures it will remain in high demand for traders looking to exploit market inefficiencies in 2025.

9. Aave Flash Loan Arbitrage Bot

Aave’s flash loan service is one of the most widely used in DeFi, and several bots are designed to specifically leverage Aave’s flash loans for arbitrage opportunities. These bots exploit price discrepancies across various decentralized exchanges (DEXs) to maximize profits.

Key Features:

- Seamless Integration with Aave’s Flash Loan Feature: Directly connects with Aave’s platform for easy access to uncollateralized loans.

- Arbitrage Across Multiple DEXs: Identifies price differences across various DEXs, allowing traders to exploit arbitrage opportunities effectively.

- High Transaction Speed: Aave’s optimized infrastructure ensures fast execution of flash loans and trades, minimizing slippage.

Why in 2025: Aave’s strong market presence and its advanced, efficient flash loan infrastructure make it a reliable and top choice for flash loan arbitrage bots, ensuring its continued dominance in 2025.

10. Balancer Arbitrage Bot

Balancer is a leading decentralized exchange known for its unique liquidity pools, offering multiple asset types within a single pool. The Balancer Arbitrage Bot targets opportunities within these pools and across other DEXs, using flash loans to execute profitable trades.

Key Features:

- Flash Loan Integrations: Leverages flash loans to execute arbitrage trades without requiring upfront capital.

- Multi-Pool Arbitrage Strategy: Identifies arbitrage opportunities within Balancer’s diverse liquidity pools and between other DEXs.

- Low Slippage and High Volume: Balancer’s high liquidity ensures minimal slippage and efficient execution of large trades.

Why in 2025: Balancer’s continuous innovation in liquidity pool structures and its ability to handle complex trades make it a prime candidate for arbitrage bots in 2025, offering new opportunities for traders looking to capitalize on market inefficiencies.

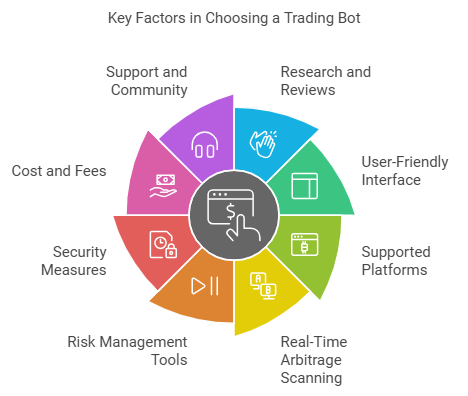

How to Choose the Right Flash Loan Arbitrage Trading Bot

Choosing the right Flash Loan Arbitrage Trading Bot is crucial for maximizing profits and minimizing risks in crypto trading.

Flash Loan Arbitrage Trading Bot

Flash Loan Arbitrage Trading Bot1. Research and Reviews

- Reputation: Start by researching the bot’s reputation in the crypto community. Look for reviews, feedback, and user testimonials to gauge its reliability and performance.

- Track Record: A bot with a proven track record of consistent performance is more likely to deliver successful trades. Ensure it has been tested in live market conditions rather than just in backtests.

2. User-Friendly Interface

- Ease of Use: A bot with a simple, intuitive interface is essential for smooth operation. You should be able to set up and manage the bot without needing extensive coding knowledge.

- Customizability: Check if the bot allows for customization, enabling you to tailor trading strategies, risk management settings, and other features to fit your goals.

3. Supported Platforms

- Blockchain Compatibility: Ensure the bot supports popular blockchain networks like Ethereum, Binance Smart Chain, Solana, and others, which allows you to access a wide range of arbitrage opportunities across different platforms.

4. Real-Time Arbitrage Scanning

- Market Monitoring: The bot should be able to scan multiple exchanges in real-time, identifying price differences quickly to capitalize on arbitrage opportunities before they close.

- Execution Speed: Arbitrage relies on speed, so ensure the bot is optimized for minimal latency and slippage during execution.

5. Risk Management Tools

- Stop-Loss and Take-Profit Settings: Look for bots with automated risk controls, including the ability to set stop-loss and take-profit limits to safeguard your funds.

- Slippage Control: The bot should have built-in measures to minimize slippage, ensuring that the trade executes at the desired price.

6. Security Measures

- Encryption and Security Protocols: Ensure the bot offers strong encryption and security features to protect your funds and private keys from hacks or exploits.

- Audit History: Check if the bot’s code has been audited by reputable third-party security firms to ensure it is secure from vulnerabilities.

7. Cost and Fees

- Pricing Structure: Evaluate the bot’s cost. Some bots charge upfront fees, while others have subscription models or take a commission on profits. Compare the fees to the potential profits to determine if it’s worth the investment.

- Transparent Fees: Ensure that the bot provides clear and transparent information about any fees associated with its use.

8. Support and Community

- Customer Support: Choose a bot that offers responsive and accessible customer support in case issues arise. Check if support is available 24/7 and if there are multiple channels like chat, email, or phone.

- Active Community: A strong community of users can provide valuable insights, tips, and solutions to common problems. Look for a bot with an active community forum or user group.

Conclusion

The best flash loan arbitrage trading bots for 2025 offer innovative features and advanced algorithms to help traders capitalize on market inefficiencies and maximize profits. As the crypto space continues to evolve, the development of these bots will play an increasingly vital role in automating complex strategies and staying competitive. Looking ahead, the future of flash loan arbitrage trading bots in the crypto market looks promising, with continuous improvements in technology and performance. To succeed, traders must thoroughly research and choose the right flash loan arbitrage trading bots development tools tailored to their specific needs, ensuring a solid foundation for their trading success.

FAQ

- What is a flash loan arbitrage trading bot, and how does it work?

A flash loan arbitrage trading bot uses flash loans — instant, uncollateralized loans — to exploit price differences across different crypto exchanges. The bot executes trades quickly, borrowing funds to buy low on one exchange and sell high on another, generating a profit within a single transaction block.

2. Are flash loan arbitrage bots profitable in 2025?

Yes, they can be profitable, especially with the rise of decentralized exchanges (DEXs) and high market volatility in 2025. However, profitability depends on several factors, such as network fees, the speed of execution, and the ability to identify arbitrage opportunities.

3. What are the risks associated with using flash loan arbitrage bots?

The risks include high gas fees, slippage, and the possibility of failed transactions due to changes in price during execution. Additionally, if not properly configured, bots could expose users to security risks or even result in loss of funds.

4. How do I choose the best flash loan arbitrage trading bot for my needs?

Look for bots that support your preferred exchanges, offer real-time execution, provide risk management features, and have a track record of profitability. It’s also important to check for user reviews and bot performance metrics in the latest market conditions.

5. Can flash loan arbitrage bots be used on multiple blockchains?

Yes, many advanced flash loan arbitrage bots are multi-chain compatible, supporting networks like Ethereum, Solana, Binance Smart Chain, and others. This allows traders to take advantage of arbitrage opportunities across different decentralized finance ecosystems.

What are the best Flash Loan Arbitrage Trading Bots for Crypto in 2025? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

47

2 months ago

47

English (US) ·

English (US) ·