About the Author

John Patten is the co-founder of Treasure, where he focuses on building infrastructure and AI projects for gaming and community engagement. He entered the crypto space in 2017 and has since contributed to various projects (including Osmosis) before co-founding Treasure in 2021 as an NFT initiative that has grown into a decentralized game console. John is passionate about fostering community involvement and believes in the transformative power of decentralized gaming.

The views expressed here are his own and do not necessarily represent those of Decrypt.

We’ve always thought of the economy as a human construct—something we build, regulate, and optimize. But what happens if this is no longer the case?

Artificial intelligence has advanced at a rapid clip since the first consumer-facing LLMs achieved rapid widespread popularity. At this point, this technology isn’t just being used to generate content or field queries; it’s beginning to transact independently and determine its own workflows. In other words, today’s most sophisticated AI agents don’t just follow commands,they make decisions based on their own learned behaviors, incentives, and self-interest.

The emerging result is a fundamentally new kind of economic reality in which AI is not just a tool, but an active, integral participant. And the key to accelerating this trend is to build more environments where AI and humans can co-create entirely new models of value exchange and collective governance.

When AI agents think for themselves

Every economy involves more than just transactions, with human policymakers, entrepreneurs, and investors historically responsible for things like market setup, resource allocation, and strategic decision-making. This means that for AI agents to engage in wide-ranging, unscripted economic activity, they must evolve to become autonomous planners, not just operators.

In other words, AI agents must be able to dynamically evaluate risk and opportunity based on their own evolving understanding of the environment. Under these conditions, an AI agent would be able to engage in weighty tasks such as decentralized governance—not by casting votes based on hard-coded logic, but rather by weighing trade-offs and anticipating abstract, far-off risks.

