Shareholders of Amazon, led by the National Center for Public Policy Research, have submitted a proposal urging the company to assess the merits of holding Bitcoin in its treasury. This groundbreaking suggestion aligns with a broader shift in corporate attitudes toward cryptocurrency and highlights Bitcoin’s growing significance as a strategic financial asset. Here’s a detailed look at the proposal, its implications, and what it means — even if Amazon ultimately decides not to adopt Bitcoin.

Bitcoin Treasury Assessment

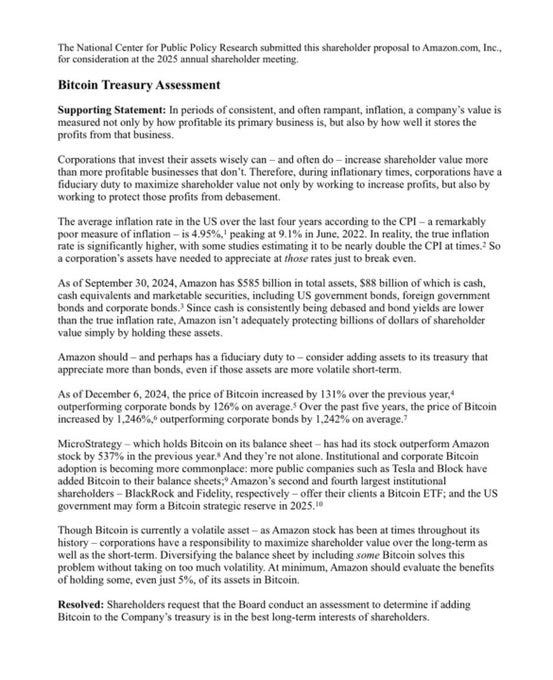

Bitcoin Treasury AssessmentSummary of the Proposal: Bitcoin Treasury Assessment

The proposal outlines the following key points:

1. Inflation Concerns:

• Over the past four years, inflation in the U.S. has averaged 4.95%, peaking at 9.1% in June 2022. This devalues cash and bonds, which are Amazon’s primary treasury holdings.

• With $88 billion in cash, cash equivalents, and marketable securities as of September 30, 2024, Amazon’s reserves are vulnerable to inflation-driven erosion.

2. Fiduciary Responsibility:

• Corporations have a duty to maximize shareholder value by protecting reserves from debasement.

• Bitcoin offers a hedge against inflation due to its finite supply and decentralized nature.

3. Bitcoin’s Performance:

• Bitcoin outperformed traditional assets in the past year, rising 131%, compared to corporate bonds’ 126% growth.

• Over five years, Bitcoin has increased by 1,246%, making it one of the best-performing assets.

4. Industry Examples:

• Companies like MicroStrategy, Tesla, and Block (formerly Square) have integrated Bitcoin into their treasuries. MicroStrategy’s stock price surged after its Bitcoin adoption, reinforcing the cryptocurrency’s potential as a high-growth asset.

5. Volatility Concerns:

• While Bitcoin is volatile, the proposal argues that this risk is comparable to Amazon stock’s historical fluctuations. The potential long-term benefits outweigh the short-term risks.

Resolution: Shareholders ask Amazon’s board to conduct an assessment to determine whether adding Bitcoin to its treasury aligns with the long-term interests of shareholders.

The Michael Saylor Connection: Bitcoin Advocacy at Microsoft

This isn’t the first time Bitcoin has entered boardroom discussions at tech giants. Michael Saylor, Executive Chairman of MicroStrategy, presented a similar case to Microsoft, emphasizing:

• Bitcoin as Digital Gold: With properties superior to traditional gold, Bitcoin offers a secure, portable, and inflation-resistant store of value.

• Inflation Hedge: Saylor highlighted the risks of holding cash reserves amid rising inflation.

• Corporate Image: Companies that adopt Bitcoin signal forward-thinking innovation, attracting younger, tech-savvy audiences.

Though Microsoft has yet to act, Saylor’s advocacy mirrors the themes in the Amazon proposal: a growing recognition of Bitcoin’s potential in corporate finance.

What This Means — Even Without Adoption

Even if Amazon decides not to add Bitcoin to its treasury, the proposal itself is significant:

1. Legitimizing Bitcoin:

• The proposal reflects Bitcoin’s evolution from a speculative asset to a serious consideration for treasury management.

2. Corporate Awareness:

• Large corporations like Amazon and Microsoft evaluating Bitcoin signals to the broader market that cryptocurrency is entering mainstream finance.

3. Driving Innovation:

• Exploring Bitcoin could inspire Amazon to innovate further, such as integrating blockchain for payment systems or supply chain management.

4. Encouraging Other Companies:

- Amazon’s exploration might motivate other companies to reassess their treasury strategies, contributing to the broader adoption of Bitcoin.

Risks and Rewards for Amazon

Potential Benefits:

• Inflation Protection: Safeguards reserves against currency devaluation.

• Shareholder Value: Aligns with fiduciary duties to maximize returns.

• Market Leadership: Positions Amazon as a financial innovator.

Potential Risks:

• Volatility: Bitcoin’s price swings could introduce short-term instability.

- Regulatory Uncertainty: Government policies around cryptocurrency remain unclear.

The proposal to Amazon — and Michael Saylor’s presentation to Microsoft — signals a paradigm shift in how Bitcoin is viewed in corporate finance. Whether or not Amazon adopts Bitcoin, the discussion highlights its growing role as a hedge against inflation and a strategic asset for forward-thinking companies. This development is more than just a conversation about Bitcoin; it’s about innovation, risk management, and redefining the way corporations approach financial sustainability.

💡 What’s your take? Should Amazon add Bitcoin to its balance sheet, or is it too soon? Let’s discuss!

Follow me on X for more Bitcoin related news. https://x.com/jmoroles1981

Why Amazon Shareholders Want Bitcoin in the Treasury: A Breakdown was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

1 month ago

31

1 month ago

31

English (US) ·

English (US) ·