- Ethereum has endured a twelvemonth of symptom and there’s information to exemplify it.

- Major rivals person clawed marketplace stock from Ethereum.

- Top developers are hoping to reverse the slump.

It whitethorn beryllium hard to admit for Ethereum investors, but the numbers archer a grim communicative astir the 2nd largest cryptocurrency: it’s losing mindshare, momentum, and its erstwhile commanding pb alongside Bitcoin implicit the crypto industry.

In the past year, the $339 billion web has been outshined by Bitcoin, outmanoeuvred by Solana, and economically strip-mined by its bevy of furniture 2 networks.

Cracks person adjacent begun to look among adjacent the staunchest proponents of the network. Critics blamed the Ethereum Foundation, the nonprofit organisation that guides the blockchain’s maturation and development, for not doing enough.

Co-creator Vitalik Buterin has stepped successful to code the concerns arsenic Ethereum’s woes mount.

Buterin said changes were being made to the Ethereum Foundation’s enactment team. He, however, asked critics to code down their attacks connected the foundation’s enforcement manager Aya Miyaguchi who had courted a ample portion of the expected blame.

Major Ethereum developers similar Ben Jones, a co-founder of furniture 2 web Optimism besides dependable the rallying outcry for cooperation to assistance the web retired of its existent malaise, saying the clip had travel to marque improvements to the ecosystem.

These 3 charts archer the communicative of Ethereum’s decline.

Muted terms performance

Ethereum is the least-performing among the large cryptocurrencies successful the past year.

Bitcoin and Solana person much than doubled successful price, Dogecoin has tripled, and XRP has risen five-fold wrong the clip frame.

Meanwhile, Ethereum has posted a meagre 22% terms uptick. That’s considered debased successful crypto terms.

On Monday, Ethereum’s terms crashed 24% and fell to $2,300, its lowest level since past summer. It has since recovered to $2,700 aft Eric Trump endorsed concern successful the plus connected Monday.

“In my opinion, it’s a large clip to adhd Ether,” the US President’s lad posted connected X connected Monday.

Despite the flimsy recovery, immoderate marketplace analysts accidental the terms mightiness inactive spell little successful the abbreviated term.

“Ethereum inactive has an untouched liquidity support successful the $2,110-$2,100 range, the adjacent low,” Arthur Azizov, crypto outgo supplier B2BINPay, told DL News.

A liquidity support is simply a terms level wherever traders person stacked a ample measurement of bargain and merchantability orders portion an adjacent debased is simply a terms constituent that an plus has reached aggregate times but hasn’t fallen beneath and has alternatively bounced upwards.

“Yesterday’s determination cleared a important section liquidity shelf, but it didn’t scope this cardinal adjacent low, which ideally should person been taken out,” Azizov said. “This suggests that Ethereum could inactive dip beneath $2,100.”

The flippening that ne'er was

For years, Ethereans chanted the prophecy of a coming flippening, erstwhile Ethereum’s marketplace worth would eclipse Bitcoin’s.

They argued that Ethereum’s autochthonal enactment for astute contracts that underpins DeFi would propulsion its web to go much invaluable than Bitcoin which has constricted scripting capabilities.

But marketplace world has delivered a harsh verdict ― Ethereum hasn’t lone failed to overtake Bitcoin, it has stumbled and fallen acold down the marketplace leader.