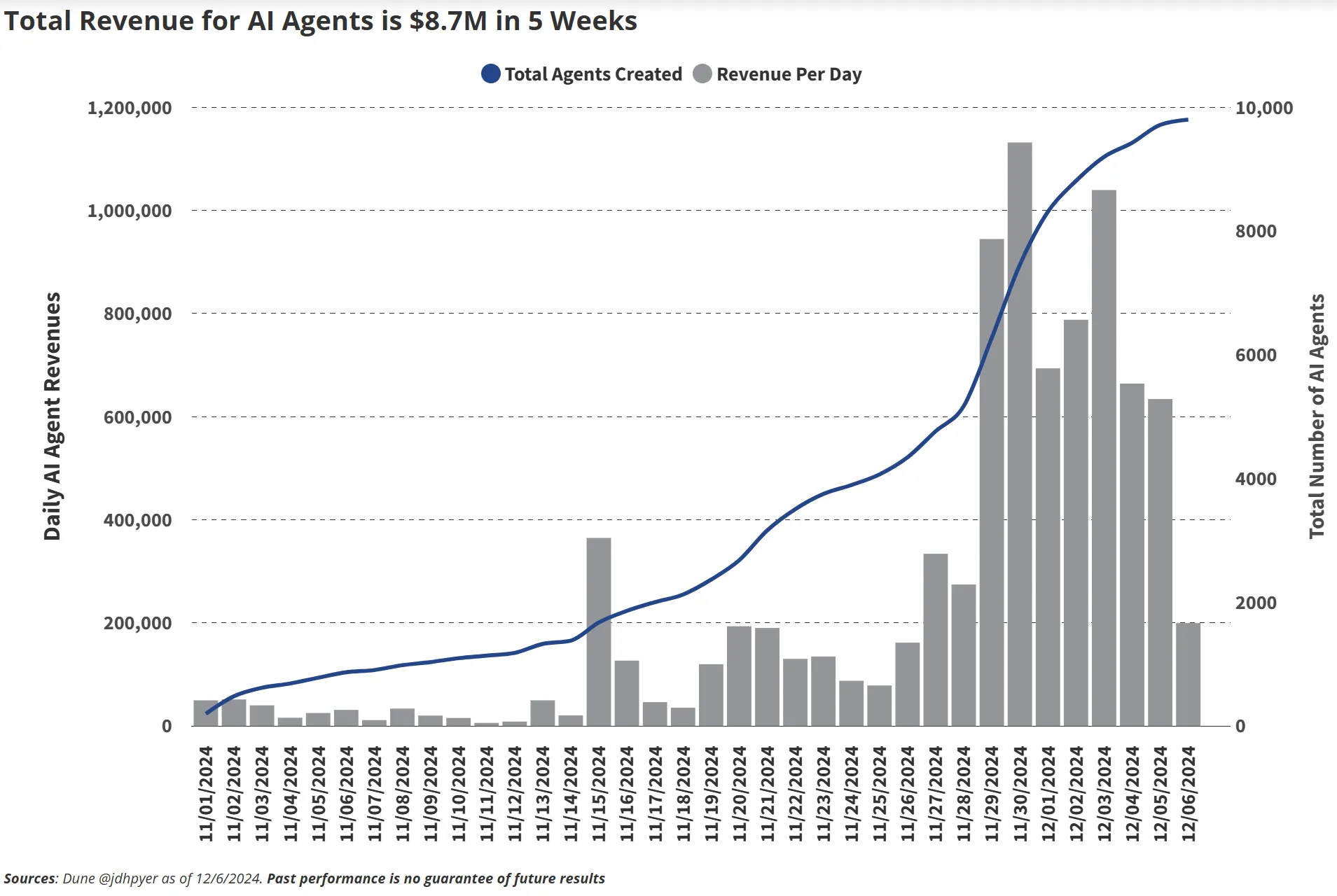

AI agent revenue in late 2024

AI agent revenue in late 2024The need for more dynamic, open-ended AI agents is reflected in last year’s data, with nearly 10,000 web3-related AI agents created by the end of 2024, even as overall agent revenue growth fell. This suggests that while AI agents are proliferating at an astonishing rate, their ability to generate value isn’t keeping pace as they increasingly compete for the same pools of opportunity.

In other words, AI agents are fighting for a limited slice of the pie, rather than expanding the pie itself. To solve this, we need to unlock new playing fields for AI. That means enabling agents to participate in environments beyond pure financial speculation, where they can create, experiment, and even build infrastructure for human and machine collaboration.

Open-ended autonomous worlds, decentralized governance experiments, and novel AI-to-AI service economies could provide the breathing room AI agents need to operate more like entrepreneurs, rather than mere extractors of existing value.

AI needs money—and crypto is the perfect fit

For AI agents to participate in an economy, they need financial autonomy. But there’s a problem: traditional finance is designed around human activity and bureaucratic control, not autonomous AI. Banks don’t open accounts for AI, and credit card transactions require human authorization. Even today’s algorithmic trading systems, for all their automation, still require human sign-offs and intermediary oversight.

Crypto changes this. Blockchain networks provide AI agents with a global, permissionless financial infrastructure, from crypto wallets where they can hold assets and interact with decentralized apps in real time to protocols that allow them to initiate and settle transactions instantly, unencumbered by oversight.

In short, bringing AI on-chain allows autonomous agents to participate in the digital economy in ways that traditional, off-chain financial rails would never allow for. This ability to move and allocate capital without a human bottleneck unlocks brand new possibilities for the human users deploying this form of AI, as these agents find creative approaches to general pre-set goals or define and capture entirely new forms of value.

True AI innovation will come from play

One of the biggest misconceptions about AI is that its greatest breakthroughs will come from more serious enterprise applications, ranging from logistical optimizations to the development of more sophisticated, adaptive trading bots. But true AI innovation won’t come from spreadsheets and supply chains—it will come from playtime.

Currently, AI systems must be trained on enormous amounts of data, which presents potential bottlenecks for systems that rely on static datasets. The best way forward is to deploy AI agents in a constantly shifting, data-rich environment. Online games provide the perfect environment for this, serving as sandboxes where AI can experiment, learn, and evolve in dynamic, unpredictable settings. Real-life players interacting with AI agents within these environments further enrich the dataset, helping AI learn in ways that go beyond simple automation.

Smolverse, an NFT-based work built on Ethereum layer-2 networkArbitrum, is an early example of this approach. There, AI-driven Smols are not just playing within the game—they’re shaping its economy, testing different strategies and influencing other AI and human players in real-time.

The implications extend far beyond gaming. AI trained in these open-ended environments can yield valuable insights into how new behaviors emerge organically, and refine themselves at the cross-section of agentic AI and human interaction. This will enable future models to be better equipped to function in the real world, making games not just a proving ground for AI, but an ideal environment for its continued evolution.

AI-driven economies are closer than we think

This shift toward true, self-directed AI is no longer the stuff of sci-fi. AI agents are already executing trades, managing DAOs, and discovering new drugs. And because Web3 was never intended to just be about blockchain, crypto projects are integrating AI at a foundational level to create new forms of online engagement and automation. What was once a niche experiment is rapidly evolving into a new economic paradigm.

But what does it really mean to give AI agents full economic autonomy? A trading bot making split-second financial decisions is one thing, but an AI agent that can self-fund, reinvest, and accumulate wealth indefinitely presents an entirely different challenge. Even well-intentioned AI could, in optimizing for short-term profit, destabilize the very ecosystems it relies on.

That doesn’t mean we should fear AI-driven economies; we just need to be intentional about how they’re designed. AI must operate within transparent, auditable frameworks that ensure human alignment. Mechanisms like participatory governance, incentive recalibration, and adaptive economic models will be critical in ensuring AI-driven markets evolve in a way that benefits everyone, not just the most efficient algorithms.

In other words, if we want AI that can build and sustain fairer, more efficient systems, we should start by giving it a space to play. And in doing so, we won’t just be shaping AI—we’ll be redefining the concept of “the economy” itself.

Edited by James Rubin

Generally Intelligent Newsletter

A weekly AI journey narrated by Gen, a generative AI model.

5 months ago

50

5 months ago

50

English (US) ·

English (US) ·