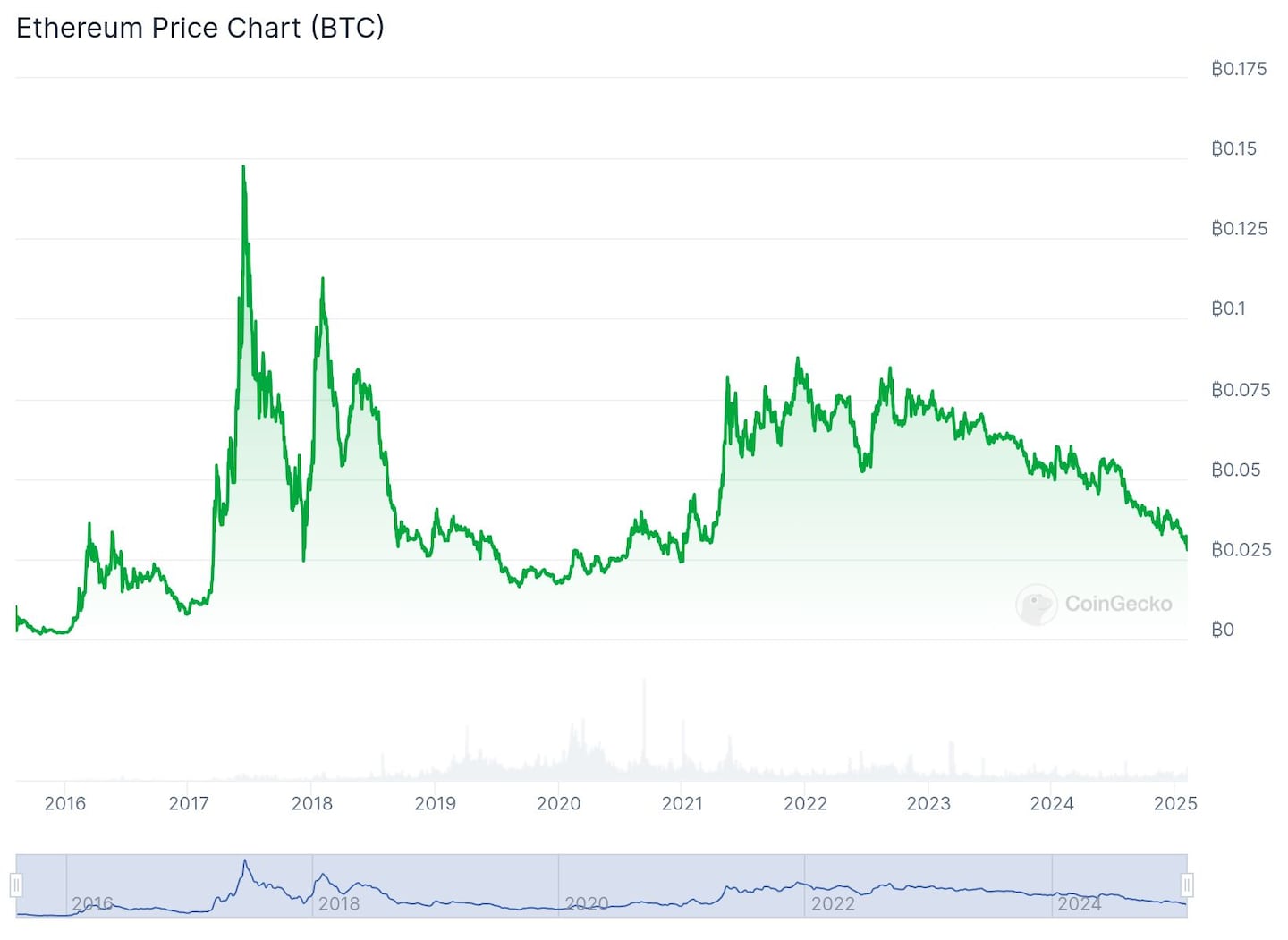

The Ether/Bitcoin ratio which tracks the terms of Ethereum against Bitcoin is astatine its lowest level successful 4 years, according to terms tracker CoinGecko.

Ether/Bitcoin ratio has fallen to its lowest level successful 4 years. Photo: CoinGecko

Four years ago, sectors specified arsenic NFTs and decentralised concern were conscionable taking off.

NFTs person fizzled retired and DeFi isn’t an Ethereum-only sector, adjacent if the web inactive controls the bulk of the market.

DeFi’s marketplace worth arsenic measured by the measurement of capitalist funds successful the assemblage is astatine $132 billion, according to DefiLlama data ― that’s $73 cardinal shy of its November 2021 peak.

Meanwhile, Bitcoin has go the darling of organization investors with publically listed companies holding the plus connected their equilibrium sheets.

Michael Saylor’s MicroStrategy began acquiring Bitcoin successful 2020. The institution now owns $30 cardinal worthy of the asset.

In the US, the Securities and Exchange Commission approved Bitcoin exchange-traded funds past year. They amassed $107 billion successful assets nether absorption amid frenzied adoption from big-money players. Ethereum ETFs besides launched past twelvemonth but did not execute the aforesaid level of success.

Economic achromatic holes

Ethereum spent years transitioning to a deflationary Ether proviso issuance.

The Merge and EIP-1559 made Ether’s proviso shrink, causing the cryptocurrency’s proviso to go nett antagonistic and frankincense deflationary.

But the Dencun upgrade that rolled retired blobspaces, a impermanent mode to store ample information connected the blockchain, seems to person reversed those gains.

While Dencun made furniture 2 networks cheaper to usage by reducing information retention costs, it has had an unintended effect of accelerating the Ether token supply.

Ether proviso ostentation has astir reversed the pain since The Merge. Photo: Ultrasound.money

Ethereum’s once-scarce proviso is inflating again, reversing the deflationary effects of its pain mechanism. The web is present connected the verge of erasing each the Ether burned since The Merge implicit 2 years ago, according to data from Ethereum analytics dashboard Ultrasound.money.

Ethereum proponents present look to the upcoming Pectra upgrade to lick immoderate of these problems.

The Pectra upgrade aims to reverse Dencun’s unintended broadside effect that dampened Ethereum’s pain complaint and made the cryptocurrency to go inflationary.

Ethereum developers accidental Pectra volition upgrade the mode astute contracts enactment and summation on-chain enactment and state consumption. Gas is what Ethereum users wage to transact connected the network.

The upgrade is besides expected to present a caller interest marketplace for blobs that would beryllium economically viable for some furniture 2 networks and Ethereum itself.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. Got a tip? Please interaction him at [email protected].

8 months ago

43

8 months ago

43

English (US) ·

English (US) ·